The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Federal Tax Reform Might Push New Jersey to Reform Tax System

New Jersey has the worst state business tax climate of the 50 states and the third highest state and local tax burden. If federal tax reform prompts New Jersey to overhaul its tax code, it’s long overdue.

3 min read

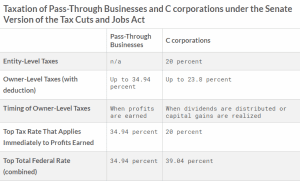

Are Pass-Through Businesses Treated Fairly Under the Senate Version of the Tax Cuts and Jobs Act?

A more careful look shows that the Senate Tax Cuts and Jobs Act doesn’t put pass-through businesses at a disadvantage compared to C corporations.

4 min read

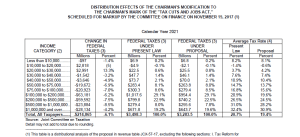

Understanding JCT’s New Distributional Tables for the Senate’s Tax Cuts and Jobs Act

Much attention is being paid to distributional tables released by JCT on the Senate’s Tax Cuts and Jobs Act, but their results don’t quite seem to show what some are suggesting. While the results appears to show a tax increase for some lower-income filers, this is due to the unique nature of the individual mandate and the premium tax credits available under the Affordable Care Act.

2 min read

The House Takes a Big Step Forward on Tax Reform

The House of Representatives passed the Tax Cuts and Jobs Act by a vote of 227-205. Here is a summary of the major provisions in the final package.

2 min read

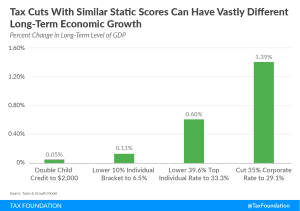

The Economics of Permanent Corporate Rate Cuts Must Outweigh the Optics of Sunsetting Individual Tax Cuts

The Senate Tax Cuts and Jobs Act is right to make the most pro-growth policies permanent and sunset the ones that will do less economic harm.

6 min read

Overview of the Senate’s Amendment to the Tax Cuts and Jobs Act

The Chairman’s Mark of the Senate’s Tax Cuts and Jobs Act includes a number of important changes. Here’s a quick overview of those that matter most.

3 min read

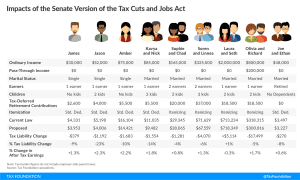

Who Gets a Tax Cut Under the Senate Tax Cuts and Jobs Act?

Here’s how the individual income tax provisions of the Senate’s Tax Cuts and Jobs Act would impact individuals and families across the income spectrum.

5 min read

Eight Important Changes in the Senate Tax Cuts and Jobs Act

The Senate Tax Cuts and Jobs Act includes hundreds of structural reforms to the tax code. Here is a guide to the eight most important changes.

5 min read

Important Differences Between House and Senate Versions of the Tax Cuts and Jobs Act

This list, though not exhaustive, catalogues the major differences between the House and Senate version of the Tax Cuts and Jobs Act.

4 min read