Key Findings

- OECD countries rely heavily on consumption taxes, such as the value added taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , and social insurance taxes, such as the payroll tax.

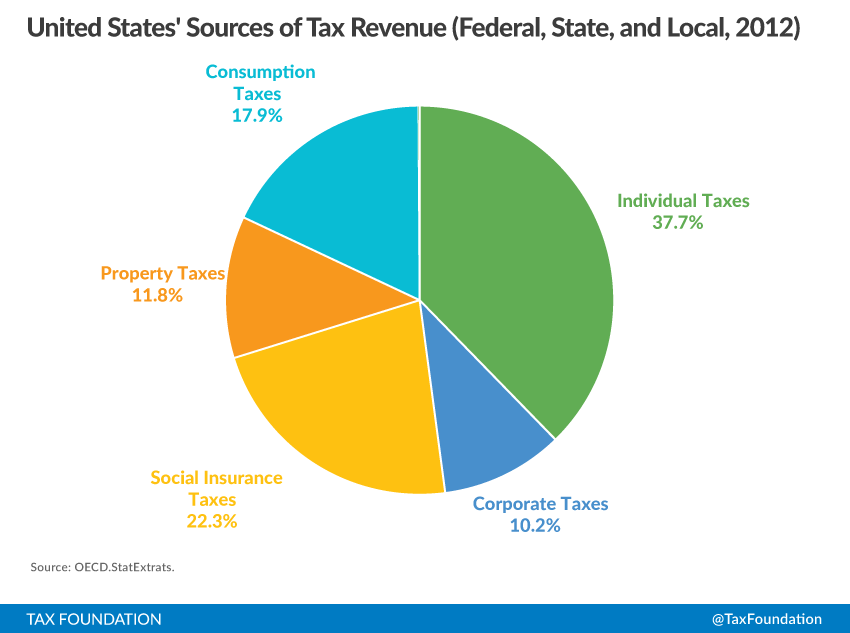

- The United States relies heavily on the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , at 37.7 percent of total government tax revenue.

- On average, OECD countries collect little from the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. (8.5 percent of total tax revenue).

Developed countries raise tax revenue through a mix of individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes. However, the extent to which an individual country relies on any of these taxes can differ substantially.

A country may decide to have a lower corporate income tax to attract investment (as many have),[1] which may reduce its reliance on corporate income tax revenue and increase its reliance on social insurance taxes or consumption taxes. For example, Estonia only raises 4.5 percent of total revenue from corporate income taxes, but makes up the lower corporate income tax revenue by raising a combined 77.5 percent of total revenue from social insurance taxes and consumption taxes.

Countries may also be situated on natural resources that allow them to rely heavily on taxes on related economic activity. Norway, for example, has a substantial oil production industry on which it levies a high (78 percent)[2] income tax and thus raises a significant amount of corporate income tax revenue.

These policy and economic differences among Organization for Economic Co-operation and Development (OECD) countries have created differences in how they raise tax revenue.

OECD Countries Raise the Most Revenue from Consumption Taxes and Social Insurance Taxes

According to the most recent data from the OECD (2012),[3] consumption taxes are the largest source of tax revenue for OECD countries. On average, countries raise approximately 32.8 percent of their tax revenue from consumption taxes. This is unsurprising given that all OECD countries (except the United States) levy value-added taxes at relatively high rates.

The next significant source of tax revenue is social insurance taxes. OECD countries raised approximately 26.2 percent of total tax revenue from social insurance taxes.

Individual income taxes accounted for 24.5 percent of total tax revenue across the OECD. Corporate income taxes accounted for only 8.5 percent of total tax revenue. Property taxes raised the least across the OECD, accounting for 5.4 percent of total tax revenue.

The remaining 3 percent include stamp taxes and certain taxes on goods and services.

The United States Relies Heavily on Individual Income Taxes

The United States relies the most on individual income taxes. According to OECD data, the United States (federal, state, and local combined) raised approximately 37.7 percent of all tax revenue from individual income taxes (compared to 24.5 percent among all OECD countries).

Social insurance taxes make up the second largest source of government tax revenue in the United States (22.3 percent of the total).

The United States relies much less on taxes on goods and services than other OECD countries. In 2012, the United States raised 17.9 percent of its total tax revenue from taxes on goods and services. This is compared to the 32.8 percent average among OECD countries.

The smallest source of tax revenue for the United States is the corporate income tax. Federal, state, and local governments collected approximately 10.2 percent of total tax revenue from corporate income in 2012. This is slightly higher than the OECD average of 8.5 percent.

Taxes on Goods and Services

Consumption taxes are taxes on goods and services. These are either in the form of excise taxes, value-added taxes (VAT), or retail sales taxes. Most OECD countries levy consumption taxes through value-added taxes and excise taxes. The United States is the only country in the OECD with no value-added tax. Instead, most state governments apply a retail sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. on the final sale of a product and excise taxes on goods such as cigarettes and alcohol.

