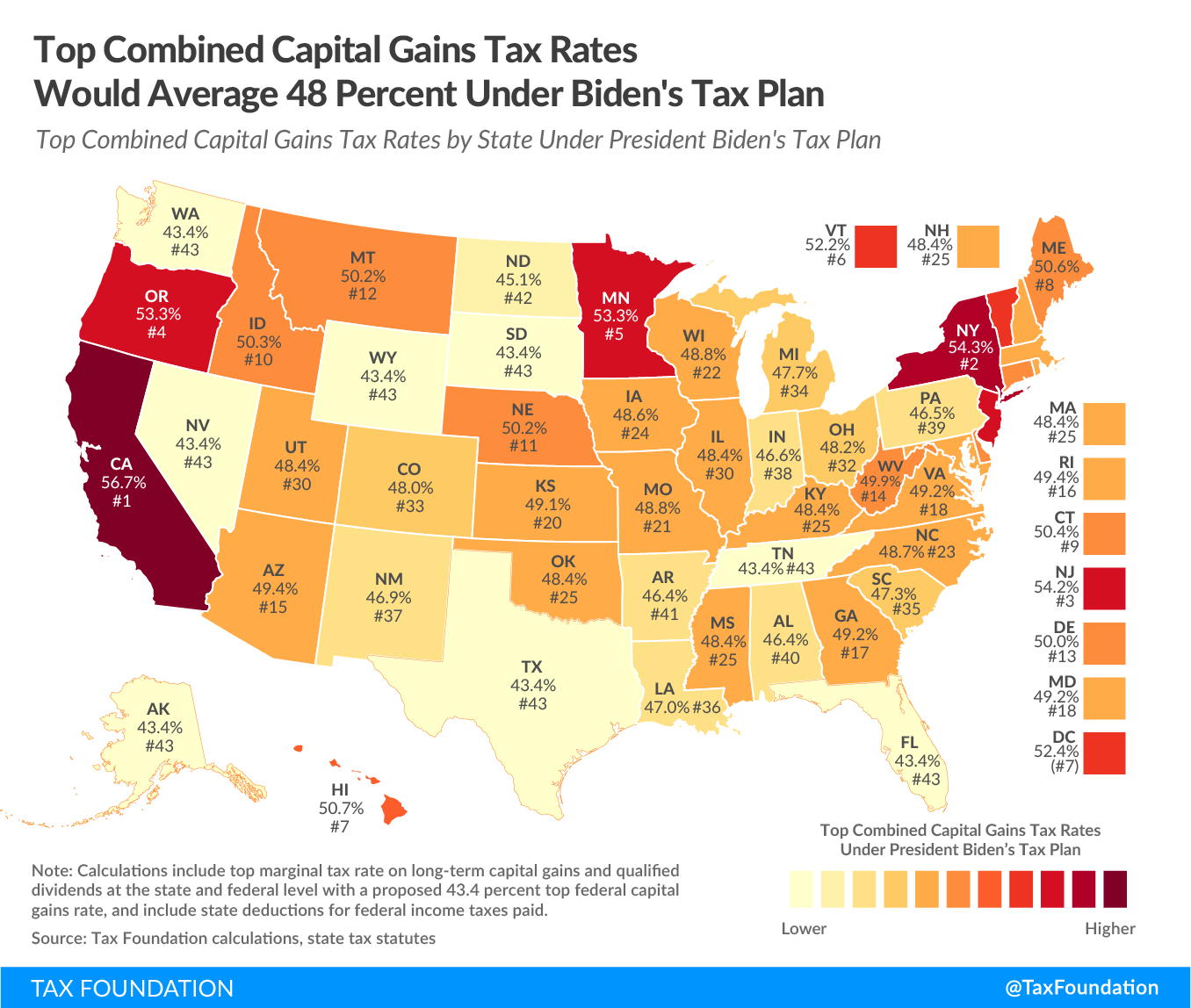

President Joe Biden’s American Families Plan will likely include a large increase in the top federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate on long-term capital gains and qualified dividends, from 23.8 percent today to 39.6 percent for higher earners. When including the net investment income tax, the top federal rate on capital gains would be 43.4 percent. Rates would be even higher in many U.S. states due to state and local capital gains taxes, leading to a combined average rate of 48 percent compared to about 29 percent under current law.

A high combined capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rate would influence when taxpayers decide to sell assets and realize the gain. If the effect is large enough, federal revenue from capital gains income would decline because taxpayers have decided to avoid realizing gains and the higher tax rate.

