The latest version of the Build Back Better Act includes a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on nicotine products, which would tax products by nicotine content at a rate of $50.33 per 1,810 milligrams of nicotine. This rate has been chosen to establish approximate parity between the tax rate on a pack of cigarettes and vapor products. Nicotine products are not uniform, however, and as a result, some nicotine-containing products would experience tax rates well above the rate levied on more harmful tobacco products. The original Build Back Better Act included tobacco and nicotine taxes which were estimated to raise $100 billion over 10 years, but the tobacco tax increases have been dropped from the latest version.

A standalone nicotine tax increase will not raise nearly that much revenue. According to a Joint Committee on Taxation score of a similar tax proposal from 2019, this tax would raise less than $10 billion over 10 years, and this estimate may now be too high given the Food and Drug Administration’s (FDA) recent moves to ban substantial portions of the vapor market.

It is a well-established concept that taxes on tobacco and nicotine products serve (at least) two purposes: to improve public health and raise revenue. The tax can do that if it is properly designed. A good design means internalizing externalities related to consumption of a product. With tobacco and nicotine product consumption, these externalities are (1) the health risks connected to frequent use and (2) quantity consumed. Nicotine is the addictive substance in the products, but not the harmful ingredient. In other words, the proposal does not target the harmful behavior directly.

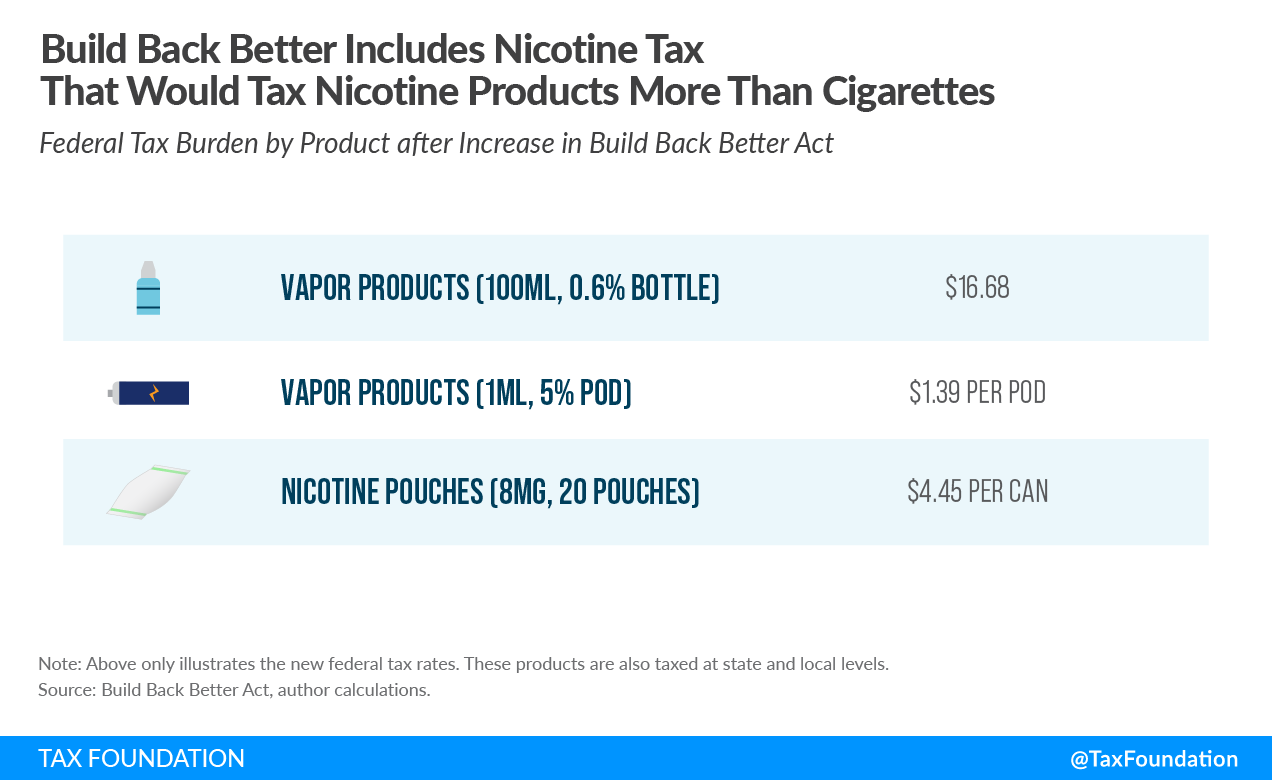

Taxing based on nicotine content would favor low-nicotine liquids and could encourage increased consumption in the quantity of liquid. For instance, a vapor pod that has a nicotine content of 3 percent and contains 1 ml of liquid would be taxed at $0.83 whereas a vapor pod that has a nicotine content of 5 percent and also contains 1 ml of liquid would be taxed at $1.39 even if there is no difference, or even a negative differential, in broader health effects of the two pods.

For those reasons, using nicotine as a proxy is not a desirable structure. Moreover, nicotine content alone does not determine nicotine absorption since absorption depends on delivery method. For instance, differences in electronic cigarette device design have significant implications for how much nicotine is absorbed by the consumer. In addition to variations among electronic cigarettes, other, and vastly distinct, nicotine products exist. However, due to the flawed definition of nicotine products in the bill, nicotine pouches, a relatively novel product which is consumed similarly to snus or dipping tobacco, will be taxed at very high rates. The high rate is a result of tax being levied on milligrams of nicotine since nicotine pouches contain more of it. Absorption through the mouth is slower than through the lungs, so these products require higher nicotine contents to satisfy consumers. Importantly, higher nicotine content does not translate to higher absorption.

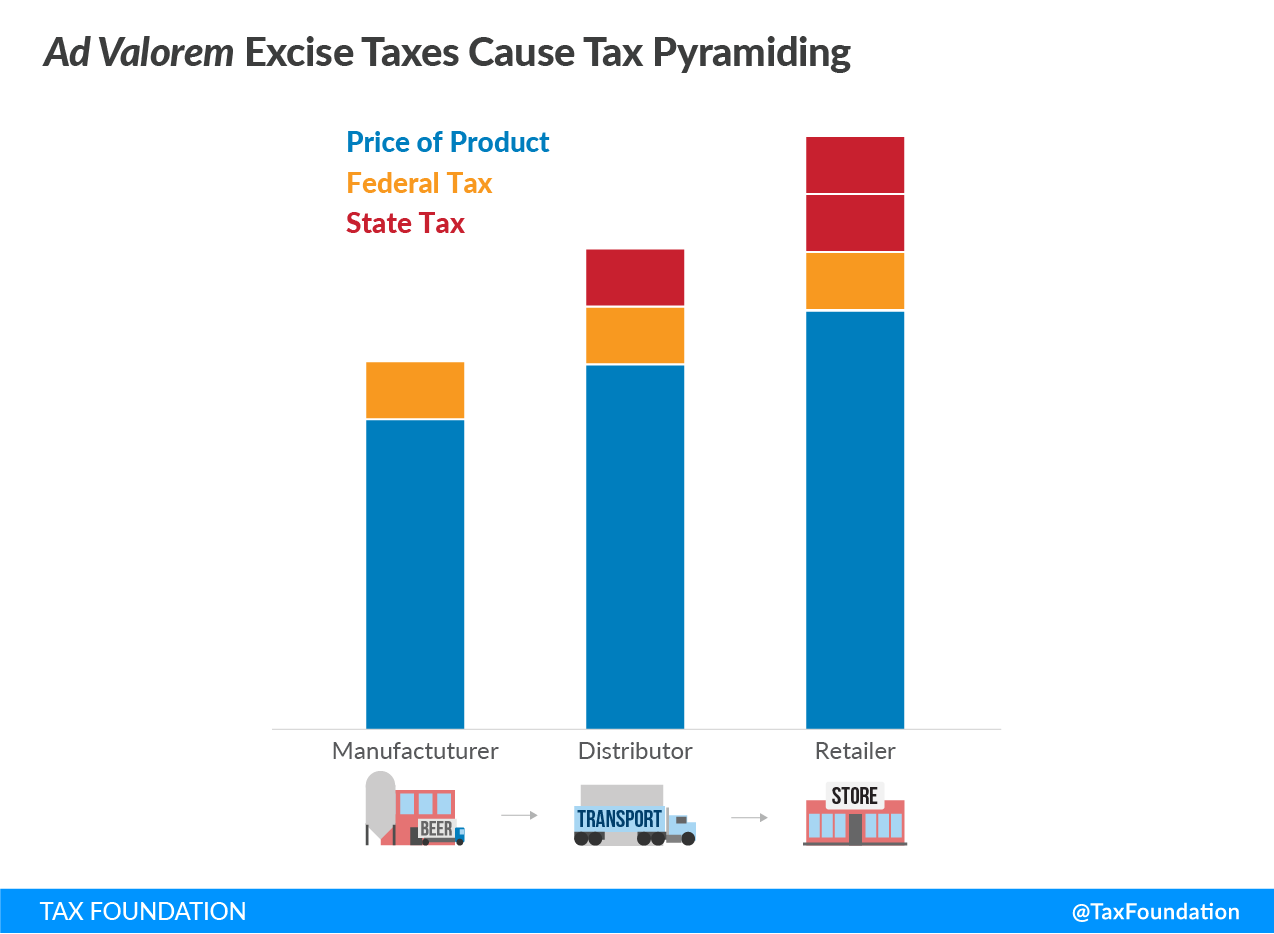

Nicotine pouches for oral consumption would be subject to a very high rate. A can of 20 pouches, each containing 8 mg of nicotine, would be subject to $4.45 in taxes per can. Because nicotine products—vapor products and nicotine pouches alike—are often taxed at a percentage of value in the states, these high federal rates would compound at the state level, because the federal tax is built into the price by the time it reaches state-level distributors. The accompanying table illustrates this effect for a few example products.

Open vapor products refer to tank systems. These are typically refillable, modifiable, and they use less potent liquid in larger quantities. Closed vapor products refer to cartridge-based systems. These typically use more potent liquid in small quantities. The states referenced are included either because they tax vapor products based on price (ad valorem) or because they tax nicotine pouches.

