New data released this week from the Internal Revenue Service on Individual Retirement Accounts (IRAs) most notably includes who contributed to IRAs and how much for tax year 2015. Taxpayers contributed nearly $40 billion to IRAs in 2015, indicating that taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. -neutral savings accounts will continue to be an important source of capital income. Expanding and simplifying their structure would broadly benefit many Americans.

Americans can generally choose to save for retirement using either a traditional-style account or a Roth-style account. In traditional-style, or tax-deferred, accounts, the initial savings are not subject to income tax and the returns are subject to tax when they are later withdrawn. In Roth-style accounts, the initial savings are subject to income tax and the account grows tax-free. While the distinction of how these accounts are taxed is relatively straightforward, the restrictions and rules applying to different types of accounts create much complexity for those wishing to save.

Previously released IRS data had shown that in 2015, pension and retirement account distributions were an important source of capital income for the middle class. The contributions made by taxpayers in 2015 indicate that both traditional and Roth IRAs continue to be a largely middle-class phenomenon.

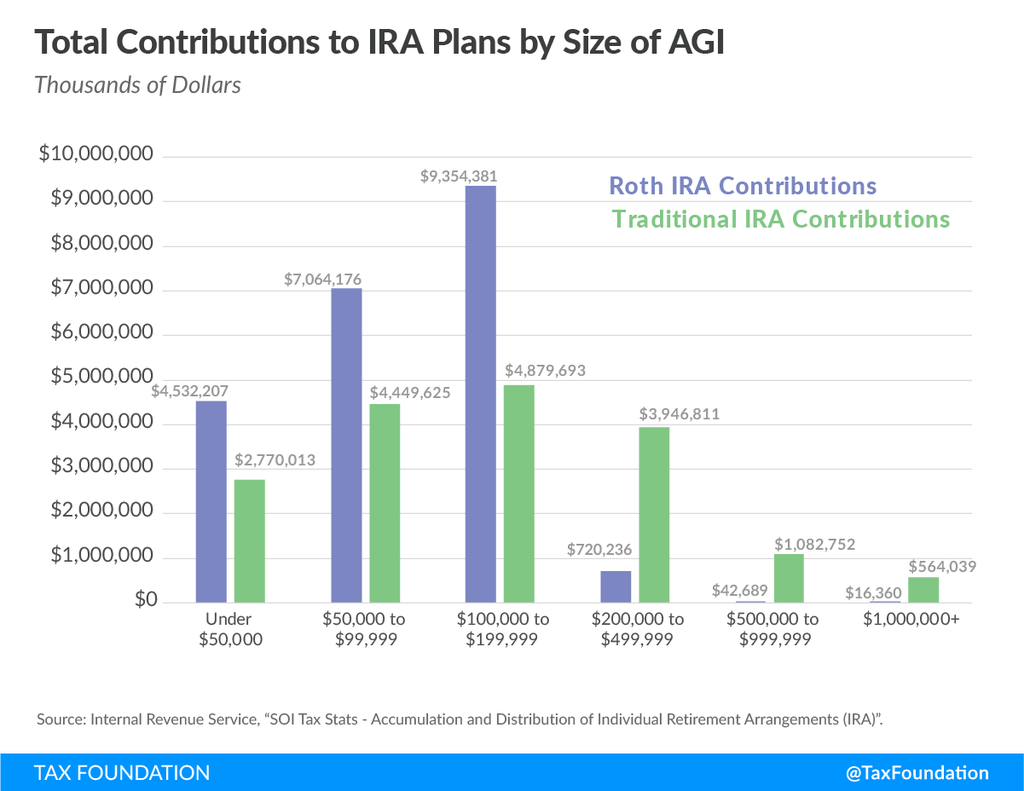

In tax year 2015, taxpayers contributed a total of $17.7 billion to traditional IRAs and $21.7 billion to Roth IRAs. These amounts do not include contributions to 401(k)s, so they do not represent all retirement saving. In 2015, the adjusted gross income (AGI) phaseout range for making contributions to Roth IRAs was $183,000 to $193,000 for married couples filing jointly, meaning that if their AGI was above these limits they generally could not contribute to Roth IRAs. The contribution limit to IRAs in 2015 was $5,500.

