Thursday, the New Jersey Senate and Assembly passed bills (S21 and A21) legalizing recreational marijuana sales, as required since voters passed Question 1 on Election Day. Sales will begin after the Cannabis Regulatory Commission finalizes its rules and regulations.

Sales of recreational marijuana in New Jersey will be taxed under the general state sales rate of 6.625 percent. This is appropriate, as recreational marijuana is a consumer good and a well-designed general sales tax is levied on all final consumption while exempting all purchases made by businesses that will be used as inputs in the production process.

In addition, New Jersey will levy a so-called excise fee. This fee (or taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. ) will kick in at a rate depending on retail prices in the preceding year. The levels are:

- up to $10 per ounce if the average retail price of an ounce was $350 or more;

- up to $30 per ounce if the average retail price of an ounce was less than $350 but at least $250;

- up to $40 per ounce if the average retail price of an ounce was less than $250 but at least $200; and

- up to $60 per ounce if the average retail price of an ounce was less than $200.

This structure is a first in the nation and is seemingly an attempt to allow the legal market to compete with illegal operators by charging a lower tax when prices are high. While this has its benefits, it is still a tax based on price levels. A simpler and more neutral excise tax should correspond to the harm it is addressing or the cost it is internalizing. Neither of these have much connection to the price at which the good is sold. Taxation aimed at the negative externalityAn externality, in economic terms, is a side effect or consequence of an activity that is not reflected in the cost of that activity, and not primarily borne by those directly involved in said activity. Externalities can be caused by either the production or consumption of a good or service and can be positive or negative. connected to marijuana consumption is best expressed by the level of THC (Tetrahydrocannabinol, the main psychoactive compound in marijuana) or weight.

The bills have been negotiated by New Jersey lawmakers since the election. The original Senate bill did not include an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. . Had that bill become law, New Jersey would have been the first state in the U.S. to legalize recreational marijuana without levying an excise tax. There are legitimate reasons for levying excise taxes on marijuana, but legislatures and voters in other states should proceed with caution. Due to their narrow base, excise taxes are not a sustainable source of revenue for general spending priorities.

