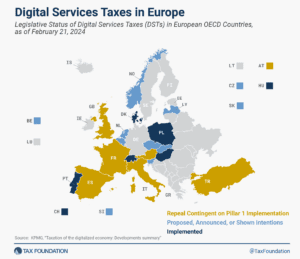

Digital Services Taxes in Europe, 2024

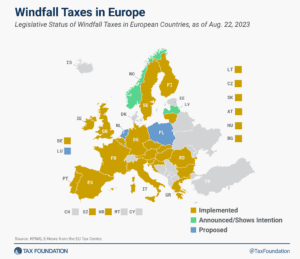

About half of all European OECD countries have either announced, proposed, or implemented a DST. Because these taxes mainly impact U.S. companies and are thus perceived as discriminatory, the United States responded to the policies with retaliatory tariff threats, urging countries to abandon unilateral measures.

4 min read