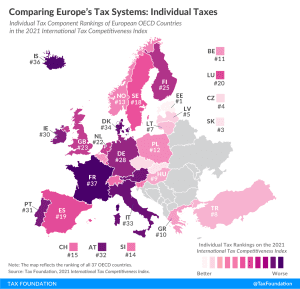

Comparing Europe’s Tax Systems: Individual Taxes

France’s individual income tax system is the least competitive of all OECD countries. It takes French businesses on average 80 hours annually to comply with the income tax.

3 min read

France’s individual income tax system is the least competitive of all OECD countries. It takes French businesses on average 80 hours annually to comply with the income tax.

3 min read

The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

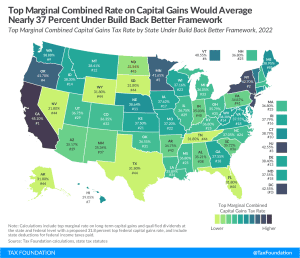

Under the Build Back Better framework, six states and D.C. would face combined top marginal capital gains tax rates of more than 40 percent, nearing the top rate among OECD countries.

3 min read

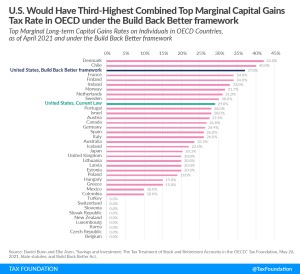

Under the new Build Back Better framework, the United States would tax capital gains at the third-highest top marginal rate among rich nations, averaging nearly 37 percent.

1 min read

Congress is debating new ways to raise revenue that would make the tax code more complex and more difficult to administer. The new proposals—imposing an alternative minimum tax on corporate book income, applying an excise tax on stock buybacks, and, at one point this week, a tax on unrealized capital gains for billionaires—are unreliable and highly complex ways to raise revenue.

10 min read

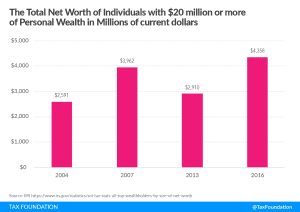

Congressional Democrats are reported to be weighing a special tax on the assets of billionaires to raise revenues to pay for their Build Back Better spending plan. There are two fundamental challenges to such a plan.

8 min read

On May 4th, Gov. Jay Inslee (D) signed legislation creating a 7 percent capital gains tax, to take effect next year. On November 2nd, Washington lawmakers will learn what voters think about it.

5 min read

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

As Congress considers President Biden’s proposal to tax unrealized capital gains at death, the history of previous efforts suggests it faces a perilous road ahead. Lawmakers must resolve tricky design and implementation details that derailed past attempts to change how capital gains are treated when assets are passed from one generation to the next.

4 min read

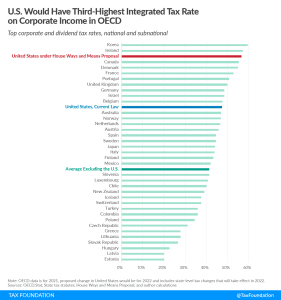

Under the House Ways and Means tax plan, the United States would tax corporate income at the third-highest integrated tax rate among rich nations, averaging 56.6 percent.

3 min read

The White House Council of Economic Advisors (CEA)’s recent report estimates the average federal individual income tax rate for the top 400 wealthiest households in the U.S to be 8.2 percent, lower than typically estimated for top earners.

4 min read

Congressional lawmakers are putting together a reconciliation bill to enact much of President Biden’s Build Back Better agenda. Many lawmakers including Senate Finance Committee Chair Ron Wyden (D-OR), however, want to make their own mark on the legislation.

5 min read

Mark-to-market is not simple to implement, as it involves new administrative and compliance challenges for taxpayers. Mark-to-market levies tax on phantom income, requiring some taxpayers to engage in some degree of liquidation, ultimately suppressing incentives to save and invest. The limited tax revenues that could result from these proposals are not worth the risk.

5 min read

The Biden administration has targeted U.S. businesses, including corporations and passthrough entities, to raise revenue to fund new spending. However, individual taxpayers across America will end up footing the bill.

4 min read

New research from Federal Reserve Bank of Boston economists suggests wealth inequality has grown less than previously estimated and that shares of wealth held by top earners drops significantly when accounting for sources of lower- and middle-class wealth that are often overlooked.

2 min read

The Biden administration has primarily focused on increasing taxes on top earners to generate revenue to fund its spending priorities. However, these proposals would hit many pass-through businesses and much of pass-through business income, including small businesses, family-owned businesses, and farms.

3 min read

President Biden’s proposal to tax capital gains at higher, ordinary income tax rates would lead the U.S. to have the highest top marginal tax rate on capital gains in the OECD.

2 min read

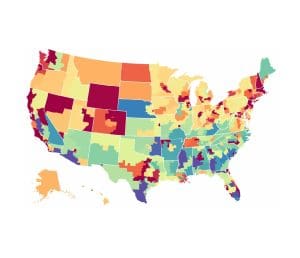

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read