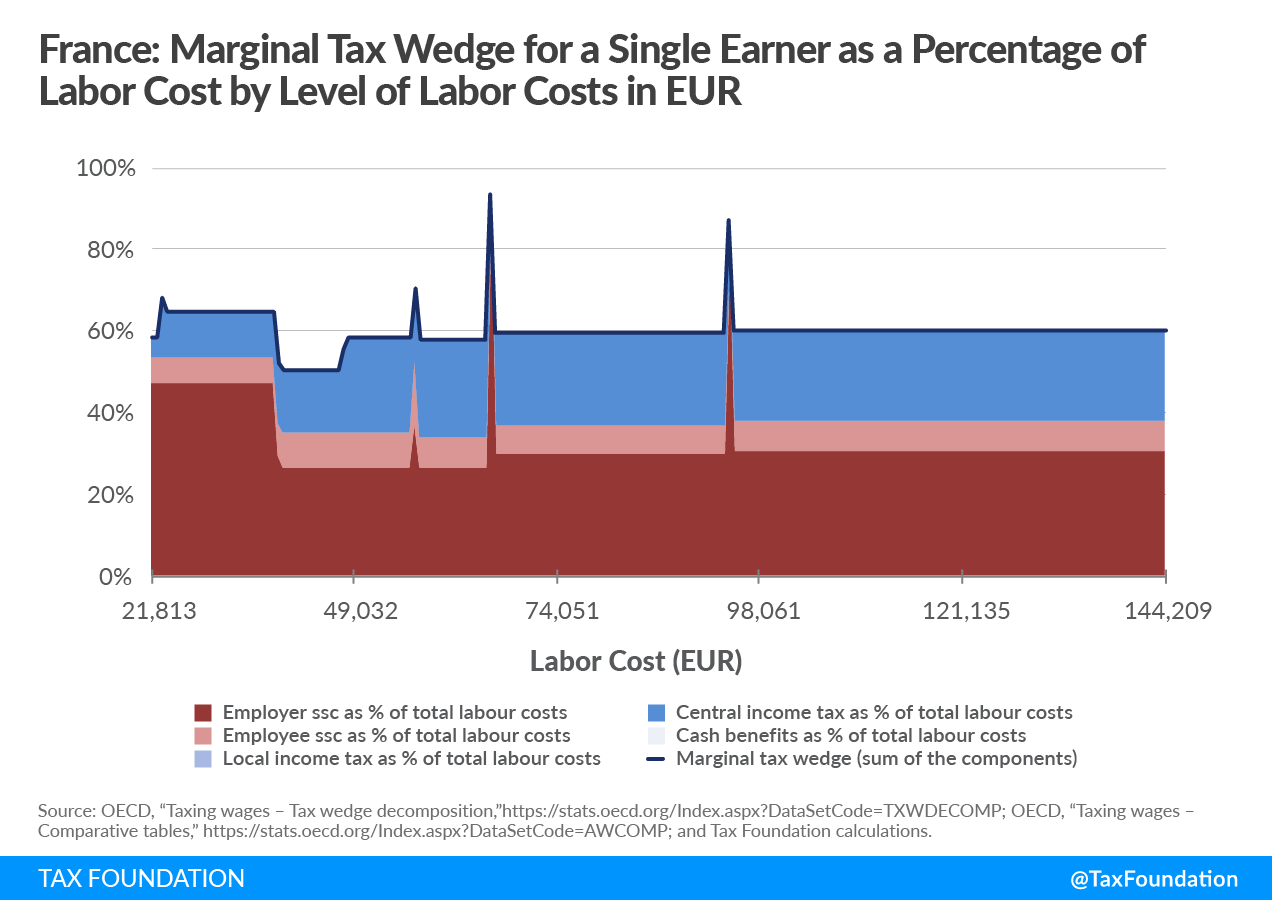

Imagine a worker who gets a raise and ends up paying in taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. the same amount as their raise. This is the case for a French worker who earns EUR 46,767. With an increase in pay of EUR 3,376, he would face a 93 percent marginal tax rate. This French worker will end up with a net pay increase of only EUR 231, while the biggest portion of the raise, EUR 2,976, goes directly towards the employer social security contribution.

This is why the marginal tax wedge is relevant for understanding how workers might benefit (or not) from an increase in pay once taxes enter the picture.

