Younger and healthier Brits have created a $17.1 billion budget hole by smoking and drinking less. That’s great news.

Excise taxes are generally levied on consumer products with negative public effects. Policymakers use these taxes to incentivize market participants to produce and purchase less of these ‘sinful’ products. Common excise taxes include those on tobacco products, alcohol, fuels, and carbon. The more successful the tax is at deterring consumption and production, the less government revenue is created.

The UK is not alone in using taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy to achieve public health objectives. All OECD countries levy a tax on alcohol or tobacco products, though the products taxed, type of tax, and rates vary widely. Norway, for example, has the largest wine tax among OECD countries, while 14 OECD countries don’t tax wine at all.

In the European Union, countries are required by law to levy an excise duty on beer of at least €1.87 per 100 liters (26.4 gal) and degree of alcohol content. That amounts to a minimum tax of €0.03 (US $0.04) for a 330ml (11.2 oz) beer bottle with 5 percent alcohol content.

While excise taxes can be a useful harm reduction tool, they should not be relied upon for budgetary stability.

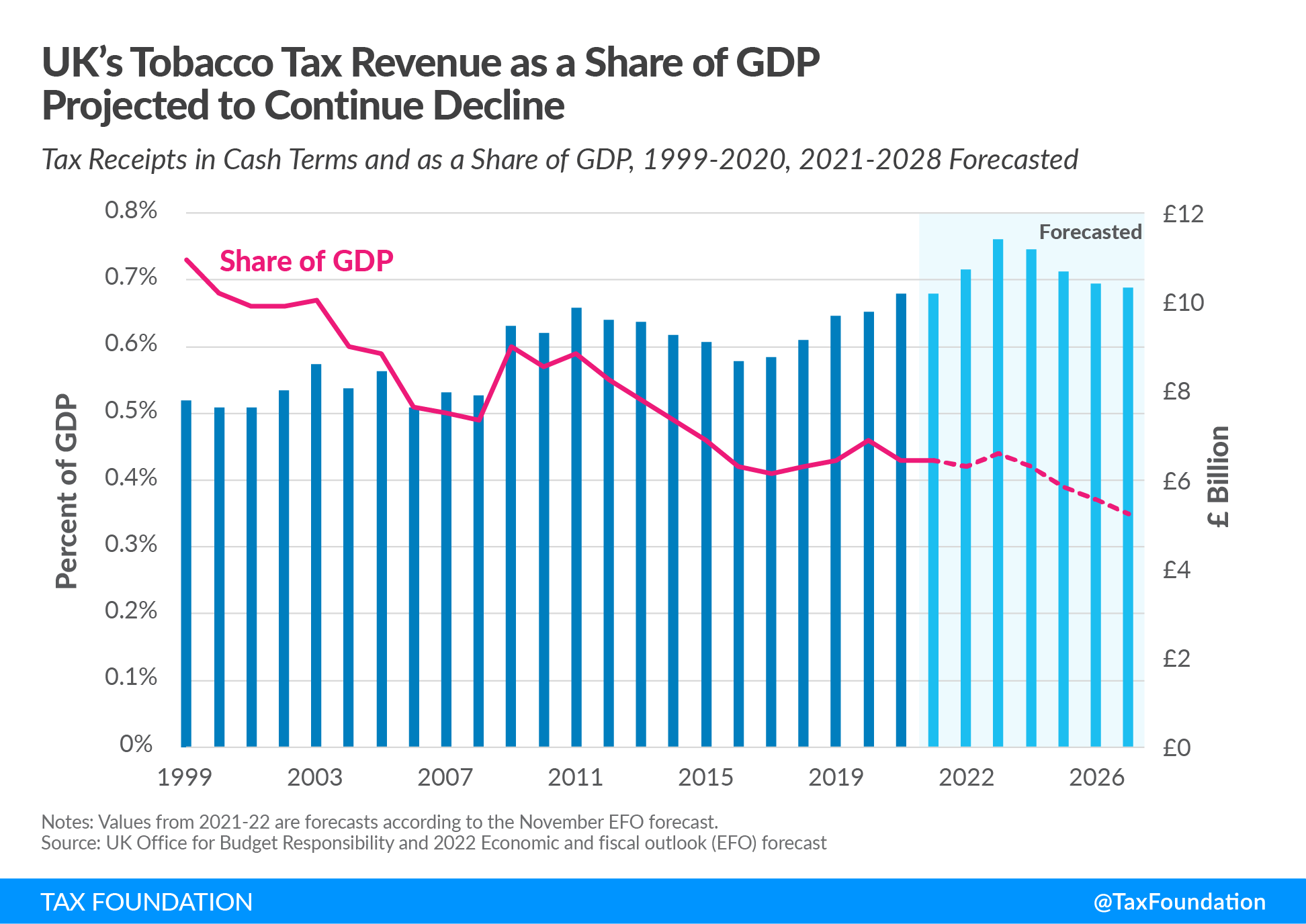

Excise taxes are typically regressive and have a narrow base with unstable consumption patterns over the long term. For instance, if younger Brits had not switched to less harmful products (such as vapes) or drank less alcohol, Bloomberg estimates that the UK government would have collected an additional £9.3 billion from tobacco duties and £4.7 billion from alcohol taxes (based on 2002 consumption levels).

This outcome should be commended. Less consumption of harmful products not only creates happier and healthier consumers, but it also produces fewer negative outcomes for third-party bystanders (e.g., less smoking in public places benefits people who don’t smoke).

An overall healthier population will likely generate less burden on public expenditures, such as health services. After all, one of the primary justifications for a specific tax on unhealthy products is that they lead to an increase in public health expenditures. In the United States alone, more than $225 billion dollars, or 12 percent of U.S. annual healthcare spending, can be attributed to cigarette smoking. Alcohol represents over $249 billion in losses for the American economy, from health care and workplace productivity to collisions and criminal justice costs.

Yet, despite this resounding piece of positive news, some see any decline in tax revenues as a public finance crisis and call for more taxes and higher rates. Furthermore, creating new excise taxes to compensate for this revenue loss with taxes on vaping products misses the point. Excise taxes target a tax base that is intended to shrink. Less consumption is a stated goal of the policy.

Rather than asking how to offset revenue losses from a shrinking tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , British policymakers should ask why the budget has overly relied on revenue from these narrow and unstable taxes for so long.

To double down and increase the tax rate on these products is not the answer. Excessive tax rates on cigarette for instance, induce substantial black and gray market movement of these products from low-tax jurisdictions into higher-tax jurisdictions. Tax policy that is too aggressive threatens to reverse the positive trends in healthier decision-making.

A principled solution would be to focus on pro-growth tax reforms with low rates and a broad base that fill the budget gap in sustainable ways. This way, people will live healthier lifestyles while the government raises enough revenue for spending priorities.

Share this article