The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Fixing Tax Treatment of Capital Investments Could Improve Supply Chain Resiliency

While taxes are not at the root of supply chain disruptions, improvements to the tax code could make supply chains more resilient in the future.

3 min read

New Study Shows Tax Policy Has Strong Effects on Innovation

When examining how tax policy impacts the economy, researchers typically look at labor supply and investment responses. One other channel through which taxes impact the economy has been less studied: innovation.

3 min read

The Rich Are Not Monolithic and Taxing Their Wealth Invites Tax Collection Volatility

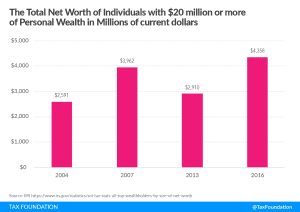

Congressional Democrats are reported to be weighing a special tax on the assets of billionaires to raise revenues to pay for their Build Back Better spending plan. There are two fundamental challenges to such a plan.

8 min read

How Would House Dems’ Tax Plan Change Competitiveness of U.S. Tax Code?

The legislation put forward by Democratic members of the House of Representatives would reverse many of the 2017 reforms while increasing burdens on businesses and workers.

2 min read

Washington Voters to Weigh in on New Capital Gains Income Tax

On May 4th, Gov. Jay Inslee (D) signed legislation creating a 7 percent capital gains tax, to take effect next year. On November 2nd, Washington lawmakers will learn what voters think about it.

5 min read

Lawmakers Could Pay for Reconciliation While Improving the Tax Code

With corporate and individual rate hikes potentially out of the Build Back Better (BBB) reconciliation package, lawmakers are weighing alternative options to raise revenue. Rather than come up with untested proposals and complicated changes to the tax base, they should prioritize options that raise revenue while improving the structure of the tax code.

4 min read

Proposed Minimum Tax on Book Income Would Hit Stock-Based Compensation

Raising taxes on stock-based compensation through a book income tax will disadvantage this form of compensation and produce more complexity in the tax system without providing benefits to workers.

5 min read

Funding for Democrats’ $3.5 Trillion Spending Plan Is Unstable and Unsustainable

One has to wonder how stable or sustainable the Democrats’ spending program can be if it must rely so heavily on the taxes paid by such a small number of taxpayers as in the top 1 percent.

5 min read

Louisiana Voters Have Chance to Simplify Taxes and Lower Burdens

Passage of Louisiana Amendments 1 and 2, which are aimed at the sales tax and individual and corporate income taxes, respectively, would substantially simplify the Pelican State’s tax code and provide tax relief in both the short and long term.

8 min read