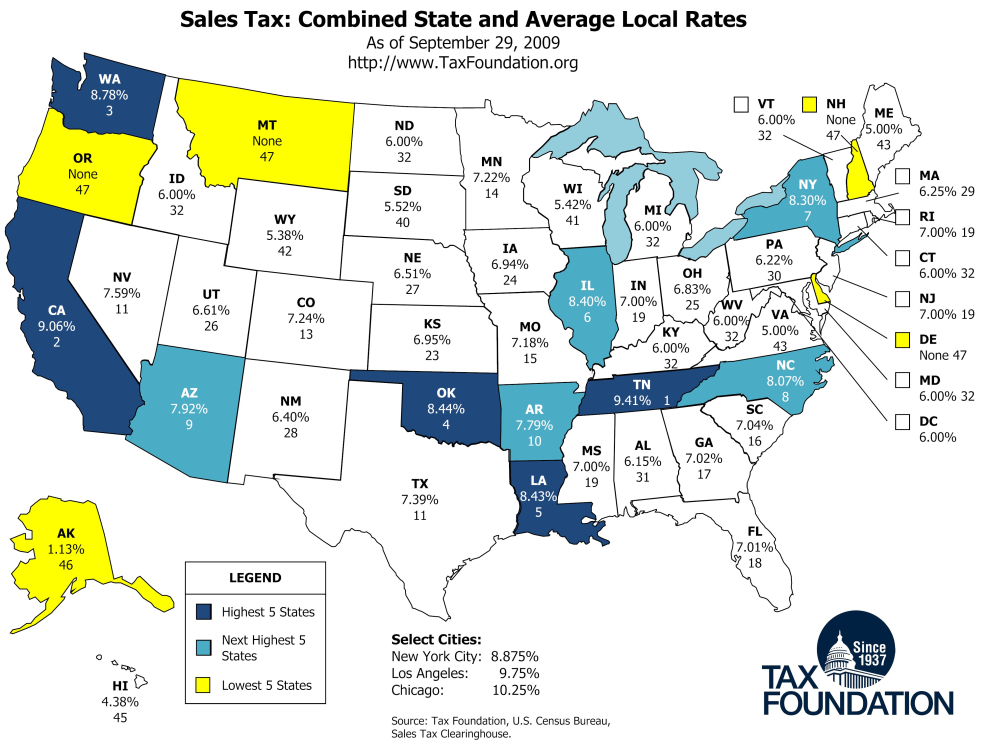

Making use of newly available data sources, we are now able to update information on average local sales taxes more regularly. The map shows current state sales taxes, average local sales taxes, and the combined rate and state rank.

There are five states that do without a general statewide sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. : Alaska, Delaware, Montana, New Hampshire and Oregon. Alaska is the only state on this list that allows municipalities to charge a local sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , and these can be quite high in some cases. For example, Juneau, the capital, has a city sales tax rate of 5 percent.

Delaware, Montana, New Hampshire and Oregon rank lowest with no state or local sales taxes. Alaska comes next with a combined local and state rate of 1.61 percent, followed by Hawaii (4.38 percent), Maine (5 percent), Virginia (5 percent), Wisconsin (5.42 percent) and Wyoming (5.42 percent). The states with highest combined state-local rates are Tennessee (9.41 percent), California (9.06 percent), Washington (8.78 percent), Oklahoma (8.44 percent) and Louisiana (8.43 percent).

Read the report that this map came from here.

Click on the image for larger size version of the “State Business Tax Climate Index” map. Click here for the map in printer-friendly or alternative formats (PDF, TIFF).

More on sales taxes here. Previous maps: State Business Tax Climate Index and Property Taxes on Owner-Occupied Housing.

Share this article