The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

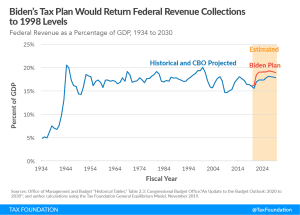

Placing Joe Biden’s Tax Increases in Historical Context

If we consider Biden’s tax plan over the entire budget window (2021 to 2030) as a percentage of GDP—1.30 percent—it would rank as the 6th largest tax increase since the 1940s and and one of the largest tax increases not associated with wartime funding.

6 min read

The UN Approach on Digital Taxation

The UN tax committee will be considering a change to the UN’s model tax treaty that, if adopted and implemented, could result in digital companies paying more taxes in countries where their customers are located even if those companies do not have physical locations there.

5 min read

Biden-Harris Proposals Can Raise Taxes on the Middle Class

If we look at both the legal incidence of the Biden-Harris policy proposals and their economic incidence, we find both direct and indirect tax increases on many taxpayers who earn less than $400,000.

2 min read

Two Roads Diverge in the OECD’s Impact Assessment

The difference that the OECD presents between the potential impact in the context of agreement compared to a harmful tax and trade war should show policymakers the value of continuing multilateral discussions.

6 min read

Top Rates in Each State Under Joe Biden’s Tax Plan

President Joe Biden’s tax plan would yield combined top marginal state and local rates in excess of 60 percent in three states: California, Hawaii, and New Jersey (also New York City).

4 min read

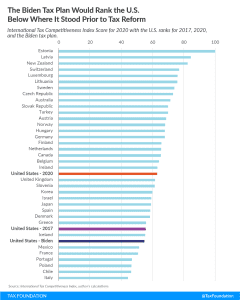

How Would Biden’s Tax Plan Change the Competitiveness of the U.S. Tax Code?

While the Biden campaign is certainly focused on increasing taxes on U.S. businesses and high-income earners, it is important that policymakers also understand what that reversal might do to U.S. competitiveness, and the competitive global environment in which U.S. companies and U.S. workers operate.

3 min read

Role of the 2017 Tax Reform in the Nascent U.S. Economic Recovery

While there is still plenty of work to be done to get unemployed Americans back to work, the U.S. economy as a whole is now recovering strongly from the pandemic-induced economic downturn, outperforming forecasts from earlier in the year and outperforming most other developed countries.

4 min read

Reviewing the Commitment to American GROWTH Act

House Republicans recently introduced HR 11, the Commitment to American GROWTH Act, outlining an alternative to Democratic presidential nominee Joe Biden’s tax vision. The proposal would address upcoming expirations of the 2017 Tax Cuts and Jobs Act (TCJA) and create or expand other tax provisions designed to boost domestic investment.

5 min read

Arizona Proposition 208 Threatens Arizona’s Status as a Destination for Interstate Migration

Significantly raising the income tax through Proposition 208 will only serve to make Arizona less competitive, especially at a time when individuals and small businesses are already struggling. If Arizona is looking for a long-term way to increase education funding, it would do well to avoid overburdening struggling taxpayers and look toward more broad-based, stable sources of revenue.

5 min read

Pillars, Blueprints, an Impact Assessment, and Construction Delays

The OECD released blueprints for proposals on changing international tax rules alongside an impact assessment based on the overall design of the proposals. While the blueprints cover proposals both for changing where large multinationals owe corporate tax and designing a global minimum tax, there are still many unanswered questions. In the meantime, other digital tax proposals are moving forward and have the potential to result in a harmful tax and trade war.

4 min read