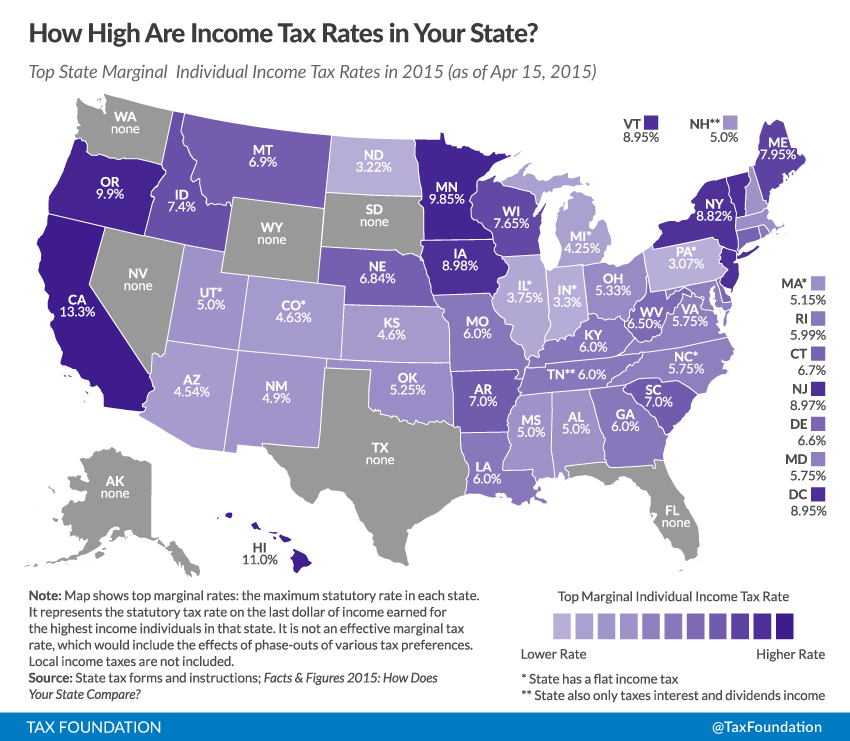

This week's taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. map presents the highest individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates in each state for 2015 (full report on state income tax rates: here). Income taxes are a major, and often complicated, component of state revenues. Furthermore, unlike sales or excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. es which individuals pay indirectly, income taxes are levied directly on individuals, meaning that income taxes are usually featured prominently in any discussion of tax burdens and public policies.

Income taxes are structured in many different ways throughout the states. Some are flat systems with one rate for all income, while other states offer progressive systems taxing different levels of income at different rates, and some states have no income tax at all.

These taxes are also subject to change: over the past two years, eight states (Illinois, Indiana, Kansas, Massachusetts, North Carolina, North Dakota, Ohio, and Wisconsin) and the District of Columbia reduced income taxes, and one state (Minnesota) increased income taxes.

For the most up-to-date data available on current state tax rates and brackets, standard deductions, and per-filer personal exemptions for individuals filing singly, see our report here.

Share