Under the new Build Back Better (BBB) framework, the top marginal capital gains tax rate would reach 31.8 percent at the federal level.

In the U.S., long-term gains currently face a top marginal tax rate of 23.8 percent at the federal level, the result of a maximum 20 percent capital gains tax rate plus a 3.8 percent net investment income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. . The BBB proposal would push that top rate to 31.8 percent by applying a new surcharge of 8 percentage points to modified adjusted gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. (MAGI) above $25 million, including on capital gains income.

That would be the highest federal tax rate on capital gains since the 1970s—and it would be above the generally estimated revenue-maximizing rate of 28 percent. The proposal should also be considered in the context of state-level capital gains taxes, which most states levy.

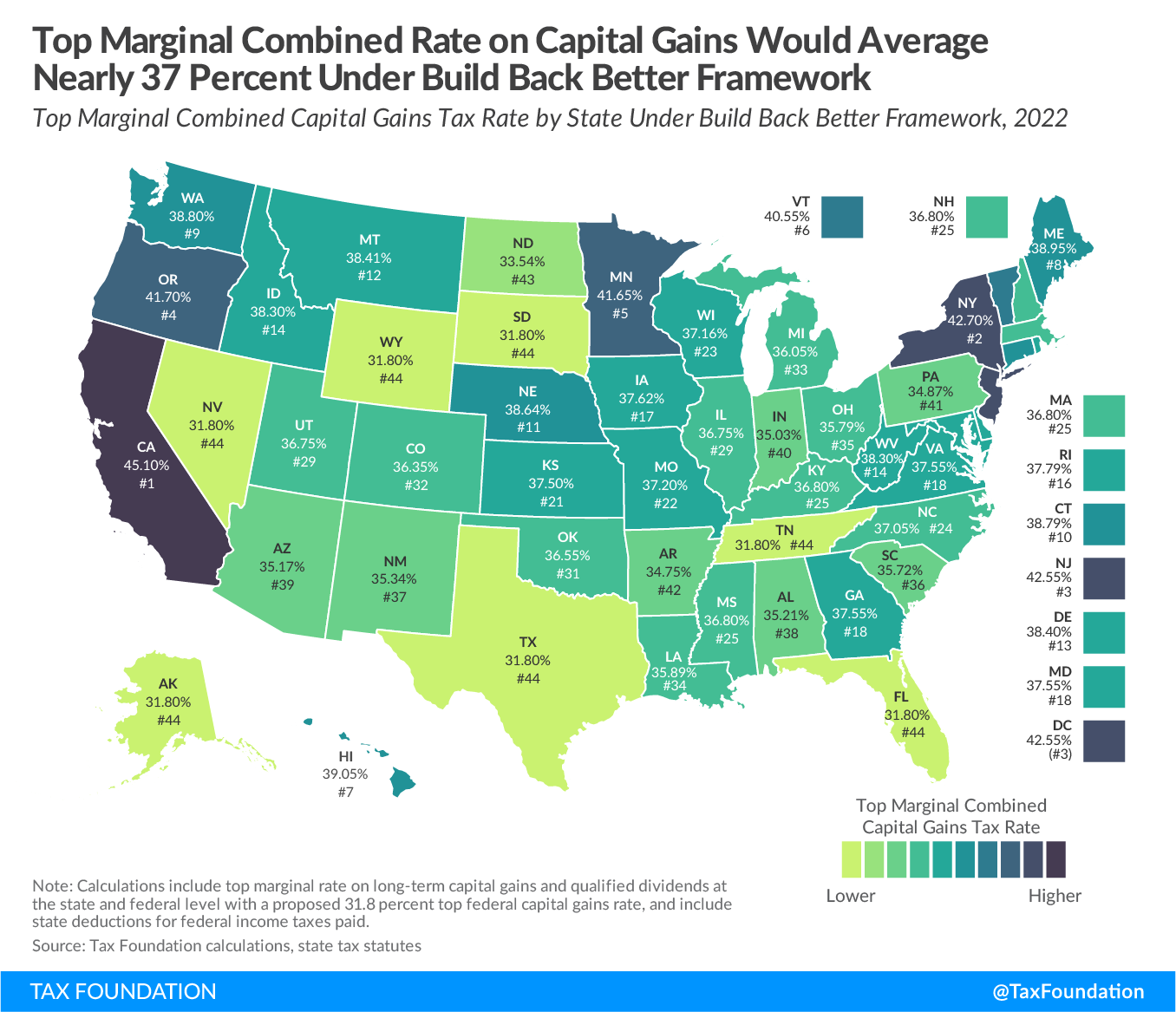

When considering state-level policies, the average top marginal combined tax rate on capital gains would be nearly 37 percent. Six states (Oregon, New Jersey, California, New York, Vermont, and Minnesota) and the District of Columbia would face combined top marginal capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rates of more than 40 percent, nearing the top rate among OECD countries, currently levied by Denmark at 42 percent.

A high combined capital gains tax rate would influence when taxpayers decide to sell assets and realize the gain. If the effect is large enough, federal revenue from capital gains income would decline as taxpayers decide to avoid realizing gains and the higher tax rate.

The top combined tax rate on qualified dividends would rise from 29.2 percent to 37.2 percent. Dividends face a slightly higher average tax rate than capital gains because the partial exemptions or exclusions offered in eight states for long-term capital gains do not apply to dividends. For example, North Dakota provides a 40 percent exclusion for long-term capital gains, but not for dividends. This means in North Dakota, long-term gains face a 1.74 percent state income tax, while dividends face the full 2.9 percent top state income tax rate. This pushes North Dakota’s top combined tax rate on dividends to 34.7 percent under the tax plan, compared to 33.5 percent for long-term capital gains.

Note: This post was originally published on September 14th, but has been updated on November 1st to reflect the recent proposals in the Build Back Better framework.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe