President Biden and congressional Democrats have justified their plan to raise taxes on the rich to fund much of their $3.5 trillion spending by claiming that the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code is not progressive enough. Yet a recent Joint Committee on Taxation (JCT) analysis of the House Ways and Means tax plan undermines that thesis by showing that high-income taxpayers already bear a disproportionate share of the federal tax burden and that the tax proposal would simply make that burden more disproportionate.

One has to wonder how stable or sustainable the Democrats’ spending program can be if it must rely so heavily on the taxes paid by such a small number of taxpayers as in the top 1 percent.

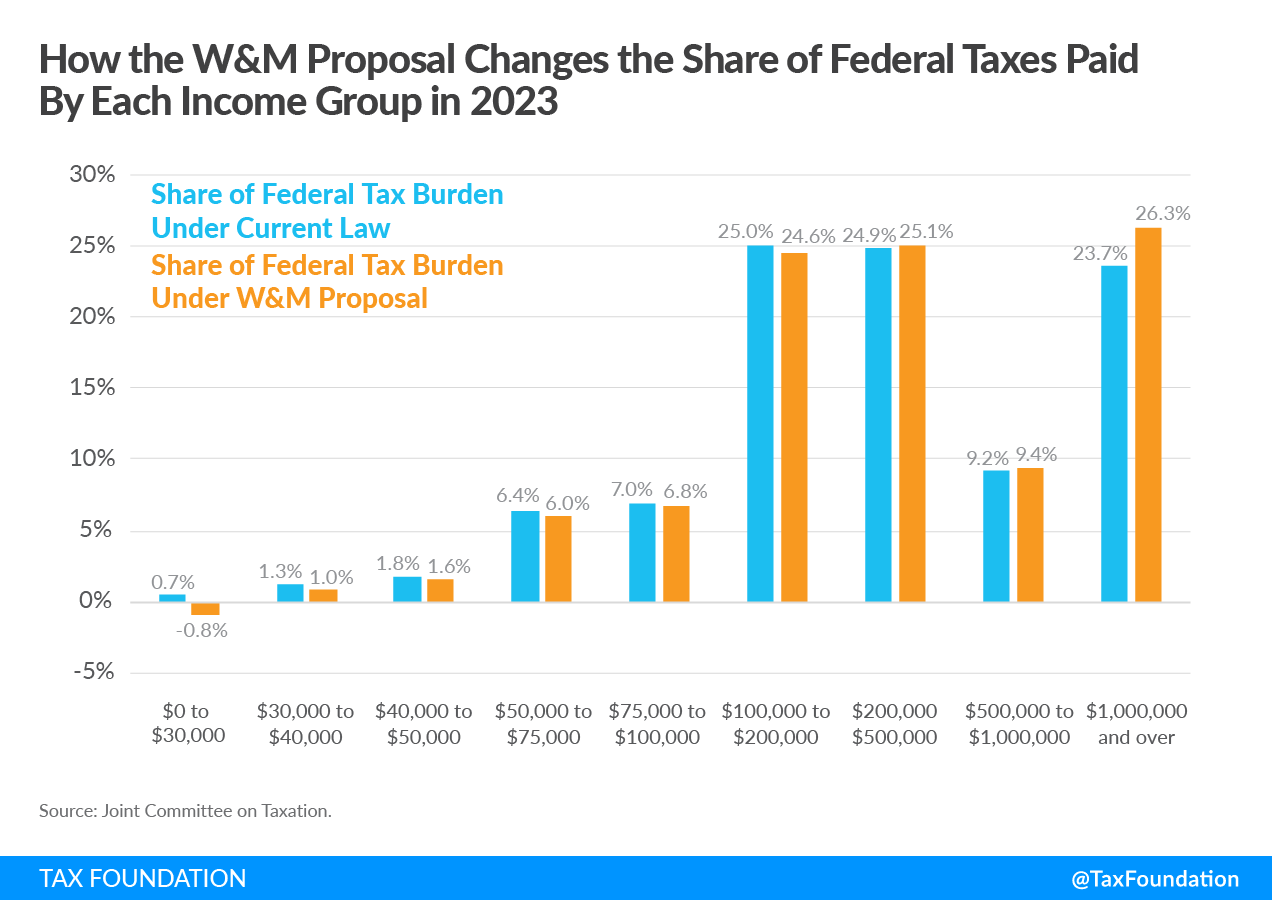

The accompanying chart shows how much of the current federal tax system is borne by high-income taxpayers and how little is paid by taxpayers earning under $100,000. In 2023, JCT estimates that under current law, taxpayers earning under $100,000 (totaling 124 million) will collectively pay 17.2 percent of all federal taxes, including, income taxes, payroll taxes, corporate taxes, and excise taxes. This amounts to $655 billion out of the more than $3.8 trillion in expected total federal revenues that year under current law.

Millionaires Pay a Greater Share of Federal Tax Burden than 124 Million Neighbors

By contrast, according to the IRS, there are roughly 500,000 taxpayers with incomes above $1 million. JCT estimates that these taxpayers will pay nearly 24 percent of all federal taxes in 2023, amounting to $908 billion. In other words, the relatively small number of taxpayers with incomes above $1 million will pay a substantially greater share of all federal taxes than some 124 million of their neighbors combined.

The remaining share of the tax burden is borne by taxpayers with incomes above $100,000 and less than $1 million. For example, there are about 21 million taxpayers earning between $100,000 and $200,000 and JCT estimates that they will pay 25 percent of all federal taxes in 2023. The nearly 7 million taxpayers earning between $200,000 and $500,000 also are expected to pay 25 percent of the tax burden.

There are about 1.1 million taxpayers who earn between $500,000 and $1 million and JCT estimates that they will pay 9.2 percent of all federal taxes in 2023. If we combine this group with those with incomes above $1 million, it roughly equates to the top 1 percent of taxpayers. Combined, the top 1 percent of taxpayers pays nearly one-third of all federal taxes. By any definition, this is a very progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. system.