Mexico relies the most on taxes on goods and services, raising approximately 54.5 percent of their total tax revenue from these taxes. Mexico is followed by Chile (50.1 percent) and Turkey (45 percent). (Table 1, below)

The United States raises the least amount of revenue from consumption taxes as a share of total tax revenue in the OECD at 17.9 percent. Japan raises slightly more at 18 percent, followed by Switzerland at 22.9 percent.

The Growth of the Value-Added Tax

The structure of consumption taxes in the OECD has drastically changed over time. In 1965 (the earliest year of data available), 78.1 percent of all revenue from consumption taxes came from excise taxes, customs duties, and sales taxes. In 1965, no country had a truly broad-based, value-added tax.[4] Only France levied a VAT on a limited basis. The OECD on average only raised approximately 4.7 percent of total consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or income taxes where all savings are tax-deductible. revenue from the VAT.

In the 1970s and 1980s, countries started replacing sales taxes, excise taxes, and custom duties with the value-added tax, which was seen as an improvement due to its export neutrality and exemption of business-to-business transactions.[5] As countries throughout Europe[6] and the rest of the OECD adopted the VAT, reliance on its revenue steadily grew. By 2012, it accounted for 59.5 percent of total consumption tax revenue across the OECD. In contrast, tax revenue from sales taxes, excise taxes, and customs duties declined to 33.8 percent of total consumption tax revenues.

Social Insurance Taxes

Social insurance taxes are typically levied in order to fund specific programs such as unemployment insurance, health insurance, and old age insurance. In most countries, these taxes are applied to both an individual’s wages and an employer’s payroll. For example, the United States levies social insurance taxes at the state and federal levels in order to fund programs such as Social Security, Medicare, and Unemployment Insurance.

The Slovak Republic relies the most on social insurance taxes (43.9 percent of total revenue) among OECD countries, followed by the Czech Republic (43.6 percent) and Japan (41.6 percent). (Table 1, below)

Denmark raises the least amount of tax revenue from social insurance taxes at 1.9 percent. Australia and New Zealand are the only two countries in the OECD that do not levy specific social insurance taxes on workers to fund government programs.

Individual Income Taxes

Income taxes are levied directly on an individual’s income, typically wage income. Many nations, such as the United States, also levy their individual income taxes on investment income such as capital gains and dividends, placing a double-tax on corporate income. These taxes are typically levied in a progressive manner, meaning that an individual’s average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. increases as his income increases. Denmark relies the most on individual income taxes at 50.7 percent of tax revenue, followed by Australia (39.2 percent) and the United States (37.7 percent). (Table 1, below)

The Slovak Republic (9.2 percent), the Czech Republic (10.6 percent), and Hungary (13.8 percent) raised the least amount of revenue from individual income taxes.

Corporate Income Taxes

The corporate income tax is a direct taxA direct tax is levied on individuals and organizations and is not expected to be passed on to another payer (unlike indirect taxes such as sales and excise taxes), though economic incidence can still fall upon others. Often with a direct tax, such as the individual income tax, tax rates increase as the taxpayer’s ability to pay, or financial resources, increases, resulting in what is called a progressive tax. Article 1, Section 9, of the US Constitution requires direct taxes to be apportioned by state population, though the 16th Amendment establishes that income taxes are not subject to this requirement. on corporate profits. All OECD countries levy a tax on corporate profits. However, many countries differ substantially in how they define taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. and the rate at which they apply the tax, which affects the amount of revenue these countries raise. Generally, the corporate income tax raises little revenue compared to other sources. Norway relies the most on the corporate income tax, raising 24.8 percent of total tax revenue. Australia (18.9 percent) and Korea (14.9 percent) also rely heavily on their corporate income taxes compared to the OECD average of 8.5 percent. (Table 1, below)

Greece (3.3 percent), Hungary (3.4 percent), and Slovenia (3.4 percent) rely the least on the corporate income tax.

Property Taxes

A much smaller source of tax revenue for most OECD countries is the property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. . The property tax is levied on the value of an individual’s or business’s property, whether that property is tangible or intangible. In the United States, property taxes are most typically levied on real estate, cars, and boats by state and local governments. Other types of property taxes include net wealth taxes and estate, gift, and inheritance taxes. The United Kingdom relies the most on property taxes in the OECD (11.9 percent), followed by the United States (11.8 percent) and Korea (10.6 percent). (Table 1, below)

Estonia relies the least on property taxes, raising only 1 percent of total tax revenue. Austria (1.3 percent) and the Czech Republic (1.5 percent) also rely very little on property taxes.

Conclusion

In general, developed nations lean more on tax revenue from social insurance taxes and consumption taxes. The United States, in contrast, relies more on individual income taxes, while raising relatively little from consumption taxes. This policy difference matters considering that consumption taxes raise revenue with less economic damage.

| Table 1. Source of Tax Revenue, OECD Countries, 2012 | ||||||

| Country | Individual Income Taxes | Corporate Income Taxes | Social Insurance Taxes | Property Taxes | Consumption Taxes | Other |

| Australia | 39.2% | 18.9% | 0.0% | 8.6% | 28.1% | 5.2% |

| Austria | 22.9% | 5.3% | 34.1% | 1.3% | 27.6% | 8.8% |

| Belgium | 27.8% | 6.8% | 32.1% | 7.5% | 24.9% | 0.9% |

| Canada | 36.6% | 9.5% | 15.5% | 10.6% | 24.5% | 3.3% |

| Chile | 39% (1) | 6.5% | 4.3% | 50.1% | 0.1% | |

| Czech Republic | 10.6% | 9.9% | 43.6% | 1.5% | 33.9% | 0.5% |

| Denmark | 50.7% | 6.3% | 1.9% | 3.8% | 31.4% | 5.9% |

| Estonia | 16.4% | 4.5% | 35.3% | 1.0% | 42.2% | 0.6% |

| Finland | 29.3% | 4.9% | 29.6% | 2.8% | 33.1% | 0.3% |

| France | 18.0% | 5.6% | 37.4% | 8.5% | 24.5% | 6.0% |

| Germany | 25.6% | 4.8% | 38.3% | 2.4% | 28.4% | 0.5% |

| Greece | 20.6% | 3.3% | 32.0% | 5.6% | 37.8% | 0.7% |

| Hungary | 13.8% | 3.4% | 32.8% | 3.2% | 43.7% | 3.1% |

| Iceland | 37.4% | 5.4% | 10.4% | 7.1% | 35.1% | 4.6% |

| Ireland | 33.2% | 8.4% | 15.3% | 7.0% | 34.9% | 1.2% |

| Israel | 18.4% | 8.9% | 17.1% | 9.0% | 39.2% | 7.4% |

| Italy | 27.2% | 6.5% | 30.3% | 6.3% | 25.5% | 4.2% |

| Japan | 18.6% | 12.5% | 41.6% | 9.1% | 18.0% | 0.2% |

| Korea | 15.0% | 14.9% | 24.7% | 10.6% | 31.2% | 3.6% |

| Luxembourg | 21.9% | 13.4% | 29.3% | 7.1% | 28.1% | 0.2% |

| Mexico | 26.3% (1) | 14.9% | 1.5% | 54.5% | 2.8% | |

| Netherlands | 20.2% | 5.1% | 41.2% | 3.0% | 29.3% | 1.2% |

| New Zealand | 37.7% | 14.1% | 0.0% | 6.2% | 38.3% | 3.7% |

| Norway | 23.4% | 24.8% | 22.6% | 2.9% | 26.3% | 0.0% |

| Poland | 14.1% | 6.6% | 37.8% | 3.9% | 36.2% | 1.4% |

| Portugal | 18.5% | 8.7% | 28.3% | 3.9% | 39.7% | 0.9% |

| Slovak Republic | 9.2% | 8.4% | 43.9% | 1.6% | 35.4% | 1.5% |

| Slovenia | 15.5% | 3.4% | 40.8% | 1.8% | 37.9% | 0.6% |

| Spain | 22.6% | 6.4% | 35.8% | 6.3% | 26.6% | 2.3% |

| Sweden | 28.2% | 6.1% | 23.6% | 2.4% | 29.1% | 10.6% |

| Switzerland | 31.7% | 10.5% | 24.9% | 6.6% | 22.9% | 3.4% |

| Turkey | 14.4% | 7.4% | 27.2% | 4.2% | 45.0% | 1.8% |

| United Kingdom | 27.5% | 8.1% | 19.1% | 11.9% | 32.9% | 0.5% |

| United States | 37.7% | 10.2% | 22.3% | 11.8% | 17.9% | 0.1% |

| Note: | (1) No data available. | |||||

| Source: | OECD.StatExtrats, http://stats.oecd.org/. |

[1] From 1982 to 2015, the average top marginal corporate income tax rate in the OECD has declined from around 48 percent to around 25 percent. OECD Tax Database, Table II.1 Corporate Income Tax Rate, May 2014, http://www.oecd.org/ctp/tax-policy/Table%20II.1-May-2014.xlsx.

[2] Ernst and Young, 2014 Global oil and gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. guide, Norway, 2014, http://www.ey.com/GL/en/Services/Tax/Global-oil-and-gas-tax-guide—Country-list.

[3] OECD.StatExtracts, OECD, 2015, http://stats.oecd.org/.

[4] Kathryn James, Exploring the Origins and Global Rise of VAT, Tax Analysts, 2011, http://www.taxanalysts.com/www/freefiles.nsf/Files/JAMES-2.pdf/$file/JAMES-2.pdf.

[5] Ibid.

[6] Joining the EU was conditional on adopting the value added tax.