The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

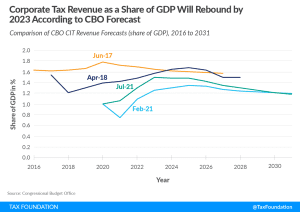

Corporate Tax Revenue Forecasted as Robust following the 2017 Tax Reform

In light of these forecasts, which could be revised upwards further given the pace of growth in the economy and corporate profits, it seems clear that the 2017 tax reform did not substantially reduce the revenue potential of the corporate tax.

3 min read

Here’s How Louisiana’s Tax Plan Would Simplify the Tax Code and Benefit Residents

Louisiana legislators passed a tax reform plan that has received overwhelming support in both the House and Senate, but voters will get the ultimate say on whether that plan succeeds. In light of this, it may be valuable to walk through what is included in these reforms and what effect the changes will have on taxpayers.

5 min read

The Bipartisan Infrastructure Plan Avoids Tax Increases, Undermines User-Pay Principle, and Misses Chance to Modernize Obsolete Programs

The good news is that lawmakers avoided raising taxes to cover the cost of the new spending and instead used some reasonable fees and asset sales. The bad news is that half of the offsets come from unused, debt-financed COVID-19 relief funds and the economic return on many of these investments is questionable.

7 min read

How Did We Ever Agree to Fund Infrastructure Investments?

As lawmakers explore funding mechanisms for additional federal infrastructure investment, they should focus on permanent, sustainable, and transparent revenue options that conform to the benefit principle. Permanent user fees, appropriately adjusted to restore and maintain their purchasing power, would serve as ideal revenue sources for federal infrastructure investments.

5 min read

D.C.’s Income Tax Hike Helps Maryland and Virginia, Not D.C.

Even as lawmakers in eleven states have cut income taxes this year, the D.C. Council has responded to surpluses and growth by voting to include substantial income tax increases in the budget.

7 min read

Amortization Deductions for Sports Teams Properly Part of the Income Tax System

The media has reported on how wealthy taxpayers who own sports teams lower their tax liability by deducting the cost of purchasing a sports team over 15 years. Contrary to claims that deducting the cost of a sports team from taxable income is a “loophole,” such deductions are a normal and proper part of the income tax system.

3 min read

Survey Shows Growing Tax Complexity for Multinationals

New data clearly points to an increase in tax complexity for multinationals in the OECD as well as globally. The OECD’s ongoing efforts to reform the international tax system will likely further add complexity to the international tax environment.

3 min read

North Carolina Considers Corporate Income Tax Repeal and Individual Income Tax Relief

Taken together, the proposed reforms would further solidify North Carolina’s position as a leader in sound tax policy and as a state whose tax code is among the most conducive to generating long-term economic growth.

7 min read

Illuminating the Hidden Costs of State Tax Incentives

In most states, tax incentives abound, usually offered as a way of promoting new investment or attracting certain industries by shielding them from the full impact of otherwise high tax rates.

6 min read

Intellectual Property Came Back to U.S. after Tax Reform, but Proposals Could Change That

Intellectual property is a key driver in the current economy. Among other things, intellectual property includes patents for life-saving drugs and vaccines and software that runs applications on phones and computers.

5 min read