The top 20 percent of taxpayers pay a disproportionate share of federal income taxes and total federal taxes, according to a new report by the Congressional Budget Office on the distribution of household income and federal taxes. (For an overview, see here.)

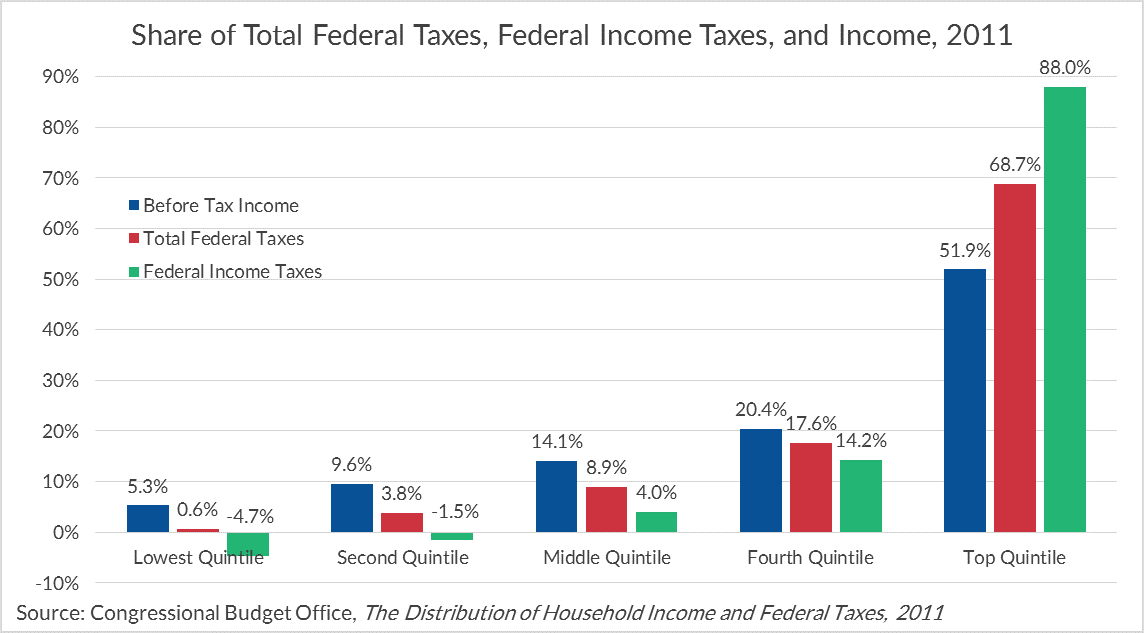

The report finds that the top 20 percent of households earn 52 percent of income, but pay 69 percent of all federal taxes. If we look strictly at income taxes, the top 20 percent of the country pays 88 percent of federal income taxes.

Each of the four other quintiles pay a smaller share of total federal taxes and income taxes than their share of income. Additionally, the bottom two quintiles face negative shares for income taxes, which means they receive more back in taxes than they pay.

Households with higher incomes also pay higher average taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates. For total federal taxes, the top quintile faces an average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. just below 25 percent. This average tax rate is sure to rise following the tax increases on the top two tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. at the start of 2013.

These findings are as expected. The individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. system in the United States is highly progressive. While lower income households pay other taxes (payroll taxes, corporate taxes, and excise taxes), the federal tax system remains progressive when considering total federal taxes.

Share this article