The Louisiana legislature partially renewed the state’s sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. to 4.45 percent at the end of June after holding a special legislative session to address the state’s expected revenue shortfall for fiscal year 2019. A temporary sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increase from 4 percent to 5 percent enacted in 2016 was set to expire at the end of this fiscal year on June 30. Days before the fiscal year ended, state lawmakers extended the rate to 4.45 percent until 2025.

Louisiana’s State Sales Tax Structure Has Improved

The special session was called to address the state’s projected $568.2 million revenue shortfall on the enacted $29 billion budget, which resulted partly from the upcoming expiration of the temporary tax increases. The last special session earlier this month ended after state lawmakers failed to come to an agreement on whether to renew the sales tax hike and by how much to increase the rate to close the revenue gap, with proposals ranging from 4.33 to 4.5 percent. Lawmakers settled on the new rate of 4.45 percent as a compromise.

This agreement is bittersweet. One sizable improvement in the legislation is a removal of the roughest edges of what is known in the state as the “clean penny.” The clean penny was a temporary 1 percent sales tax hike that had been applied to a different basket of transactions than the underlying 4 percentage points that make up the majority of the state sales tax.

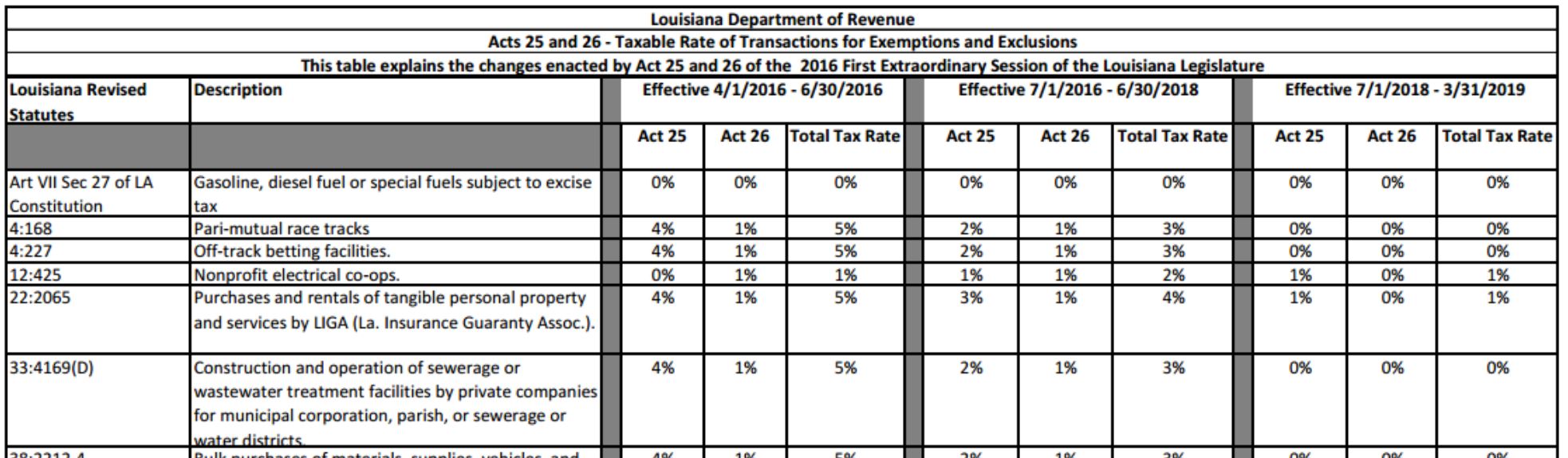

It is hard to overstate how odd the structure of this provision was when it was passed in 2016. As shown in the screengrab below from the guidance document the department of revenue released to help taxpayers, transactions were subject to a whole host of rates (the document ended up being 25 pages from all the complexities, the updated copy is here). Tyler Bridges at the Advocate noted in a recent article: “the state taxed Bibles at the full 5 percent, electricity for nonresidential use at 4 percent, new boats at 3 percent, new-car rebates at 2 percent and the sale of equipment used for manufacturing at 1 percent.” The transactions that were subject to the “clean penny” had phase-ins and phase-outs scattered through the enactment period of the temporary measure.

