The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Can Taxes Predict the UEFA Champions League Winner?

Before competing in the UEFA Champions League, football clubs in Europe also compete to lure the best players.

5 min read

Which Global Minimum Tax Will We Get?

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have been debated in recent months, there are clear divides between U.S. proposals and the global minimum tax rules.

5 min read

Kentucky Legislature Sends Pro-Growth Tax Changes to Governor

Kentucky is making commendable progress toward a more modern and competitive tax code, but more work on comprehensive tax reform should be prioritized next session.

7 min read

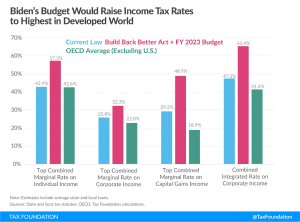

Biden Budget Would Raise Income Tax Rates to Highest in Developed World

The FY 2023 budget proposes several new tax increases, which in combination with the Build Back Better Act, would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

4 min read

Sustainable Tax Reform a Win for Mississippians

Mississippi policymakers delivered the largest tax cut in state history, providing meaningful relief for taxpayers by cutting individual income tax rates.

7 min read

Will Colorado Spend Millions on Flavored Tobacco and Nicotine Prohibition?

Lawmakers in Colorado, and in the several other states considering flavor bans, should think twice before following in the footsteps of Massachusetts. A statewide ban on flavored tobacco products is more than likely to costs millions of dollars, increase smuggling, and have a negligible effect on public health.

5 min read

Biden’s Trade Agenda Should End the Trade War and Promote Free Trade

The Biden administration should lift the Trump administration’s tariffs, as they have failed in their objective to bring better trading practices and instead brought about significant damage to U.S. businesses and workers.

6 min read

State Legislatures Take Up Tax Reform and Relief in 2022

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

Are Tax Rebates a Good Way to Provide Relief from Rising Prices?

States are flush with cash, but taxpayers’ purchasing power is being eroded by high inflation. Tax rebates, gas tax holidays, and other temporary tax expedients have the potential to add to existing inflation—but good intentions do not always make for good policy.

5 min read

Analyzing Recent Tax Trends Among EU Countries

In recent years, EU countries have undertaken a series of tax reforms designed to maintain tax revenue levels while supporting investment and economic growth. However, not all tax reforms were created equal.

7 min read