The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

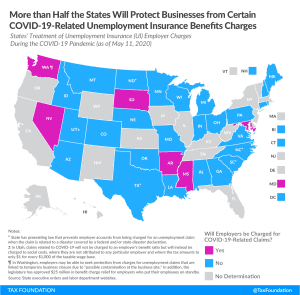

More Than Half the States Will Protect Businesses from Certain COVID-19-Related Unemployment Insurance Tax Hikes

Lawmakers can help expedite their state’s economic recovery by protecting employers from facing higher unemployment insurance tax rates at a time when they can least afford to pay them.

8 min read

HEROES Act Temporarily Increases Dependent Credit Generosity

The HEROES Act would make notable expansions to all three dependent-related credits, increasing maximum credit amounts, refundability, and income eligibility phaseouts. Practically, this means that certain filers could expect to receive a larger refund for each additional hour of work, eligible dependent, and dependent care expenses if the bill became law.

5 min read

Breaking Down State and Local Aid under the SMART Act

The SMART Act, sponsored by Senators Bob Menendez and Bill Cassidy and Rep. Mikie Sherrill, would provide $500 billion in flexible funding to state and local governments.

6 min read

Neutral Cost Recovery Is Not a New Idea

As stated by Rep. Jack Kemp in 1985, “Neutral cost recovery is designed to provide the present value of investment expensing without some of its practical problems.”

5 min read

Empirical Evidence Shows Expensing Leads to More Investment and Higher Employment

The Tax Foundation’s General Equilibrium Model suggests that allowing businesses to immediately deduct or “expense” their capital investments in the year in which they are purchased delivers the biggest bang for the buck in spurring economic growth and jobs compared to other tax policies.

7 min read

Louisiana Considers Temporary Suspension of Part of Corporation Franchise Tax

State recovery plans should lessen the burden on businesses by shifting from capital stock taxes and other taxes that are charged regardless of profitability. Louisiana does well to target its Corporation Franchise Tax, a burdensome tax that would target businesses that may already be struggling.

2 min read

HEROES Act First Bid to Provide Phase 4 Relief for Businesses and Individuals

The HEROES Act, the $3 trillion relief package proposed by House Democrats, is the first bid to provide additional phase 4 aid for businesses and individuals amid the coronavirus pandemic.

7 min read

Accounting for Deficits: When Should They Matter and How Should We Solve It?

Revenue shortfalls and deficits can be addressed best by considering when to consider the deficit as the primary priority and reevaluating how revenue can be raised most efficiently through sound tax policy principles.

5 min read

Under the HEROES Act, State Budgets Could Soar as the Economy Suffers

The HEROES Act, proposed by House Democrats as a next round of fiscal relief during the coronavirus outbreak, contains about $1.08 trillion in aid to states and localities. That would bring the pandemic total to $1.63 trillion—an amount so large that it might overwhelm their ability to spend it and could reward fiscal irresponsibility.

8 min read

How the HEROES Act Would Allocate State and Local Aid for Coronavirus Relief

The HEROES Act would provide more than $1 trillion to state and local governments. Here’s how funding would be distributed and provisional estimates of how much aid each state would receive.

5 min read