There’s a lot of misinformation about taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy floating around online. Usually, the Tax Foundation can’t take the time to correct every erroneous claim about federal taxes that we run across on the internet. But it’s a slow August day, Congress is out of session, and I just came across an article on AlterNet titled, “Monarchy in America? One of Trump’s Tax Proposals Would Create a Permanent Aristocracy Overnight.”

The article, by RJ Eskow, is about Trump’s proposal to repeal the federal estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. . Over the last few days, Trump has faced a great deal of criticism for this proposal – but none so hyperbolic as the claim that eliminating the estate tax would create a “permanent aristocracy” in America.[1]

In fact, the estate tax is a small, relatively inconsequential piece of the federal tax system. Eliminating the estate tax would lower taxes on the wealthiest Americans – but not by much. Even if the estate tax were repealed, the federal tax system would still remain highly progressive.

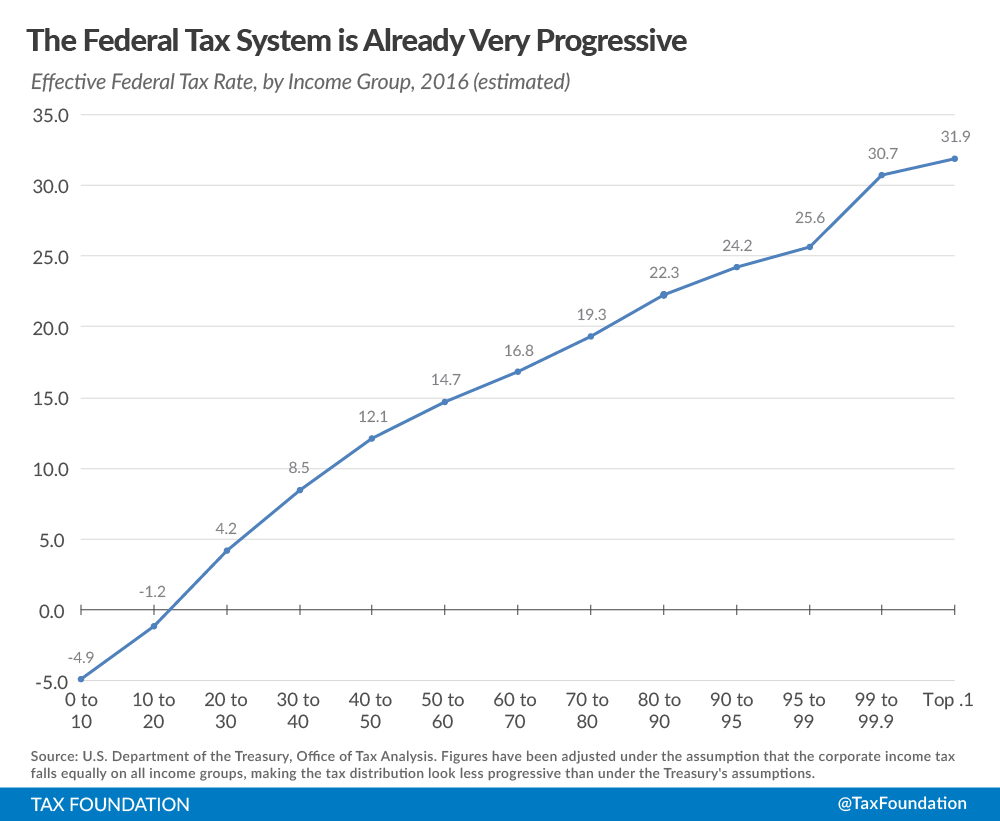

The first mistake in the AlterNet article is the claim that “our tax system already favors the wealthy in many different ways.” Frankly, this just isn’t the case. According to the latest estimates for 2016 from the Department of the Treasury, the top 0.1 percent of taxpayers will pay 39.2 percent of their income in federal taxes. Meanwhile, the bottom 90 percent of taxpayers will pay 14.1 percent of their income in federal taxes this year.

