Taxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income.

Arriving at Taxable Income

Individuals begin with gross income, the total amount earned in a given year. This includes income from bonuses, tips, freelancing, rental properties, retirement plan payouts, unemployment benefits, court awards, gambling winnings and prizes, interest, digital assets and cryptocurrency, and royalties. An individual taxpayer’s filing status—whether single, married, or head of household—is also important in determining taxable income.

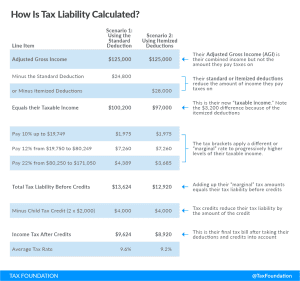

For individual filers, calculating federal taxable income starts by taking all income minus “above the line” deductions and exemptions, like certain retirement plan contributions, higher education expenses, student loan interest, and alimony payments, among others. This results in a taxpayer’s adjusted gross income (AGI).

Upon arriving at AGI, a taxpayer may then take the standard deduction, which reduces a taxpayer’s taxable income by a set amount, or choose to itemize their below-the-line deductions, which produces taxable income.

Due to these deductions, taxable income is typically less than a taxpayer’s AGI.

Income Starting Points

Most states use either AGI or federal taxable income as a starting point for their own calculations of individual income tax liability for the state income tax. Beginning with federal taxable income incorporates federal standard and itemized deductions, as well as the personal exemption when available (it is currently suspended), whereas beginning with AGI excludes these modifications, leaving states to establish their own deductions and exemptions, or to separately link their codes to the federal provisions.

Nontaxable Income

Most types of income are considered “taxable” by the Internal Revenue Service (IRS). However, some types of income people earn are not subject to tax. With exceptions, examples of nontaxable income can include:

- Life insurance payouts

- Payouts from qualified retirement accounts like 401(k) plans and Roth IRAs

- Health savings account (HSA) payments for qualified medical expenses

- The value of employer-provided insurance like health insurance or long-term care insurance

- Disability insurance payments

It is important to note a difference between income excluded from the tax base altogether, like employer-sponsored health insurance, and income that can be placed in a vehicle for savings-neutral tax treatment via a deduction for traditional accounts or Roth treatment. Health savings accounts are unique in that they receive both traditional and Roth treatment.

Other forms of income are technically not considered taxable income but can be taxed in other ways.

For example, financial gifts over $2.92 million in 2023 may be subject to a gift tax and inheritances are subject to inheritance and estate taxes.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe