Budget Reconciliation: Tracking the 2025 Trump Tax Cuts

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

16 min read

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

16 min read

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

Sean Bray interviewed Professor of Business Accounting and Taxation at the University of Kiel, Jost Heckemeyer, about the future of the EU tax mix. The interview shows that there is a trade-off between stability and flexibility in European tax policymaking. It also shows that there ought to be a balance between fairness and competitiveness when thinking about improving tax policy.

16 min read

The flat tax trend is gaining momentum nationwide, and Missouri lawmakers are right to identify income tax rate reductions as particularly pro-growth.

4 min read

Surtaxes such as Germany’s solidarity surtax run counter to the principles of simplicity and transparency of the tax system because they impose an additional layer of tax on taxpayers and create a more complex tax structure that often obscures the actual tax burden.

4 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Many countries’ personal income tax systems tax various sources of individual income—including investment income such as dividends and capital gains.

4 min read

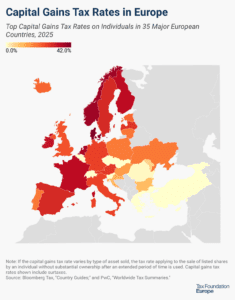

Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

5 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

Facing a projected $3 billion budget deficit in fiscal year 2026, with forecasts of a growing gap over the next five years, Governor Wes Moore (D) has included about $1 billion in proposed tax increases in his budget proposal.

7 min read

Given the poor state of the budget process and worsening debt trajectory, lawmakers should move boldly and quickly to address the issue, including via a fiscal commission process. Issues to consider should include reforms to both spending and taxes.

42 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

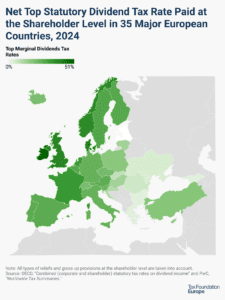

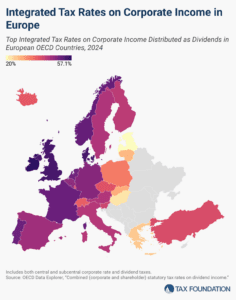

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

Fiscal pressures are likely to weigh heavily on lawmakers as they craft a tax reform package. That increased pressure could result in well-designed tax reform that prioritizes economic growth, simplicity, and stability, or it could encourage budget gimmicks and economically harmful offsets. Lawmakers should avoid the latter.

8 min read

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

92 min read

On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

17 min read