Nearly 48 percent of IRA contributions to either style of account were made by households making under $100,000 per year, representing 55 percent of the number of households that made IRA contributions. If we consider households making between $100,000 and $200,000 middle class, then these shares rise to nearly 84 percent and 88 percent, respectively.

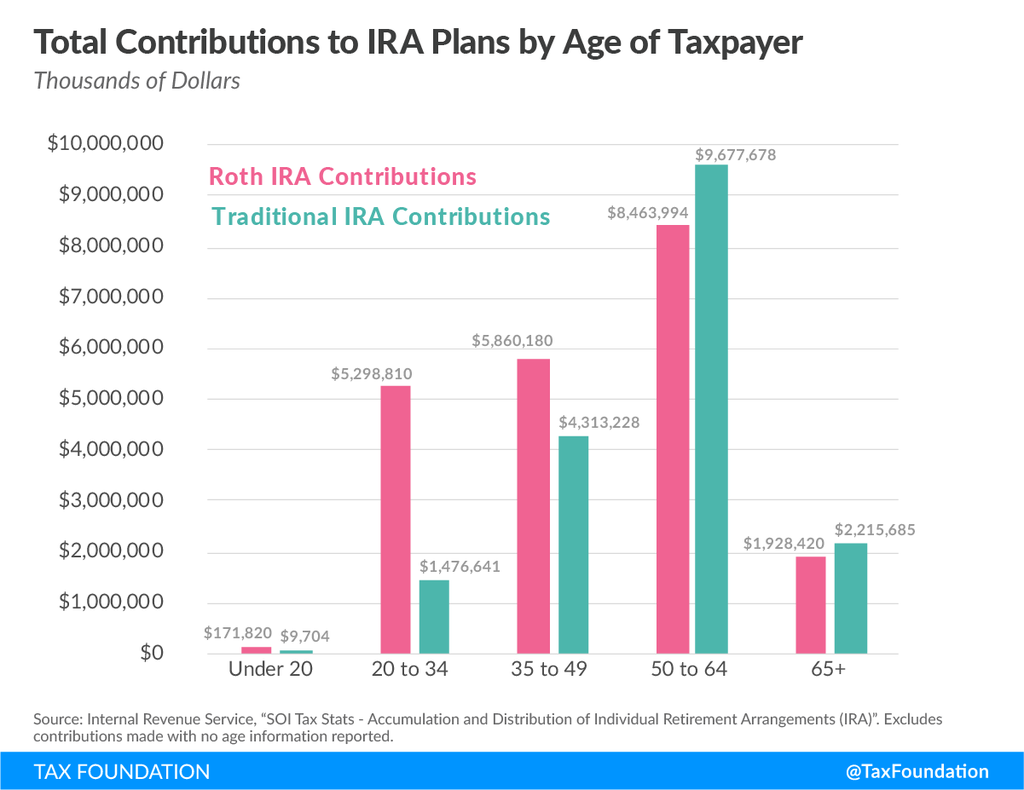

The IRS also provides data on the age of taxpayers making contributions to IRAs. Contributions made by taxpayers ages 20 to under 35 represent 28 percent of contributions made to traditional IRAs but just 11 percent made to Roth IRAs. On the other hand, taxpayers ages 50 to under 65 made up the largest share of contributors to both styles of accounts: nearly 33 percent of traditional contributions and 50 percent of Roth contributions were made by taxpayers in this age group. Notably, individuals are generally allowed to make catch-up contributions to their retirement accounts beginning at age 50, subject to certain limitations.

Tax-neutral retirement savings accounts constitute a large portion of saving for the middle class, and provide a large share of the capital income earned by the middle class. These savings help provide a secure retirement because of the return on investment that savings generate. This area of the tax code is a prime target for future reforms, including consolidation, simplification, or the creation of universal savings accounts.

Share this article