| State | Tax Structure | Open Vapor Product | Closed Vapor Product | Nicotine Pouch | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Consumer Cost Increase from FET | State Excise Tax Burden Increase from FET | Consumer cost after FET | Consumer Cost Increase from FET | State Excise Tax Burden Increase from FET | Consumer cost after FET | Consumer Cost Increase from FET | State Excise Tax Burden Increase from FET | Consumer cost after FET | ||

| California | All ad valorem | 11% | 11% | $34.24 | 46% | 46% | $9.10 | 127% | 127% | $16.48 |

| Colorado | All ad valorem | 11% | 11% | $26.88 | 46% | 46% | $7.17 | 127% | 127% | $12.99 |

| Connecticut | Open system ad valorem tax | 11% | 11% | $20.87 | 41% | 0% | $5.94 | 127% | 0% | $9.86 |

| Georgia | Open system ad valorem tax | 11% | 11% | $21.16 | 46% | 0% | $5.56 | 127% | 0% | $9.95 |

| Illinois | Ad valorem vapor tax | 11% | 11% | $20.61 | 46% | 46% | $6.41 | 127% | 0% | $10.09 |

| Kentucky | Open system ad valorem tax | 11% | 11% | $21.29 | 31% | 0% | $7.28 | 127% | 0% | $9.83 |

| Louisiana | Nicotine Pouch ad valorem tax | 11% | 11% | $24.62 | 46% | 0% | $5.67 | 127% | 127% | $12.19 |

| Maine | Ad valorem vapor tax | 11% | 11% | $20.61 | 46% | 46% | $7.73 | 127% | 0% | $9.78 |

| Maryland | All ad valorem | 11% | 11% | $31.61 | 43% | 46% | $8.50 | 127% | 127% | $15.04 |

| Massachusetts | Ad valorem vapor tax | 11% | 11% | $20.89 | 46% | 46% | $9.52 | 127% | 0% | $9.85 |

| Minnesota | All ad valorem | 11% | 11% | $41.04 | 46% | 46% | $10.73 | 127% | 127% | $19.43 |

| Nevada | Ad valorem vapor tax | 11% | 0% | $19.44 | 46% | 46% | $7.20 | 127% | 0% | $10.04 |

| New Hampshire | Open system ad valorem tax | 11% | 11% | $34.21 | 42% | 0% | $5.47 | 127% | 127% | $15.30 |

| New Jersey | Open system and nicotine pouch ad valorem tax | 11% | 11% | $27.26 | 41% | 0% | $5.96 | 127% | 127% | $12.85 |

| New Mexico | Open system ad valorem tax | 11% | 11% | $21.10 | 40% | 0% | $6.15 | 127% | 0% | $10.00 |

| New York | Ad valorem vapor tax | 11% | 0% | $19.44 | 42% | 46% | $8.63 | 127% | 0% | $10.06 |

| Oregon | Ad valorem vapor tax | 11% | 0% | $19.44 | 46% | 46% | $8.45 | 127% | 0% | $9.27 |

| Pennsylvania | Ad valorem vapor tax | 11% | 11% | $21.04 | 46% | 46% | $7.62 | 127% | 0% | $9.86 |

| Texas | Nicotine pouch tax | 11% | 9% | $21.22 | 46% | 0% | $5.54 | 117% | 0% | $10.42 |

| Utah | Ad valorem vapor tax | 11% | 8% | $21.22 | 46% | 46% | $8.56 | 112% | 0% | $10.51 |

| Vermont | Ad valorem vapor tax | 9% | 3% | $24.42 | 46% | 46% | $10.44 | 68% | 0% | $13.67 |

| Washington, D.C. | All ad valorem | 11% | 11% | $36.86 | 46% | 46% | $9.77 | 127% | 127% | $17.69 |

| Wyoming | Ad valorem vapor tax | 11% | 0% | $19.44 | 46% | 46% | $6.20 | 127% | 0% | $9.77 |

|

Note: Open systems assumed to contain 60 mg of nicotine and be a 100 ml bottle with a wholesale value of $15. Closed systems assumed to contain 50 mg of nicotine and be a 1 ml cartridge with a wholesale value of $3. Nicotine pouches assumed to contain 8 mg of nicotine, have 20 pouches to a can, and weigh 0.25 oz, with a wholesale value of $3.50. Markup is assumed to be 8 percent. Consumer cost includes state sales tax and an average of local sales taxes. Sources: state statutes, author calculations. |

||||||||||

States often tax nicotine products by price, and the tax on the product will pyramid since the federal tax would be levied at the manufacturer level and the state tax is levied at the distribution level. In effect, the state tax base includes the federal tax and becomes a tax on a tax. This means that even if the taxes on tobacco and other nicotine products are approximately equal at the federal level, by the time it reaches the consumer, the nicotine product will carry a higher tax (and often a higher price). This is highly problematic when considering that cigarettes are much more harmful than nicotine products. That makes the federal tax proposal look like a harm-maximizing strategy.

The effects of the tax are most substantial for nicotine pouches, such that the category is unlikely to survive. (In Minnesota, a can would cost almost $20.)

However, vapor products will also find it difficult to attract smokers if the products aren’t competitively priced. Combine that with the FDA’s regulatory action, which has removed millions of products from the shelves through the Premarket Tobacco Application (PMTA) process. These recent regulatory developments further illustrate that definitional issues in the tobacco space not only derail taxation but also impact regulation. Because nicotine products regulated by the FDA are defined as tobacco-derived products, a synthetic nicotine product is almost completely unregulated. As a result, highly regulated and taxed products must compete with unregulated and less taxed products (the new federal tax would be imposed on both tobacco-derived and synthetic nicotine).

There are ways to tax nicotine products in an appropriate way. First, better definitions of nicotine products that distinguish between vapor products and nicotine pouches would solve the inequities in the current design. Updating definitions would also afford lawmakers an opportunity to makes sure synthetic nicotine is treated similarly to tobacco-derived nicotine. Poor definitions are not just an issue with the federal proposal but also a major problem in many states. States often rope in novel nicotine products to existing tobacco products definitions without concern for the unique characteristics of the products.

Second, tax policy should play a role in tobacco harm reduction, at least indirectly. The tax code should remain as neutral as possible, and it should not pick winners and losers. That being said, the nature of excise taxes is such that a well-designed tax scheme would encourage consumers to switch from cigarettes. Because harm associated with consumption of other nicotine products (vapor products, nicotine pouches) is much lower, the tax rate should be much lower. Since lower rates translate to lower retail prices, it allows the consumers to navigate the market and helps them switch to less harmful products.

In terms of tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , a tax on nicotine products should be based on quantity. For vapor products, the obvious choice is taxing the liquid by volume (that is, per ml), and for nicotine pouches, a tax by weight or per pouch is a straightforward solution. It is the administratively simplest and most straightforward way for the federal government to tax these goods, as it does not require valuation and as such does not require expensive administration.

The nicotine tax proposal in the Build Back Better Act neglects sound excise tax policy design and by doing so risks harming public health. Lawmakers should reconsider this approach to nicotine taxation.

Note: This post was originally published on October 18th but has been updated to reflect the latest version of the Build Back Better plan.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe