The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Washington Supreme Court Affirms Capital Gains Tax and Invites Challenge to Broader Income Tax Restrictions

The Washington Supreme Court not only gave its blessing to a capital gains tax that runs afoul of the state constitution, but it also set out a welcome mat for legislators eager to implement a broader income tax.

7 min read

Mississippi’s Capital Improvement Plan Leads in the South and Nationwide

A recently enacted bill in Mississippi made the Magnolia State only the second state in the country to make full expensing permanent. The bill joins reductions to the individual income tax and capital stock tax rates, already in progress, as model, pro-growth reforms for the region.

5 min read

Vermont Tobacco Flavor Ban Would Cost Nearly $16 Million Per Year

Vermont lawmakers must weigh the potential benefits of cessation for some smokers against increased smuggling (and related criminal activity), and a loss of tax revenue not commensurate with a decline in smoking.

6 min read

Temporary Full Expensing Arrives in the UK

The UK’s adoption of full expensing is a welcome step that may generate short-run economic benefits. However, for the reform to have a meaningful effect on the UK’s international competitiveness and long-run economic performance, it must be made permanent—which the British government has said it hopes to do.

6 min read

New Mexico’s Omnibus Tax Bill

Adopting the sound tax reforms still pending in Santa Fe is an opportunity for New Mexico to keep up with the pack or risk falling further behind.

7 min read

Chile Needs Pro-Growth Tax Reform

As Chile looks to the future, policymakers might want to follow the UK’s example. Policymakers should focus on growth-oriented tax policies that encourage private and foreign direct investment, savings, and entrepreneurial activity, increasing Chile’s international tax competitiveness.

2 min read

Kentucky Should Refrain from Expanding Its Taxation of Business Inputs

As final negotiations occur between the House and Senate, legislators should avoid adopting new policies that would jeopardize Kentucky’s business tax competitiveness.

5 min read

Oklahoma Lawmakers’ Tax Reform Plan Would Put State in Top 10

The changes put forth in a new package of bills would represent significant pro-growth change for Oklahoma that would set the state up for success in an increasingly competitive tax landscape.

7 min read

Positive Tax Reforms in Massachusetts Budget Proposal Have Broader Implications

The proposed reforms would be welcome changes to the Commonwealth’s tax code, but the economic principles behind the reforms also have important implications for the Bay State’s income tax system writ large.

6 min read

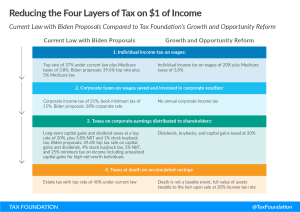

Biden’s New Tax Proposals Are Complicated and Rife with Double Taxation

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

6 min read