Tomorrow, the House Judiciary Committee will hold a markup of HB 1393, the Mobile Workforce State Income Tax Simplification Act of 2017.

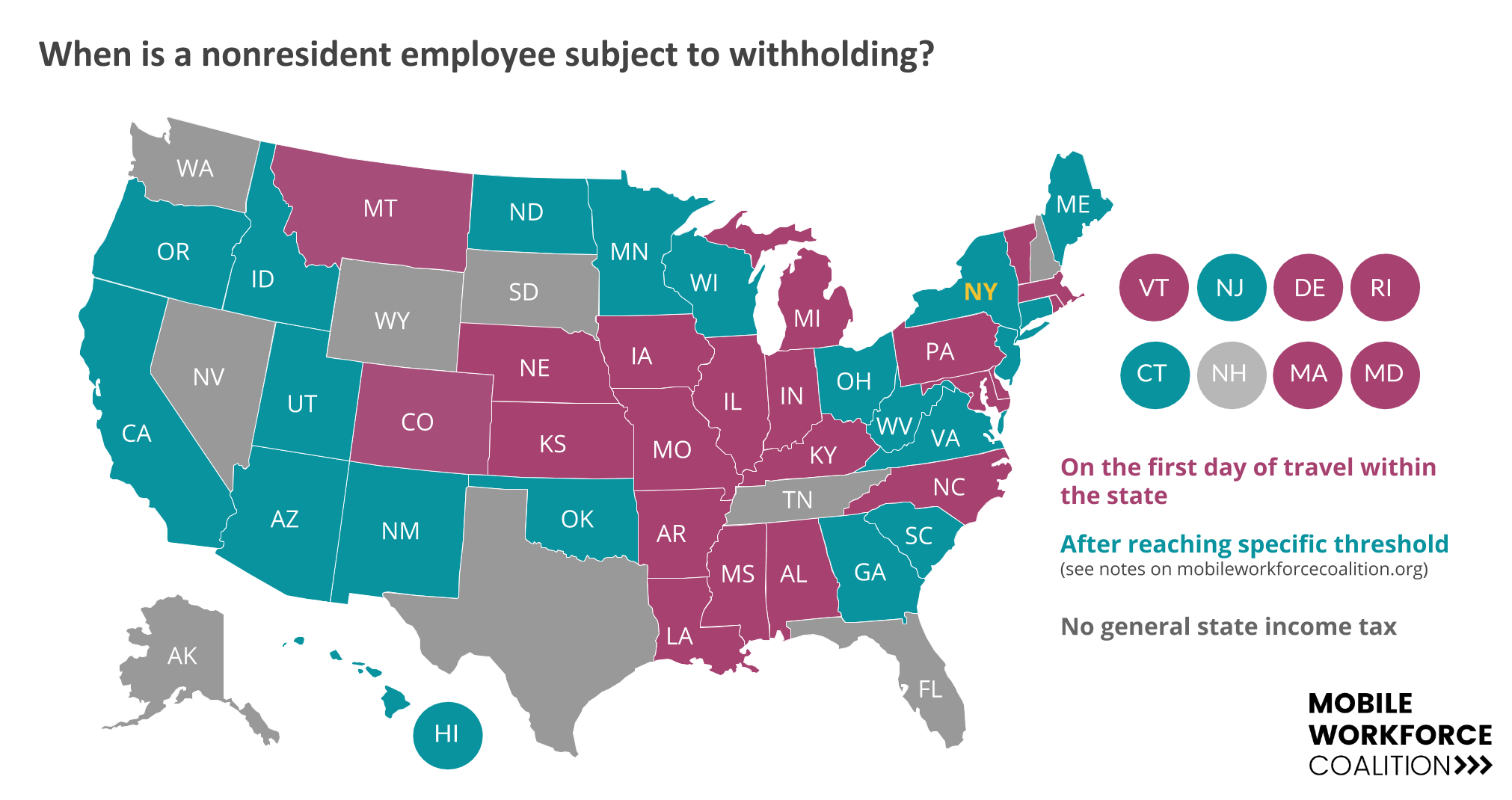

The bill limits states from imposing or collecting individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. on people who are in the state for less than 30 days. Most states technically require such payments when someone is in the state for even a day (see map below), and even that withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount the employee requests. to be set up in advance. Such practices disrupt interstate commerce and falsely suggest that business travelers earn their income in traveling states and not from the home office. We’ve increasingly heard horror stories of states trying to collect these sums.

Since all states provide a credit for taxes paid to another state, making people fill out 20 or 30 taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. returns for a net national wash is lunacy. Most everyone, except some state tax administrators, supports this legislation. (State tax administrators instead urge states to voluntarily adopt a more convoluted model, which no state has done.)

Growing state efforts to raid revenue from business travelers who are in the state for only a few days have created needless complexity and threaten to harm interstate commerce. The Constitution empowers Congress to limit the power of states to tax interstate commerce. Prohibiting states from requiring payment or withholding of income taxes from someone in the state for less than 30 days is a fair balance.

Previous Congresses have considered this legislation. In 2016, the U.S. House approved it via voice vote.

Lead sponsors of Mobile Workforce are Reps. Mike Bishop (R-MI) and Hank Johnson (D-GA) on the House side and Sen. Sherrod Brown (D-OH) and John Thune (R-SD) on the Senate side. The Senate companion legislation is S.540.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe