The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Choose Your Own Adventure: Global Minimum Tax Edition

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have surfaced in recent weeks, there are clear divides among various proposals.

5 min read

Latest White House Report Tells Incomplete Story on Average Tax Rates for Wealthy

The White House Council of Economic Advisors (CEA)’s recent report estimates the average federal individual income tax rate for the top 400 wealthiest households in the U.S to be 8.2 percent, lower than typically estimated for top earners.

4 min read

2021 Spanish Regional Tax Competitiveness Index

The Spanish Regional Tax Competitiveness Index allows policymakers, businesses, and taxpayers to evaluate and measure how their regions’ tax systems compare and serves as a road map for policymakers to reform their tax systems and make their regions more competitive and attractive for entrepreneurs and residents.

7 min read

The Good, the Bad, and the Ugly of the Ways and Means Plan

The latest version of the Biden Build Back Better agenda, released last week by the House Ways and Means committee, is dense, with too many provisions to flesh out completely. Here’s a rundown of the good, the bad, and the ugly of it.

7 min read

Federal Tobacco Tax Proposal Could Result in 50% Increase in State Taxes

The potential federal tax increase of over 1,600 percent on dipping tobacco as a result of the House Democrats’ proposal could result in state taxes and retail prices increasing by more than 50 percent in certain states.

4 min read

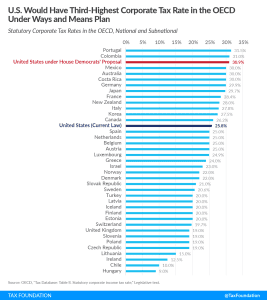

U.S. Would Have Third-Highest Corporate Tax Rate in OECD Under Ways and Means Plan

Under the Ways and Means text, the U.S. would have an average corporate tax rate of 30.9 percent, which would be the third-highest corporate tax rate in the OECD, behind only Colombia and Portugal.

1 min read

A 15 Percent VAT Rate Is Possible by Scrapping Reduced Rates

A VAT tax reform that eliminates VAT reduced rates would decrease compliance costs and allow for a more rapid economic recovery. Policymakers should focus on simplifying VAT rules and making them more efficient and neutral by broadening their tax bases and eliminating reduced rates and unnecessary tax exemptions.

4 min read

House Tobacco Proposals Defy Biden’s Tax Pledge and Undermine Harm Reduction Efforts

House Democrats’ newly released $3.5 trillion tax legislation includes a tax increase on tobacco, nicotine, and vapor products levied on tobacco manufacturers. But ultimately it would fall heavily on tobacco consumers—many of the group that earns less than $400,000 that President Biden pledged would not see a tax increase.

6 min read

Tax on Stock Buybacks a Misguided Way to Encourage Investment

Research shows that a tax on stock buybacks would not be the right policy solution to encourage long-term investment or lift wages.

3 min read

What If We Taxed Churches?

Whether spurred by a belief that government is improperly favoring religious institutions, an antipathy to wealthy celebrity pastors, or a hope that taxing houses of worship could bring down personal tax bills, the taxation of religious bodies is hotly debated online, but barely on the radar of actual elected officials. But is that true? How much, if any, tax revenue is forgone, and what do the policies look like?

7 min read