Much has been written about the House Democrats’ proposal to increase tobacco and nicotine products taxes over the last week. The proposal, which would double the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on cigarettes while taxing every other tobacco and nicotine product at comparable rates, would have significant implications on the availability of non-cigarette tobacco products. And the potential federal increase of over 1,600 percent on dipping tobacco could result in state taxes and retail prices increasing by more than 50 percent in certain states. At the high end, Massachusetts consumers would pay more than $20 for a can of dipping tobacco.

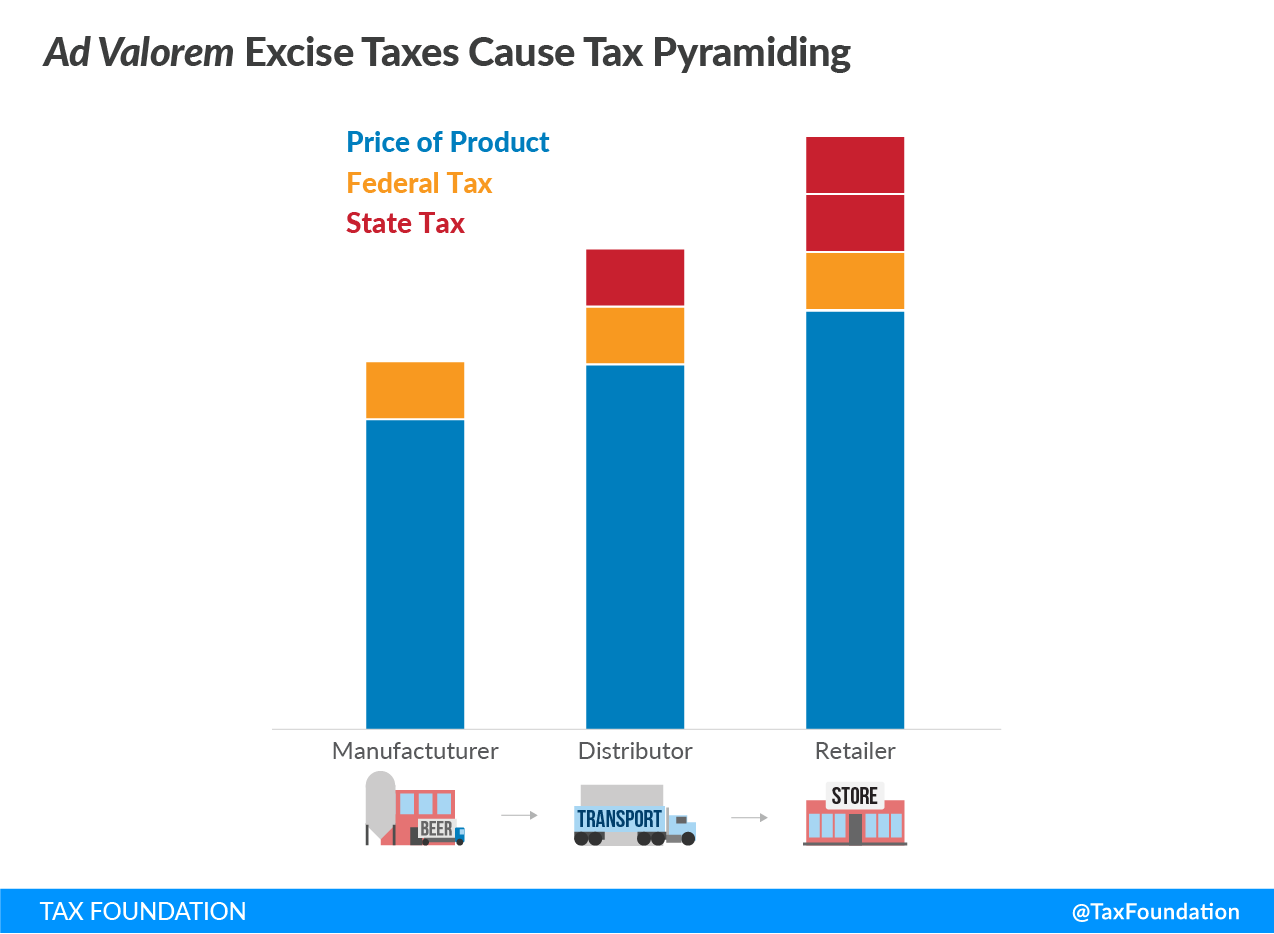

The federal government is not the only government entity to tax tobacco products—all states and many localities tax tobacco as well. Every state taxes cigarettes by quantity, but a majority tax other tobacco products (OTP) by price (ad valorem). When states tax tobacco products by price, the tax on the product will pyramid since the federal tax is levied at the manufacturer level and the state tax is levied at distribution level. In effect, the state tax base includes the federal tax and becomes a tax on a tax.