Most states levy their individual income tax rates on long-term capital gains and qualified dividends, though Hawaii levies lower tax rates. Nine states provide general exclusions or deductions for long-term capital gains. The average top tax rate on capital gains at the state level is about 5.2 percent, for a combined average rate of 29 percent under current law. If the top federal capital gains rate rises to 43.4 percent, this would raise the combined tax rate on long-term capital gains to 48.4 percent.

Thirteen states and the District of Columbia would have a top combined capital gains tax rate north of 50 percent. California, New York, and New Jersey would have combined rates of more than 54 percent. Top combined rates in some localities would go even higher. For example, New York City levies a local capital gains rate of 3.876 percent, which means an investor would pay an all-in rate of nearly 58.2 percent. Residents of Portland, Oregon would face a top capital gains rate of 57.3 percent.

Using the Tax Foundation General Equilibrium Model, we find that raising the top capital gains tax rate to 39.6 percent for those earning over $1 million would reduce long-run GDP by about 0.1 percent and reduce federal revenue by about $124 billion over 10 years.

| Gross Domestic Product (GDP) | -0.1% |

| Gross National Product (GNP) | -0.2% |

| Capital Stock | -0.1% |

| Wage Rate | -0.1% |

| Full-Time Equivalent Jobs | -15,000 |

| Conventional 10-Year Revenue, 2022 to 2031 | -$123.5 |

| Dynamic 10-Year Revenue, 2022 to 2031 | -$132.9 |

|

Source: Tax Foundation General Equilibrium Model, March 2021. |

|

Under Biden’s proposal for capital gains, the U.S. economy would be smaller, American incomes would be reduced, and federal revenue would also drop due to fewer capital gains realizations. Other proposals, such as partially repealing step-up in basis for capital gains, may help offset the realization effect and increase federal revenue, but it remains important to consider the combined tax rate on capital gains in the context of the President’s tax proposals.

| Top Capital Gains Rate (Current Law) | Top Capital Gains Rate (Proposed) | |

|---|---|---|

| Alabama | 28.8% | 46.4% |

| Alaska | 23.8% | 43.4% |

| Arizona | 29.8% | 49.4% |

| Arkansas | 26.8% | 46.4% |

| California | 37.1% | 56.7% |

| Colorado | 28.4% | 48.0% |

| Connecticut | 30.8% | 50.4% |

| D.C. | 32.8% | 52.4% |

| Delaware | 30.4% | 50.0% |

| Florida | 23.8% | 43.4% |

| Georgia | 29.6% | 49.2% |

| Hawaii | 31.1% | 50.7% |

| Idaho | 30.7% | 50.3% |

| Illinois | 28.8% | 48.4% |

| Indiana | 27.0% | 46.6% |

| Iowa | 32.3% | 48.6% |

| Kansas | 29.5% | 49.1% |

| Kentucky | 28.8% | 48.4% |

| Louisiana | 29.8% | 47.0% |

| Maine | 31.0% | 50.6% |

| Maryland | 29.6% | 49.2% |

| Massachusetts | 28.8% | 48.4% |

| Michigan | 28.1% | 47.7% |

| Minnesota | 33.7% | 53.3% |

| Mississippi | 28.8% | 48.4% |

| Missouri | 29.2% | 48.8% |

| Montana | 30.6% | 50.2% |

| Nebraska | 30.6% | 50.2% |

| Nevada | 23.8% | 43.4% |

| New Hampshire | 28.8% | 48.4% |

| New Jersey | 34.6% | 54.2% |

| New Mexico | 27.3% | 46.9% |

| New York | 34.7% | 54.3% |

| North Carolina | 29.1% | 48.7% |

| North Dakota | 25.5% | 45.1% |

| Ohio | 28.6% | 48.2% |

| Oklahoma | 28.8% | 48.4% |

| Oregon | 33.7% | 53.3% |

| Pennsylvania | 26.9% | 46.5% |

| Rhode Island | 29.8% | 49.4% |

| South Carolina | 27.7% | 47.3% |

| South Dakota | 23.8% | 43.4% |

| Tennessee | 23.8% | 43.4% |

| Texas | 23.8% | 43.4% |

| Utah | 28.8% | 48.4% |

| Vermont | 32.6% | 52.2% |

| Virginia | 29.6% | 49.2% |

| Washington | 23.8% | 43.4% |

| West Virginia | 30.3% | 49.9% |

| Wisconsin | 29.2% | 48.8% |

| Wyoming | 23.8% | 43.4% |

| Average (unweighted) | 29.0% | 48.4% |

|

Source: Tax Foundation calculations, state statutes. |

||

Errata: This piece has been updated to include the effect of state tax exclusions and deductions for capital gains.

Launch Resource Center: President Biden’s Tax Proposals

Share this article