Now, the Treasury statistics may overstate the case a bit: the Treasury assumes that the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. falls almost completely on high income Americans. However, there’s reason to believe that the corporate income tax falls largely on workers. So, I’ve taken the liberty of adjusting the Treasury statistics to assume that the corporate income tax falls on every income group equally. Even with these more modest assumptions, the federal tax system is still extremely progressive:

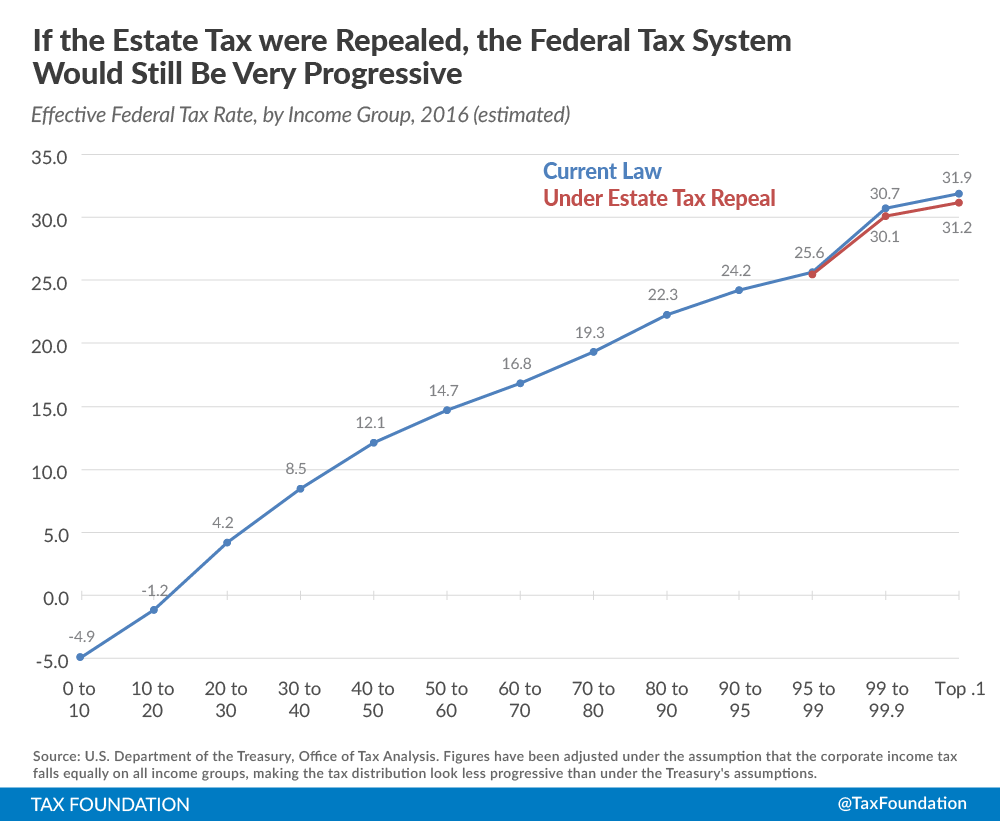

No matter how you spin it, the federal tax system simply does not favor the wealthy. And the federal tax system would not suddenly start favoring the wealthy if we repealed the estate tax:

Using the same data from Treasury, I’ve graphed how much each income group would pay in taxes in 2016 if the estate tax didn’t exist. The change is underwhelming. Under this scenario, instead of paying 31.9 percent of their income in taxes, the 0.1 percent richest American households would pay a tax rate of 31.2 percent. In other words, even if the estate tax were fully repealed tomorrow, high-income taxpayers would still shoulder the vast majority of the U.S. tax burden.

Supporters of the estate tax argue that the tax helps lessen the concentration of wealth in the United States. That’s a fine argument, and people should keep on making it. But claiming that estate tax repeal would create a “permanent aristocracy” is pure misinformation, and is not useful for a productive tax policy debate.

[1] To clarify, the headline text might have originated with an AlterNet editor, rather than with RJ Eskow. Either way, somebody is very wrong about the federal estate tax.