The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Federal Coronavirus Relief: CARES Act FAQ

Congress recently passed the largest economic relief bill in American history (CARES Act). We’ve created a FAQ portal to better inform policymakers, journalists, and taxpayers across the country on the new law.

13 min read

Understanding the Paycheck Protection Program in the CARES Act

Many small business owners are seeking guidance as they apply for loans backed by the Small Business Administration (SBA) to help maintain cash flow and retain workers even as more states announce new quarantine and shelter-in-place orders.

5 min read

Idaho, Mississippi, and Virginia are the Holdouts on July 15th Tax Deadlines

Every state with an individual income tax has made some adjustment to its filing or payment deadlines, but three—Idaho, Mississippi, and Virginia—have not followed the federal government’s date of July 15th or later.

3 min read

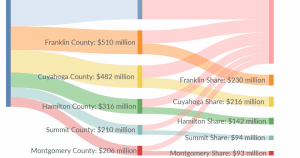

State and Local Funding Totals Under the CARES Act

State and local governments across the country split $150 billion in federal aid under a provision of the Coronavirus Aid, Relief and Economic Security (CARES) Act, passed on March 30th.

7 min read

A History and Analysis of Payroll Tax Holidays

As Congress and the White House consider ways to shore up the economy in the face of a public health crisis, President Trump has suggested suspending the entire payroll tax for the duration of the year. That would cost about $950 billion, according to our analysis.

6 min read

Retroactive SALT Repeal Combines Weak Stimulus with Bad Tax Policy

House Speaker Nancy Pelosi (D-CA) has suggested that a retroactive repeal of the cap on State and Local Tax (SALT) deductions should be included in any future stimulus plans.

3 min read

Gas Tax Revenue to Decline as Traffic Drops 38 Percent

Fewer people driving means fewer people buying gasoline, which may have positive effects on air pollution but could be detrimental to motor fuel excise tax revenue for federal and state governments.

4 min read

New Jersey Waives Telework Nexus During COVID-19 Crisis

New Jersey is temporarily waiving corporate nexus arising from employees teleworking due to the COVID-19 pandemic—a response to the crisis that other states should follow.

3 min read

Congress Approves Economic Relief Plan for Individuals and Businesses

The CARES Act, now signed into law, is intended to be a third round of federal government support in the wake of the coronavirus public health crisis and associated economic fallout, following the $8.3 billion in public health support passed two weeks ago and the Families First Coronavirus Response Act.

10 min read

March 27th Afternoon State Tax Update

Massachusetts, Ohio, and West Virginia have newly extended their income tax filing and payment deadlines to match the July 15 federal deadline.

3 min read