The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

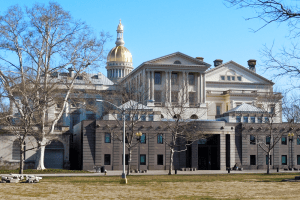

New Jersey Waives Telework Nexus During COVID-19 Crisis

New Jersey is temporarily waiving corporate nexus arising from employees teleworking due to the COVID-19 pandemic—a response to the crisis that other states should follow.

3 min read

Congress Approves Economic Relief Plan for Individuals and Businesses

The CARES Act, now signed into law, is intended to be a third round of federal government support in the wake of the coronavirus public health crisis and associated economic fallout, following the $8.3 billion in public health support passed two weeks ago and the Families First Coronavirus Response Act.

10 min read

March 27th Afternoon State Tax Update

Massachusetts, Ohio, and West Virginia have newly extended their income tax filing and payment deadlines to match the July 15 federal deadline.

3 min read

Spain’s COVID-19 Economic Response

Spain’s policy response needs to be broad and in keeping with long-term objectives. It is paramount that the short-term harm caused by this outbreak does not turn into a long-term economic downturn.

5 min read

Evaluating the Trade-offs of Unemployment Compensation Changes in the CARES Act

Policymakers must weigh the trade-offs of subsidizing unemployment with mitigating community spread of coronavirus.

6 min read

India Pushes Digital Taxes in a Difficult Time

Even during the coronavirus outbreak, efforts to change the way digital business models are taxed continue. India announced this week that its tax aimed at foreign digital companies, the “equalization levy,” will be expanded.

4 min read

Denmark Unplugs the Economy

Denmark, a high-tax country with 5.5 million citizens, has implemented policies designed to avoid layoffs and bankruptcies and basically unplug the economy during the pandemic.

4 min read

A German Export for Times of Crises: The Short-Time Work Scheme

One of the most talked about government economic responses to the COVID-19 crisis is Germany’s Kurzarbeit: the German short-work subsidy scheme.

3 min read

Weighing the Value of Tax Credits During an Economic Crisis

One idea under consideration is adjusting existing tax credits, such as the Child Tax Credit (CTC) or Earned Income Tax Credit (EITC), to provide financial relief during the crisis.

5 min read