The Tax Policy Implications of the Spanish Elections at the Regional, National, and European Levels

7 min readBy: ,The Spanish election results are moving the country away from pro-growth taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

After the inconclusive July 23 Spanish election, the newly formed parliament met for the first time on August 17. In this meeting, the Socialist Party (PSOE) candidate, Francina Armengol, was elected president of the Congress with 178 votes in the 350-seat chamber. PSOE’s candidate was backed by Sumar and all the nationalist and separatist members of Parliament.

However, since Together for Catalonia, the party of the fugitive Puigdemont, and two other separatist parties refused to meet King Felipe VI and show their support for Sánchez, the King invited the opposition leader, People’s Party (PP) candidate Alberto Núñez Feijóo, to try to form a government and avoid a political stalemate. Despite gaining 16 more seats than the Socialist Party, Feijóo does not have a ruling majority.

It looks like Spain cannot be governed without the support of those who want to break it up. Indeed, while PSOE finished second in the polls, Sánchez is looking to bring five regional parties together, four of which are separatist, to support him as prime minister for another term.

The European Costs of Forming a Spanish Government

In an unexpected turn of events, the uncertainty and negotiations between Spanish coalitions may have a broader impact on European public finances. For example, to gain Together’s support in Congress, the Spanish foreign minister sent a formal request to the European Council the same day the vote took place asking for Catalan, Galician, and Basque languages to receive EU official language status. If such a measure were approved, it would impact the administrative capacity of the European institutions because communications proposals come with high economic costs. In 2012, the European Commission quantified the total cost of translation and interpretation at at least €1 billion per year.

In addition to translation costs, Spanish leaders have discussed a new regional financing system and regional debt pardon that risk jeopardizing Spain and the EU’s fiscal credibility. A proposal to pardon Catalan’s debt would cost €70 billion—entirely offsetting the benefits Spain receives from the EU (€69 billion). The question then arises: is pardoning Catalan’s debt worth the cost of forming a government?

The Impact of the Spanish Elections at the Regional and National Levels

This general election in Spain comes after the left-wing coalition government’s parties performed poorly in May’s local and regional elections. At the regional level, the PP gained enough votes to negotiate coalition governments in most regions where they haven’t secured outright majorities.

Over several years, Spanish regions governed by PP have committed to pro-growth tax reforms that have advanced them in the Spanish Regional Tax Competitiveness Index (RTCI).

Regional tax competition has proven effective; some Spanish regions have copied Madrid and other leading regions’ tax reforms. In 2022, Andalusia was the first region to cut the top statutory inheritance taxAn inheritance tax is levied upon the value of inherited assets received by a beneficiary after a decedent’s death. Not to be confused with estate taxes, which are paid by the decedent’s estate based on the size of the total estate before assets are distributed, inheritance taxes are paid by the recipient or heir based on the value of the bequest received. rate from 81.6 percent to 49.6 percent, just below Germany’s and Switzerland’s top tax rate of 50 percent.

Regions are considering repealing or cutting wealth and inheritance taxes that negatively impact entrepreneurial activity, saving, and work, instead focusing their tax policy on creating an individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. system that boosts wages, employment, and workers’ mobility. The newly formed regional governments of the Balearic Islands, Valencia Community, and La Rioja have already slashed the inheritance tax for close heirs.

Additionally, after a political agreement between PP and Vox, Aragón is also planning to reform inheritance, wealth, and income taxes. This trend is likely to increase in the following weeks as more regions are now governed by the PP or coalition governments they are a part of. It is this regional tax competition that stopped Spain from becoming Europe’s tax hell during the five years of Pedro Sánchez’s presidency.

At the same time, the tax policy reforms at the national level have greatly harmed Spain’s international tax competitiveness. Since 2020, Spain has dropped from 26th to 34th (out of 38 countries) in the 2022 International Tax Competitiveness Index (ITCI).

Over the last several years, Spain has adopted a financial transactions tax (FTT), a digital services tax (DST), and a special value-added tax (VAT) on sugary drinks. Additionally, at the end of 2022, new taxes were approved. Spain enacted a two-year windfall profit tax on banks and energy companies.

If the latest short-sighted tax policies introduced at the end of 2022 and the beginning of 2023 are not repealed, then they will reduce the country’s overall ranking in the 2023 ITCI even more.