Louisiana “Clean Penny” Department of Revenue Guidance Document, 2016

In the process of moving the sales tax from 5 percent to 4.45 percent, the state has smoothed the “clean penny,” making the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. more uniform. As of July 1, Louisiana only has a bifurcated rate for fuel and electricity used by business, which will be taxed at 2 percent going forward. Economists will tell you that taxing business inputs like this through the sales tax is a no-no, as retail sales taxes are meant to only fall on consumer purchases. Legislators split the baby and half-taxed those transactions.

Louisiana Policymakers Will Face Constitutional Challenges Post-Wayfair

Louisiana will likely continue to struggle to respond effectively to the Supreme Court’s Wayfair decision, which held that South Dakota’s law to apply its sales tax to online purchases is constitutional. Legislators in Louisiana have excitedly pushed to begin collecting sales tax on remote sales too, but the state’s complex local tax structure risks drawing a lawsuit.

Much in the same way that the “clean penny” resulted in a different basket of transactions facing a latticework of state sales tax treatment, each of the 64 parishes in Louisiana can subject different items to different local sales tax treatment at their whim. The state is one of just a handful that does this. Parishes also do the collecting and auditing of their local sales taxes, so taxpayers are interfacing with many more taxing bodies than is usual in other states.

For simplicity, almost all other states have the same tax base at the state and local level, and all revenues are collected by the state department of revenue and are then dispersed back to local government units.

These facts matter because the Supreme Court specifically listed some of these concerns as things South Dakota did well to keep their online sales tax from being an undue burden on interstate commerce. From the Court’s decision:

South Dakota’s tax system includes several features that appear designed to prevent discrimination against or undue burdens upon interstate commerce. First, the Act applies a safe harbor to those who transact only limited business in South Dakota. Second, the Act ensures that no obligation to remit the sales tax may be applied retroactively. S. B. 106, §5. Third, South Dakota is one of more than 20 States that have adopted the Streamlined Sales and Use Tax Agreement. This system standardizes taxes to reduce administrative and compliance costs: It requires a single, state level tax administration, uniform definitions of products and services, simplified tax rate structures, and other uniform rules. It also provides sellers access to sales tax administration software paid for by the State. Sellers who choose to use such software are immune from auditA tax audit is when the Internal Revenue Service (IRS) or a state or local revenue agency conducts a formal investigation of financial information to verify an individual or corporation has accurately reported and paid their taxes. Selection can be at random, or due to unusual deductions or income reported on a tax return. liability.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeBecause Louisiana is not a member of the Streamlined Sales and Use Tax Agreement, and does not have a single, state-level administration or simplified rate structures, attempts to collect sales tax on remote transactions would likely face a legal challenge.

Anticipating this, the state has convened a commission which will serve as a single collection body for remote sales, while retaining its cumbersome, disjointed system for in-state brick and mortar retailers. The new body, the Sales and Use Tax Commission for Remote Sellers, is slated to collect an 8.45 percent sales tax on remote transactions, with 4.45 percent going to the state and 4 percent being distributed to localities. It is not clear that this plan will be constitutional either, as a uniform 8.45 percent rate on everything will almost certainly create transactions that would have been subject to a lower rate if purchased on the ground, but will be subject to a higher rate if shipped in from an online sale.

For example, the combined state and local sales tax rate on a book purchased in a store in Caddo parish is 7.8 percent, but if you ordered it online, it would be subject to an 8.45 percent tax. The Court has ruled in the 1977 Complete Auto case that rates on out-of-state taxpayers cannot be higher than in-state taxpayers, and that case law is still with us post-Wayfair.

Looking Forward

The sales tax changes enacted this session improve some things, but significant tax problems will continue to fester in Louisiana. The biggest drawback of this session is that familiar feeling of a missed opportunity to further real tax reform.

As we outlined in our book Louisiana Fiscal Reform: A Framework for the Future, Louisiana’s tax problems lie not in how much is collected, but in the structures used to raise that revenue.

There are a slate of tax reforms that would benefit Louisiana’s economy while addressing its underlying budget challenges. For the sales tax, these include eliminating duplicative tax collection, simplifying the tax base, and broadening the tax base. While the state’s structural budget shortfall appears to be in better shape for the time being, state lawmakers should prioritize working on long-term tax reform next session.

Share this article