Facts and Figures 2021: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

A year ago, it seemed possible that New Hampshire was headed toward a triggered tax increase. Instead, lawmakers may trim business tax rates and begin the phaseout of the state’s tax on interest and dividend income, which would take away the asterisk and make New Hampshire the ninth state to forgo an individual income tax altogether.

4 min read

A new study illustrates how overlooking an important element of the tax system—the structure of the tax base—can lead to an incomplete understanding of how tax reform impacts the economy.

4 min read

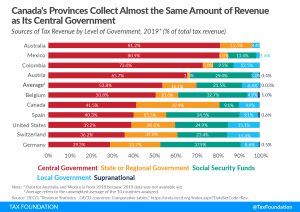

Developed countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less distortionary effects than taxes on income.

16 min read

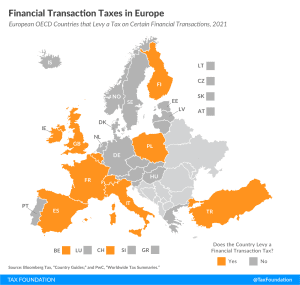

Belgium, Finland, France, Ireland, Italy, Poland, Spain, Switzerland, Turkey, and the United Kingdom currently levy a type of financial transaction tax

2 min read

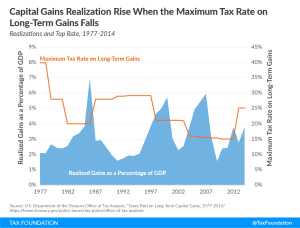

Whether you see the GameStop saga as a Robin Hood-style victory for the little guys or as a case of disruptive investor hysteria, it provides an interesting case study in just how badly the mark-to-market treatment of capital gains income could go awry.

6 min read

Lawmakers looking to close budget shortfalls would be well-advised to consider other and more stable avenues for new revenue.

28 min read

The Regional Tax Competitiveness Index (RTCI) for Spain allows policymakers, businesses, and taxpayers to evaluate and measure how their regions’ tax systems compare. This Index has been designed to analyze how well regions structure their tax system. Additionally, it serves as a road map for policymakers to reform their tax systems and make their regions more competitive and attractive for entrepreneurs and residents.

7 min read

Our new study provides a 360-degree assessment of New York’s budget crisis, analyzes proposed revenue options, and offers solutions to raise revenue without driving more taxpayers out of the state or undoing recent positive reforms

106 min read

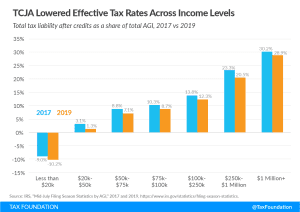

The latest IRS data continues to illustrate that the net effect of the Tax Cuts and Jobs Act was to reduce effective tax rates across income groups. In 2019, the TCJA again expanded the use of several deductions and credits, made the standard deduction more favorable than itemizing, and lowered taxes for most taxpayers.

4 min read

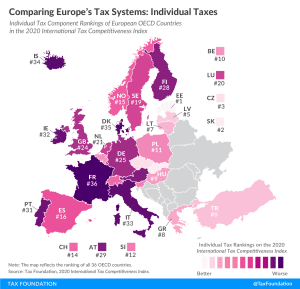

How do individual income tax codes compare among European OECD countries? Explore our new map to see how individual income tax systems in Europe compare.

3 min read

The IRS recently released the new 2021 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

6 min read

Joe Biden recently released a piece reviewing his tax proposals, contrasting them with President Donald Trump’s tax ideas. A major theme within this piece can be summarized in the title: “A Tale of Two Tax Policies: Trump Rewards Wealth, Biden Rewards Work.”

4 min read

As the NYSE prepares to conduct a test of their server capacity elsewhere, New Jersey lawmakers may be forced to rethink the viability of their financial transaction tax proposal.

4 min read

Biden’s tax vision is twofold: higher taxes on high-income earners and businesses paired with more generous provisions for specific activities and households.

4 min read

What tax policy ideas did Harris propose along the campaign trail, and how do they differ from Biden’s plan?

4 min read

Seeking new sources of funding, New York and New Jersey—two states at the heart of global financial markets—are considering financial transaction taxes.

5 min read