Conversely, during the electoral campaign, Feijóo announced tax reforms that were looking to “attract investment.” He planned to abolish or reform the two windfall taxes and review the wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. that Sánchez passed last year. He also showed concern regarding Spain’s public debt and is keen on cutting the budget deficit.

Additionally, Vox, concerned with Spain’s drop in its overall international tax competitiveness and the fall of household income in real terms, advocates for cutting the general VAT rate from 21 percent to 18 percent, cutting the income tax down to two brackets at rates of 15 and 25 percent, and gradually reducing the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate to 15 percent. The group also pledges to automatically adjust income tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and to eliminate double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. of income by abolishing both wealth and inheritance taxes.

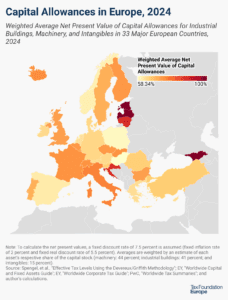

Apart from these tax reforms, Spain should abolish the FTT and DST. To increase private investment and accelerate economic growth, Spain should consider full expensing for capital investment and shift the tax mix toward less harmful consumption taxes by broadening the VAT tax base.

Spain should implement tax reforms that have the potential to stimulate economic activity by supporting private investment and employment and attracting highly qualified workers, increasing its internal and international tax competitiveness.

The Impact of the Spanish General Election at the European Level

The Spanish elections have also impacted tax policies across the continent, especially as Spain holds its fifth rotating presidency of the Council of the EU.

As an honest broker, the Spanish presidency is expected to continue discussing the key files addressed by the Swedish presidency, like the “VAT in the Digital Age” package as well as the “UNSHELL” proposal to prevent the misuse of shell entities for tax purposes. But the lens might be different: in June, Spain presented some of its tax-related priorities for the upcoming months—the consolidation of the “Social Pillar” by establishing a common minimum standard for corporate taxation across all Member States to combat tax evasion by large multinationals. It also intends to continue reforming the fiscal rules combining transparency and the flexibility required by the green and digital transitions.

On one hand, these priorities are likely to remain the same if Sánchez successfully forms a government. Specific proposals might receive more attention; for instance, the UNSHELL proposal has broad interest and clear prioritization by the Commission to further the fight against tax evasion.

On the other hand, a change in government might give room for maneuvering in other files—like Own Resources. Traditionally, Sánchez has favored European-style “Marshall Plan” public investment programs—but has not prioritized developing a plan to reimburse these programs.

Feijóo has not made many direct comments about the EU Own Resources, but his pro-growth tax reforms and views on fiscal responsibility are likely to be reflected at the European level. If Feijóo successfully forms a government, the shift towards repaying European debt might be more important, focusing increasingly on discussing the Own Resource files. President of the European Commission, Ursula von der Leyen, would likely support such a focus.

The inconclusive results of the Spanish elections at this stage seem to point to the fact that the presidency of the Council is running on autopilot. Without a clear change in government, the priorities announced in September indicate continuity from the ones announced in June. After all, this is part of the logic behind the Council’s presidency trios.

In the current political vacuum in Spain’s leadership, the Commission could try to steer discussions on the Own Resources files. These files could move swiftly in the Council before the Union enters the European Parliament election frenzy or less cooperative Member States hold the presidency.

What’s Next for Spanish and European Tax Policy?

The Spanish election results are moving the country away from the much-needed pro-growth tax reforms. At the EU level, this power vacuum might well come at the perfect time for those interested in moving forward with the Own Resources and UNSHELL files.

Feijóo’s investiture vote will take place on September 26 and 27. If he fails, the King could call a second round of consultations with party leaders and appoint Pedro Sánchez as prime minister if Sánchez can assure him that he has enough support to form a government. If no one can form a government, then new elections could be called in January. Nevertheless, if Sánchez is able to form a new government, then the addition of Together for Catalonia to the mix will complicate the approval of any landmark legislative reforms, acceptance of the annual budget proposal, or compliance with the EU budgetary rules. In any case, the next government will most likely face challenges balancing electoral promises with reducing public debt.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeTimeline of Activity

- Post was updated to reflect recent developments.

- Originally published.