The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Australia’s Tax and Benefit System Might Deter Working Parents from Advancing in Their Careers

While the tax and benefit system can be successful in keeping low-income working households out of poverty and encouraging workforce participation, high marginal tax rates like the one observed in the case of this Australian working parent act as barriers to upward mobility.

6 min read

How Does the Inflation Reduction Act Minimum Tax Compare to Global Minimum Tax?

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. tax rules for large companies. However, as proposals have been debated in recent months, there are have been clear divides between U.S. proposals and the global minimum tax rules.

6 min read

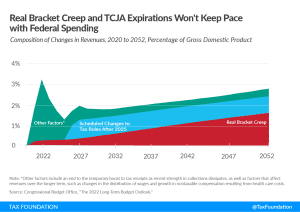

3 Observations on the CBO Long-Term Budget Outlook

The latest CBO long-term budget outlook paints a troubling picture of fiscal irresponsibility. Rather than halt this rampant spending, Congress is actively adding programs that will exacerbate these long-term trends.

7 min read

Indiana Should Use Surplus to Expedite Rate Cuts, Index Exemptions for Inflation

Expediting income tax rate reductions and indexing major income tax provisions for inflation are two of the most important tax policy changes policymakers could make to provide meaningful tax relief to Hoosiers both now and in the years to come.

4 min read

Health-care Premiums Could Deter Canadians’ Upward Mobility

Canadian workers could face up to two important marginal tax rate spikes and lose 60 percent of additional earnings to the provincial health-care premium.

4 min read

Push for Higher Taxes Is Misguided During a Time of Inflation and Looming Recession

Some 40 years ago, the U.S. dealt with high inflation and slow economic growth. Then as now, the solution is a long-term focus on stronger economic growth and sustainable federal budgets.

5 min read

Chips Are Down in Semiconductor Tax World

The Senate has begun debate on the so-called Chips bill, which would provide $52 billion in grants and $24 billion in tax credits to supposedly strengthen the production of semiconductors in the U.S.

3 min read

New Jersey’s Proposed Menthol Ban Is All Pain and No Gain

New Jersey lawmakers should be weary of flavor bans after seeing the results in Massachusetts.

3 min read

New Research Shows Positive Long-Run Effects from Corporate Tax Cuts

Policymakers should continue to focus on longer term impacts rather than emphasizing the short-term stimulus effects of tax cuts.

3 min read

How Tariffs and the Trade War Hurt U.S. Agriculture

With inflation continuing to skyrocket, especially for food, which reached 10.4 percent in June, it is worth examining how the ongoing U.S. trade war with China and U.S. tariff policy overall has impacted U.S. agriculture and food prices.

3 min read