High marginal tax rates at different earning levels like the one observed in the case of this French worker act as barriers to upward mobility, discouraging people from advancing in their careers. Very often these high rates are hidden in complex policy structures. However, a recently published study by Archbridge Institute and Tax Foundation highlights the underlying policies that drive the marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. spikes that workers are subject to in a number of countries.

| French Single Worker Average Labor Cost: EUR 54,479 (US$77,248) | ||||

|---|---|---|---|---|

| Total Labor Cost | EUR 55,569 | EUR 63,840 | EUR 93,420 | |

| Net Earnings Before the Raise | EUR 29,325 | EUR 32,744 | EUR 43,601 | |

| Amount of the Raise | EUR 631 | EUR 3,376 | EUR 1,757 | |

| Amount of Additional Tax/Benefits Reduction Due to the Raise | EUR 445 | EUR 3,145 | EUR 1,526 | |

| % of the Raise Eaten up by the MTR | 70.51% | 93.16% | 86.85% | |

| Net Earnings After the Raise | EUR 29,511 | EUR 32,975 | EUR 43,832 | |

| Source: OECD, “Taxing wages – Tax wedge decomposition,” https://stats.oecd.org/Index.aspx?DataSetCode=TXWDECOMP; OECD, “Taxing wages – Comparative tables,” https://stats.oecd.org/Index.aspx?DataSetCode=AWCOMP; and Tax Foundation calculations. | ||||

While advancing their careers French workers could face up to three important marginal tax rate spikes and lose 93 percent of additional earnings to contributions to the general equilibrium component of social security contribution and family allowance.

In 2021, the first marginal tax rate spike occurred at 102 percent of the average wage and approximately 117 percent of the median wage. If the employer of this French worker increased compensation by just EUR 631, the net pay increase for the worker was only EUR 186. This French worker with no children faced a marginal tax wedgeBroadly speaking, a tax wedge is the difference between the pre-tax price or return and after-tax price or return. For labor income, it is the difference between the total labor costs to the employer and the corresponding net take-home pay of the employee. of 71 percent for a 1 percent increase in gross earnings on top of the gross annual wage of EUR 40,771. This is because employer social security contributions are increased by 0.33 percentage points at that earnings level. This increase is generated by the contribution to the general equilibrium component that rises from 1.29 percent to 1.62 percent once the ceiling of social security contributions is reached (EUR 41,136).

Moving up the income ladder the worker faced a marginal tax wedge of 93 percent for a 1 percent increase in gross earnings on top of the gross annual wage of EUR 46,767. This is because employer social security contributions increase by 6 percentage points at this level of income. The 2018 social security financing law reduced from 13 percent to 7 percent employer’s health-maternity-disability-death contribution for workers whose yearly wages did not exceed EUR 47,685 annually, 2.5 times the French minimum wage (EUR 19,074).

When moving higher up the income ladder this French worker faced a marginal tax wedge of 87 percent for a 1 percent increase in gross earnings on top of the gross annual wage of EUR 65,553. This is due to an increase in employer social security contributions by 2 percentage points, generated by the contribution to the family allowance that moves from 3.5 percent to 5.25 percent once the income exceeds EUR 66,759, 3.5 times the minimum wage.

The system of social security contributions in France is extremely complex with numerous reductions of the rates depending on a company’s size, sector, and workers’ wages. Additionally, the existence of different social security thresholds calculated either in terms of the minimum wage or in terms of the maximum social security contributions generates a series of marginal tax rates that might keep some workers in France just below the threshold earnings that trigger the tax rate spikes. Eliminating these barriers by implementing a unique and lower rate will allow workers to have access to higher wages without confronting this barrier. Simplifying the system would also bring clarity both to employees and employers and would eventually prevent social security contribution fraud.

Follow the Leader

In order to reduce this complex social security contributions system, France could follow the Lithuanian example. Lithuania is the first and, for now, the only country in the European Union that shifted, in 2019, most of the employer social security contributions to the employee side, which translated into a gross salary increase of 28.9 percent. By closing the gap between the total labor cost and the gross salary, labor taxation became more transparent and simple. Lithuania has now a relatively flat marginal tax rate at around 44.1 percent.

Although many of the underlying policies generating these marginal tax rate spikes were designed for restoring the long-term sustainability of the system and balancing the French social security accounts, many of them come with trade-offs that policymakers must keep in mind when planning to reform the tax-benefit system. Reshaping some of these policies to generate a smoother variation of marginal tax rates over different income levels would likely raise labor supply and encourage the upward mobility of workers and especially that of average-income workers.

Note: This is part of a five-part blog series that highlights the findings of a recently published study by Archbridge Institute and Tax Foundation and explores the underlying policies that drive the marginal tax rate spikes that workers are subject to in a number of countries.