Tax Calculator: How the TCJA’s Expiration Will Affect You

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min readProviding journalists, taxpayers, and policymakers with the latest data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission.

As a nonpartisan, educational organization, the Tax Foundation has earned a reputation for independence and credibility. Our federal tax policy team regularly provides accessible, data-driven insights from sources such as the Internal Revenue Service (IRS), the Organisation for Economic Co-Operation and Development (OECD), Congressional Budget Office (CBO), the Joint Committee on Taxation (JCT), and others. For more insights on the latest federal tax policies, explore the Tax Foundation’s general equilibrium Taxes & Growth (TAG) Model

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

At the end of 2025, the individual tax provisions in the Tax Cuts and Jobs Act (TCJA) expire all at once. Without congressional action, most taxpayers will see a notable tax increase relative to current policy in 2026.

4 min read

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

New IRS data shows the US federal income tax system continues to be progressive as high-income taxpayers pay the highest average income tax rates. Average tax rates for all income groups remain lower after the Tax Cuts and Jobs Act (TCJA).

6 min read

How do current federal individual income tax rates and brackets compare historically?

1 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

How do current federal individual income tax rates and brackets compare historically?

1 min read

Reviewing the sources of personal income shows that the personal income tax is largely a tax on labor, primarily because our personal income is mostly derived from labor. However, varied sources of capital income also play a role in American incomes. While capital income sources are small compared to labor income, they are still significant and need to be accounted for, both by policymakers trying to collect revenue efficiently and by those attempting to understand the distribution of personal income.

10 min read

CBO data shows that the TCJA reduced federal tax rates for households across every income level while increasing the share of tax paid by the top 1 percent.

4 min read

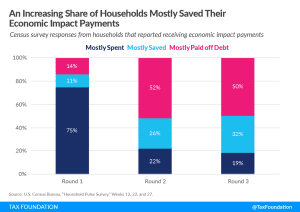

In 2020 and 2021, Congress enacted three rounds of economic impact payments (EIPs) for direct relief to households amidst the pandemic-induced downturn. Survey data from the U.S. Census Bureau indicates that households increasingly saved their EIPs or used them to pay down debt rather than spend them.

5 min read

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

Last week, an analysis by Reuters suggested that U.S. firms pay less income tax than foreign competitors, in part because “the U.S. tax code is unusually generous with tax breaks and deductions,” also known as corporate tax expenditures. However, the Reuters analysis is at odds with other data and studies indicating that U.S. corporate tax expenditures and effective tax rates are about on par with those in peer countries in the OECD.

3 min read