Thursday, Sen. Pat Toomey (R-PA) introduced the “ALIGN Act,” which would make 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. for short-life assets a permanent feature of the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code and provide a technical correction to the 2017 tax law’s “Retail Glitch.”

The Tax Cuts and Jobs Act (TCJA) of 2017 enacted a policy called 100 percent bonus depreciation, allowing businesses to immediately deduct the cost of investments in short-life assets, such as machinery and equipment. However, the law enacted this provision on a temporary basis; it is scheduled to begin phasing down in 2023 until it fully expires in 2027. Allowing the provision to phase out would increase the cost of domestic investment in machinery and equipment.

We estimate that making the TCJA’s 100 percent bonus depreciation provision permanent would increase the size of the capital stock by 2.2 percent and long-run GDP by 0.9 percent; the larger economy would result in a 0.8 percent increase in wages and 172,300 additional full-time equivalent jobs.

Full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. is a key driver of future economic growth and can have a larger pro-growth effect per dollar of revenue forgone than cutting tax rates.

|

Source: Taxes and Growth Model, August 2018 |

|

|

Gross Domestic Product (GDP) |

+0.9% |

|

Wage Rate |

+0.8% |

|

Private Business Capital Stock |

+2.2% |

|

Full-Time Equivalent Jobs |

172,300 |

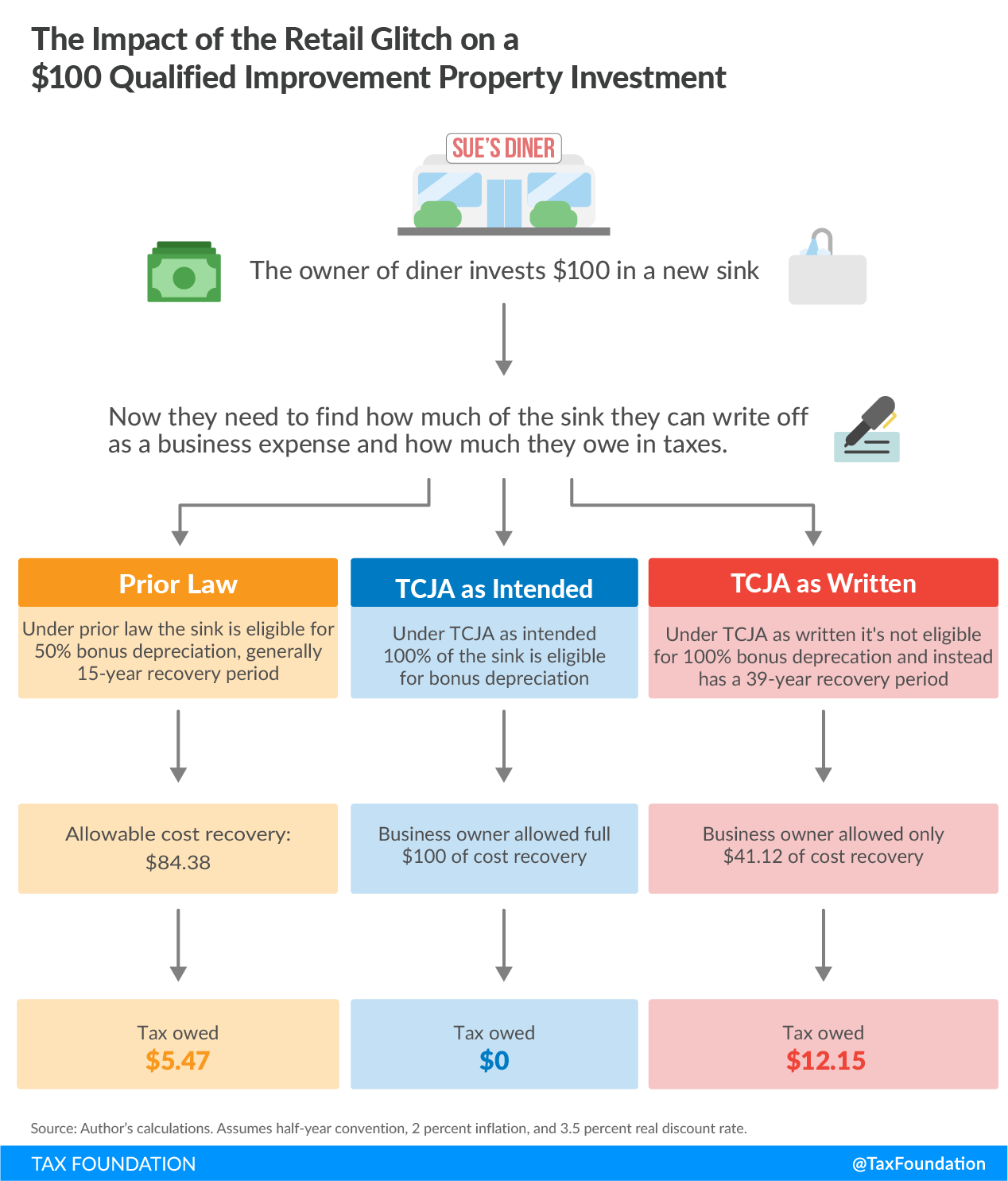

Sen. Toomey’s bill would also address the Retail Glitch, a technical error in the TCJA that accidentally excluded the category of qualified improvement property (QIP) investment from 100 percent bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. . QIP investments include improvements to the inside of commercial buildings: projects such as new flooring, lighting fixtures, sprinkler systems, or other types of remodeling and interior improvements.

The TCJA intended to consolidate the various categories of QIP that existed under old law into a new category with a 15-year cost recovery period, which would have also allowed QIP investments to be eligible for the 100 percent bonus depreciation provision created under the new law. However, as a result of a clerical error, QIP investments are excluded from bonus depreciation and now face a higher tax burden than under prior law, illustrated in the figure below.

Both provisions in Sen. Toomey’s bill would improve the tax treatment of investment. Fixing the retail glitch would mean businesses no longer face more restrictive cost recoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions. treatment for investments in QIP than before tax reform. Making 100 percent bonus depreciation permanent avoids the uncertainty associated with the phaseout of a powerful pro-growth policy and would provide a cost-effective boost to long-run economic output, wages, and employment in the United States.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe