The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

New Jersey Should Take Opportunity to Make Corporate Taxes More Competitive

By letting the corporate surtax expire, eliminating taxes on GILTI, and embracing full expensing, New Jersey would take important steps toward creating a more welcoming and competitive tax environment.

6 min read

Fast Approaching Debt Limit Deadline and Growing Debt Demand Action

As policymakers look to tackle America’s debt and deficit crisis, they should consider international experiences on successful fiscal consolidations.

6 min read

Do Consumption Taxes Do a Better Job of Taxing Criminals?

One of the arguments in favor of the FairTax is that it would do a better job of taxing the underground economy than the income tax it is intended to replace.

6 min read

Why the Estonian Tax System Would Remain Competitive after Tax Reform

When a country has a broad base with a simple and transparent tax code, small rate changes have little influence. Therefore, policymakers shouldn’t only focus on rate changes when it comes to increasing tax competitiveness.

4 min read

Minnesota’s Omnibus Tax Bill Would Undermine the State Economy

As policymakers in St. Paul finalize this year’s tax bill, they should avoid policies that incentivize the diversion or relocation of capital. Importantly, states do not institute tax policy in a vacuum. The evidence from states’ experiences and the academic literature supports the conclusion that tax competitiveness matters not just to businesses but to human flourishing.

15 min read

Reforming EU Own Resources: Competitiveness versus Raising Revenue

When it comes to EU-level tax policy ideas, competitiveness seems to be less of a priority than raising revenue or pursuing social objectives.

4 min read

What the EU’s Carbon Border Adjustment Mechanism Means for Europe and the United States

The Carbon Border Adjustment Mechanism (CBAM) is a key aspect of the EU’s broader Fit for 55 package which aims to cut 55 percent of net greenhouse gas (GHG) emissions in the EU by 2030. The growing number of competing climate policies between the EU and U.S., such as tax provisions in the Inflation Reduction Act, could present policymakers on both sides of the Atlantic an opportunity to work together.

5 min read

Inflation Reduction Act’s Price Controls Are Deterring New Drug Development

As predicted, the Inflation Reduction Act’s misguided price-setting policy is already discouraging drug development. Rather than double down on it, as President Biden proposes doing in his budget, lawmakers ought to restore incentives to invest in the United States.

5 min read

Tax Policy and Economic Downturns in Europe

While some temporary policies can help in a crisis, policymakers should focus their efforts on sustainable policies that support growth and the resilience of businesses (and government coffers) over the long term.

6 min read

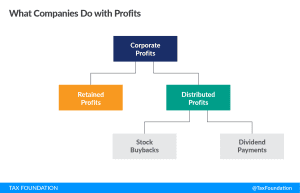

A Better Way to Tax Stock Buybacks

The distributed profits tax is a sounder approach to concerns about investment and stock buybacks than the existing policy approach.

6 min read