The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Financing Infrastructure Spending with Corporate Tax Increases Would Stunt Economic Growth

The Biden administration’s American Jobs Plan proposal to fund infrastructure spending relies on a bet that the benefits outweigh the costs of a higher corporate tax burden. Using the Tax Foundation model, we find that this trade-off is a bad one for the U.S. economy, resulting in reduced GDP, less capital investment, fewer jobs, and lower wages.

3 min read

Tax Policy Lessons from Down Under

This week the Australian government released its latest budget proposal and two policies that stand out in its fiscal response to the pandemic should be helpful as the economic engine of the country turns back on. The first is full expensing for some investments and the second is the introduction of a loss carryback provision. The new budget takes both these temporary policies and extends them into 2023.

2 min read

Taxing Unrealized Capital Gains at Death Is Unlikely to Raise Revenue Advertised

As part of the tax proposals in President Biden’s American Families Plan, unrealized capital gains over $1 million would be taxed at death. However, this policy would likely raise less revenue than advocates expect after considering the proposal’s impact on taxpayer behavior, including capital gains realizations, and historical capital gains and estate tax revenue collections.

5 min read

Many Small Businesses Could Be Impacted by Biden Corporate Tax Proposals

Policymakers should recognize that corporate tax hikes will not only impact large firms, but many smaller and younger firms as well. Considering that many of these smaller firms are significant contributors to net job growth, raising corporate taxes at this time would not be conducive for a speedy economic recovery.

2 min read

Treasury Rule on State Tax Cuts Limitation Raises New Questions

Today, the U.S. Treasury issued an interim final rule on the $350 billion in State and Local Fiscal Recovery Funds provided under the American Rescue Plan Act (ARPA). The proposed rule resolves several important questions but continues to involve the federal government in state finances at an extraordinary level.

7 min read

Recent Analysis Explores Pillar 1 Risks and the Potential for Disputes

As countries move closer to agreement on how the OECD Pillar 1 Amount A will work and which companies will be impacted by it, it is incredibly important for policymakers to continue to evaluate not just the intended effects but also the potential unintended consequences.

6 min read

Outlier No More: Kansas Adopts Tax Reform with Wayfair Safe Harbor, GILTI Exclusion

After three years of deliberations, more than two-thirds of members in both the Senate and the House enacted tax reform and relief legislation Monday over the veto of Gov. Laura Kelly (D).

4 min read

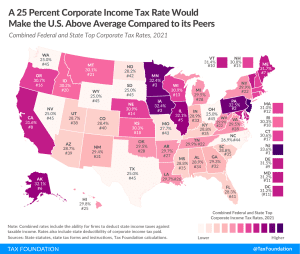

25 Percent Corporate Income Tax Rate Would Make U.S. Above Average Compared to Peers

Some lawmakers have expressed concerns about President Biden’s proposal to raise the federal corporate income tax rate from 21 percent to 28 percent, and instead suggest raising the rate to 25 percent.

3 min read

Evaluating Options to Help Low-Income Households

While strong economic growth—fueled by higher levels of investment, productivity, and jobs—will lift after-tax incomes over time, policies that provide relief by immediately boosting after-tax incomes of lower-income households are also available. As lawmakers consider such policies, they should keep in mind the trade-offs among them.

4 min read

Relaxing State and Local Tax Deduction Cap Would Make Tax Code Less Progressive

As President Biden’s tax plans are considered in Congress, the future of the $10,000 cap for state and local tax deductions (SALT) is becoming an important part of the tax debate.

3 min read