Facts & Figures 2025: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min readProviding journalists, taxpayers, and policymakers with the latest data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission.

As a nonpartisan, educational organization, the Tax Foundation has earned a reputation for independence and credibility. Our state tax policy team regularly provides accessible, data-driven insights on state tax rates, collections, burdens and more, from sources such as the U.S. Census Bureau, Internal Revenue Service (IRS), and others.

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

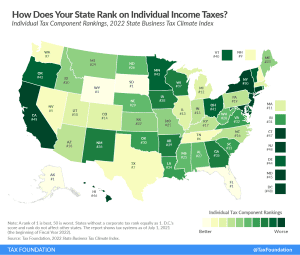

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

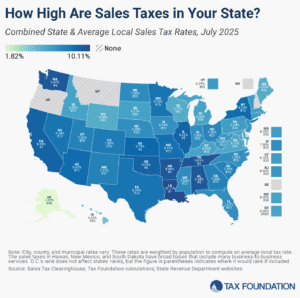

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 24 percent of combined state and local tax collections.

17 min read

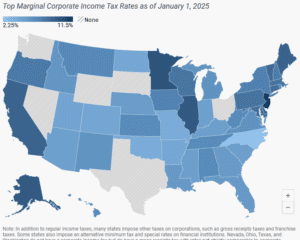

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read

Property taxes are the primary tool for financing local governments. While no taxpayers in high-tax jurisdictions will be celebrating their yearly payments, property taxes are largely rooted in the benefit principle of taxation: the people paying the property tax bills are most often the ones benefiting from the services.

9 min read

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

The sales tax is too important a part of states’ revenue toolkits to be permitted further erosion, making sales tax modernization a vital project of the 2020s.

17 min read

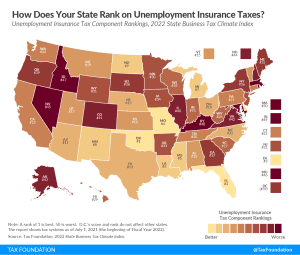

Ranking unemployment insurance tax codes on the 2022 State Business Tax Climate Index. Learn more about state unemployment insurance tax code and systems.

4 min read

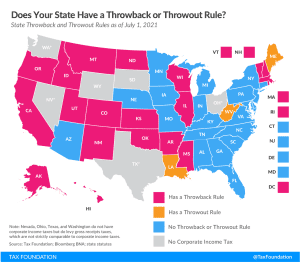

While throwback and throwout rules in states’ corporate tax codes may not be widely understood, they have a notable impact on business location and investment decisions and reduce economic efficiency.

3 min read

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read