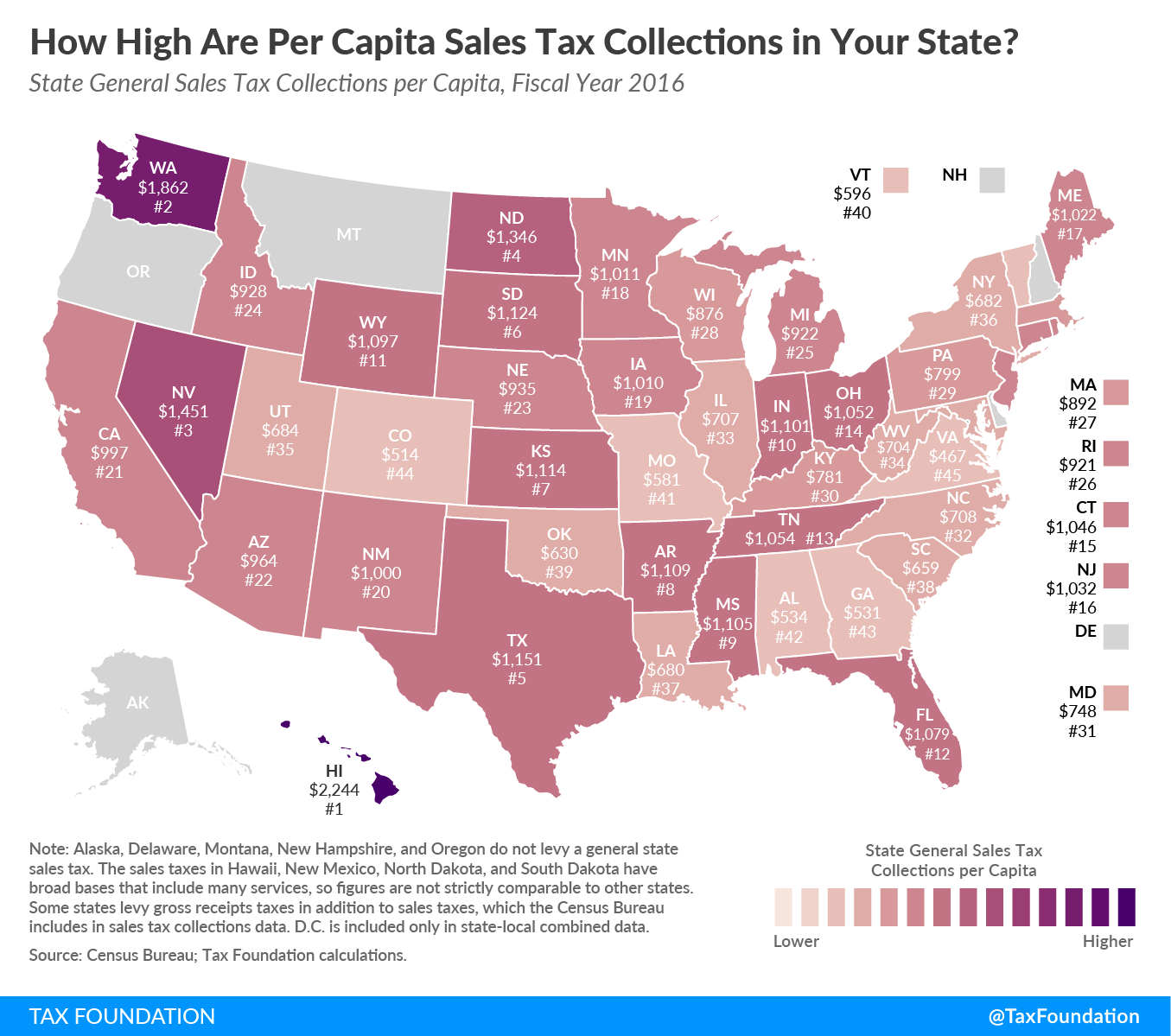

Forty-five states and the District of Columbia have a state-levied sales tax, while five states have no state sales tax. State sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. collections per capita are shown below.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeStates collecting the least in state sales taxes per capita are Virginia ($467), Colorado ($514), and Georgia ($531). In each case, a combination of low rates and relatively narrow bases contributes to low collections per capita. For example, only two states have a narrower sales tax base than Virginia, and Colorado’s state sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate–2.9 percent–is lowest in the country. (It’s important to note that Colorado’s average local sales tax rate, 4.62 percent, is high, so while the state brings in a small amount of state sales tax collections per capita, when local sales taxes are taken into account, Colorado is in the middle of the pack in terms of combined state and local sales tax collections per capita.)

States collecting the most in state sales taxes per capita are Hawaii ($2,244), Washington ($1,862), and Nevada ($1,451), although Hawaii’s sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. is broader than economists recommend, applying not just to final consumer products and services, but also to many business-to-business transactions. This results in multiple layers of taxation on the same product or service. At 6.85 percent and 6.5 percent, respectively, Nevada and Washington’s state sales tax rates are among the 10 highest in the country, and their bases are among the 15 broadest, contributing to high collections per capita.

In most states, narrow sales tax bases make the sales tax less productive (from a revenue standpoint) than it could be. Many states exempt certain goods (like groceries or clothing) from the sales tax for political reasons, but these exemptions put upward pressure on the tax rate that applies to other purchases, such as household goods or meals at restaurants. In addition, most states fail to include services in their sales tax base because services represented a small share of the consumer economy when state sales taxes first emerged. States that are willing to broaden their base will be able to lower rates while generating the same amount of revenue. Base broadening also brings the added benefit of a more neutral sales tax that places final consumer goods and services on a more level playing field, mitigating the distortion that occurs when consumers alter their purchasing behavior due to high rates.

Note: This is part of a map series in which examine per capita state tax collections

- How High are State and Local Tax Collections in Your State?

- How Much Does Your State Collect in Individual Income Taxes Per Capita?

- How Much Does Your State Collect in Corporate Income Taxes Per Capita?

- How Much Does Your State Collect in Excise Taxes Per Capita?

- How Much Does Your State Collect in Property Taxes Per Capita?