The House Ways and Means Plan Makes a Very Progressive System Even More Progressive

But the House Ways and Means tax plan would make this system even more progressive. Because of the plan’s massive expansion of tax programs such as the Child Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. (the original terms reported to be cut back by the Democrats) and Earned Income Tax Credit, the share of federal taxes paid by those earning under $100,000 would fall to 14.6 percent, or $555 billion out of the $3.8 trillion in total federal revenue that JCT estimates will be collected in 2023.

Since these tax credits are also available to some upper-middle-class taxpayers, we can see that the tax burden on taxpayers earning between $100,000 and $200,000 would shrink slightly, from 25 percent to 24.6 percent. Meanwhile, taxpayers earning between $200,000 and $500,000 would see their share of the tax burden rise slightly, to 25.1 percent.

At the top end of the income scale, millionaires would see their share of the federal tax burden rise to 26.3 percent, amounting to more than $1 trillion in total taxes paid. When combined with the share paid by those earning between $500,000 to $1 million, the top 1 percent of taxpayers would see their share of the federal tax burden rise to 35.7 percent, or nearly $1.4 trillion.

Could San Antonio Fund the Rest of America’s Benefits?

That 1 percent of taxpayers is equal to a population the size of San Antonio. Asking such a small group of Americans to fund a major expansion of federal programs that benefit the rest of the country seems unfair at best and fiscally irresponsible at worst.

The plan’s advocates may respond that JCT’s 2023 estimates are just the first year of a 10-year tax plan and a number of the plan’s policies, such as the Child Tax Credit, are set to sunset after 2025, which will revert the relative tax burdens to the current level of progressivity.

However, we have seen this situation before, during the so-called Fiscal Cliff episode at the end of 2012, when all of the Bush tax cuts of 2001 and 2002 were set to expire. President Obama and leaders in Congress agreed on a deal that made permanent many of the tax cuts in place for the middle class but raised the top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. back to 39.6 percent and limited itemized deductions and personal exemptions for high-income taxpayers. Based on this history, JCT’s estimate for 2023 is likely a much more realistic picture of the future balance of federal tax burdens than its estimate for 2031.

And those numbers are unsustainable.

Share this article