In states that levy specific taxes (based on quantity), this effect is avoided. If a state tax is $10 per pound of chewing tobacco, the state tax stays the same regardless of federal tax choices. If, on the other hand, the state levies a tax of 100 percent of wholesale price, it greatly matters what the federal government does. Table 1 illustrates this by showing the impact of the potential federal increase on tax and price for a standard priced 1.2 ounce can of dipping tobacco for all 50 states before and after the federal tax increase. The states marked in the table levy ad valorem taxes. A federal cannabis tax proposal shares this issue.

| State | Price per Can before Federal Increase | Price per Can after Federal Increase | Increase in Price | Increase in State Tax Burden | Ad Valorem State Tax |

|---|---|---|---|---|---|

| Alabama | $4.59 | $7.03 | 53% | 0% | |

| Alaska | $7.44 | $11.41 | 53% | 53% | ✓ |

| Arizona | $4.87 | $7.29 | 50% | 0% | |

| Arkansas | $7.69 | $11.79 | 53% | 53% | ✓ |

| California | $7.13 | $10.93 | 53% | 53% | ✓ |

| Colorado | $6.75 | $10.35 | 53% | 53% | ✓ |

| Connecticut | $8.94 | $11.31 | 27% | 0% | |

| Delaware | $5.48 | $7.71 | 41% | 0% | |

| District of Columbia | $8.77 | $13.45 | 53% | 53% | ✓ |

| Florida | $8.91 | $13.67 | 53% | 53% | ✓ |

| Georgia | $4.91 | $7.53 | 53% | 53% | ✓ |

| Hawaii | $7.16 | $11.02 | 54% | 53% | ✓ |

| Idaho | $6.04 | $9.31 | 54% | 53% | ✓ |

| Illinois | $4.98 | $7.43 | 49% | 0% | |

| Indiana | $5.05 | $7.46 | 48% | 0% | |

| Iowa | $6.23 | $8.65 | 39% | 0% | |

| Kansas | $5.00 | $7.72 | 54% | 53% | ✓ |

| Kentucky | $4.65 | $7.03 | 51% | 0% | |

| Louisiana | $5.46 | $8.42 | 54% | 53% | ✓ |

| Maine | $7.38 | $9.76 | 32% | 0% | |

| Maryland | $5.73 | $8.83 | 54% | 53% | ✓ |

| Massachusetts | $13.70 | $21.11 | 54% | 53% | ✓ |

| Michigan | $5.82 | $8.97 | 54% | 53% | ✓ |

| Minnesota | $9.04 | $13.94 | 54% | 53% | ✓ |

| Mississippi | $5.12 | $7.89 | 54% | 53% | ✓ |

| Missouri | $4.95 | $7.58 | 53% | 53% | ✓ |

| Montana | $5.38 | $7.61 | 41% | 0% | |

| Nebraska | $5.13 | $7.48 | 46% | 0% | |

| Nevada | $5.88 | $8.97 | 52% | 53% | ✓ |

| New Hampshire | $7.11 | $10.90 | 53% | 53% | ✓ |

| New Jersey | $5.58 | $7.92 | 42% | 0% | |

| New Mexico | $5.63 | $8.59 | 53% | 53% | ✓ |

| New York | $7.59 | $9.95 | 31% | 0% | |

| North Carolina | $5.04 | $7.70 | 53% | 53% | ✓ |

| North Dakota | $5.37 | $7.72 | 44% | 0% | |

| Ohio | $5.24 | $8.00 | 53% | 53% | ✓ |

| Oklahoma | $6.69 | $10.26 | 53% | 53% | ✓ |

| Oregon | $6.69 | $8.92 | 33% | 0% | |

| Pennsylvania | $5.27 | $7.61 | 44% | 0% | |

| Rhode Island | $5.98 | $8.32 | 39% | 0% | |

| South Carolina | $4.72 | $7.19 | 53% | 53% | ✓ |

| South Dakota | $6.00 | $9.16 | 53% | 53% | ✓ |

| Tennessee | $4.88 | $7.44 | 52% | 53% | ✓ |

| Texas | $6.38 | $8.74 | 37% | 0% | |

| Utah | $7.24 | $9.58 | 32% | 0% | |

| Vermont | $8.29 | $10.61 | 28% | 0% | |

| Virginia | $4.95 | $7.28 | 47% | 0% | |

| Washington | $7.80 | $10.17 | 30% | 0% | |

| West Virginia | $4.99 | $7.61 | 53% | 53% | ✓ |

| Wisconsin | $8.81 | $13.46 | 53% | 53% | ✓ |

| Wyoming | $5.29 | $7.61 | 44% | 0% | |

|

Notes: Price includes federal and state excise taxes as well as state and local sales taxes. Source: Orzechowski & Walker price estimates, state statutes, and author’s calculations. |

|||||

If the federal government increases the tax on dipping tobacco by over 1,600 percent, all states experience price increases in excess of 25 percent, but state tax burdens increase by over 50 percent where ad valorem taxes are levied. These double-digit tax burden increases result in 15 states where a can of 1.2 ounces of dipping tobacco would cost more than $10. Today that is only the case in one state—Massachusetts. After the increase, Massachusetts would be the only state where a can costs more than $20. Such increases make cigarettes a cheaper option in many states despite cigarettes being the most harmful way to consume tobacco and nicotine.

There are additional reasons to not levy excise taxes on tobacco based on price. For most excise taxes, the base should be the harm or cost-causing element because that best internalizes a negative externalityAn externality, in economics terms, is a side effect or consequence of an activity that is not reflected in the cost of that activity, and not primarily borne by those directly involved in said activity. Externalities can be caused by either production or consumption of a good or service and can be positive or negative. . For tobacco products, that is clearly the quantity of tobacco consumed, with the 23 states that tax quantity getting this right. Price shares no relationship with the harm associated with consumption.

In addition to being a regressive tax that is unlikely to generate stable revenue, such significant tax and price increases are highly likely to accelerate tobacco product smuggling. Federal lawmakers should take these unintended consequences into account when considering revenue options for their spending priorities.