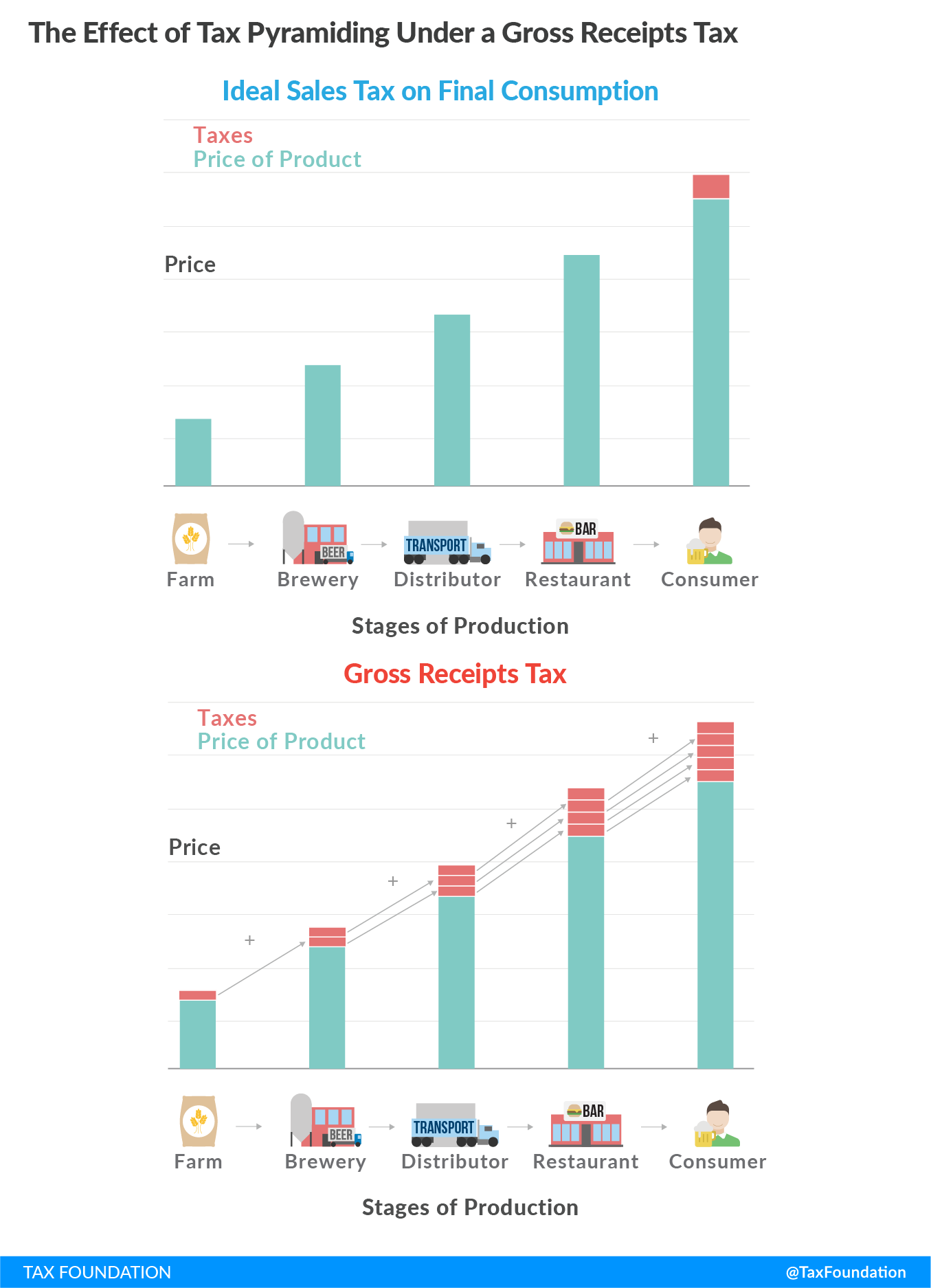

More worrying than the excise fee is the local transfer tax. This tax, which is optional for localities, is a gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding. on all marijuana businesses. The rate is capped at 2 percent or less per transaction, but the tax can be imposed at multiple points in the process, leading to tax pyramiding. The tax can be imposed at each of the following stages of sales:

- By a cannabis cultivator (up to 2 percent)

- By a cannabis manufacturer (up to 2 percent)

- By a cannabis wholesaler (up to 1 percent)

- By a cannabis retailer (up to 2 percent)

In other words, by the time marijuana is sold to a consumer, local taxes could be applied four different times—by one or more localities. It could be the same locality, if all transactions occurred within the borders of one jurisdiction, or alternatively, one locality might tax the sale by the cultivator, and another by the manufacturer and wholesaler, and yet another by the retailer. If any of these functions are combined within a single entity, the tax is imposed on the value of the non-sale transaction, meaning there would be a deemed (and taxed) sales price between manufacturer and wholesaler even if they are the same company. As a result, by the time the product reaches the consumer, the product’s effective tax rate has become very high.

When designing state and local taxes for recreational marijuana, lawmakers should take note of 26 U.S. Code § 280E, which concerns sales of controlled substances. Because recreational marijuana is a Schedule I drug according to the federal Controlled Substances Act, marijuana businesses must conform with section 280E. In practice, marijuana businesses cannot deduct common business expenses from their income taxes (except for Cost of Goods Sold), which means they often pay a much higher effective rate than other businesses. (States that automatically conform to the federal code, of which New Jersey is one, would do well to decouple from 280E to avoid discriminating against marijuana businesses at the state level.)

High state and local taxes combined with discriminatory federal tax treatment can make it very difficult for marijuana businesses to scale and survive—especially early on when expenses are often higher than earnings.

Revenue from the state-level taxes will largely be dedicated to the Cannabis Regulatory, Enforcement Assistance, and Marketplace Modernization Fund (100 percent of revenue from the excise fee, and 70 percent of revenue from the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. ), and will be spent on social equity programs like grants, loans, reimbursements of expenses, and other financial assistance, in municipalities defined as impact zones. The remaining revenue will be spent on operating the program. Funds from the local gross receipts tax will be collected by and allocated to the locality.

New Jersey’s tax design adds another element to the ongoing experiment with legal recreational marijuana in the states, but there is still much we do not know. One thing is certain, though: general fund revenue should not be a short-term key priority when it comes to recreational marijuana legalization. However, in the long term, a successful legalization could yield meaningful revenue—beyond the general sales tax, legal marijuana businesses would also pay business taxes and employees would pay personal income taxes. A similar conclusion was recently reached by the Congressional Budget Office when it scored a proposal for a federal excise tax on recreational marijuana. Revenue from these broad-based taxes, combined with a potential saving as illicit operations decline, do represent a meaningful and sustainable form of revenue for the state.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe