The Biden administration has proposed a new minimum tax that would raise taxes on multinational enterprises (MNEs). Similarly, the OECD has also proposed a global minimum tax under Pillar Two. Together, the proposals would affect patterns of international investment and potentially decrease the volume of foreign direct investment (FDI).

The InflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. Reduction Act (IRA) would implement a minimum taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. of 15 percent on a corporation’s book incomeBook income is the amount of income corporations publicly report on their financial statements to shareholders. This measure is useful for assessing the financial health of a business but often does not reflect economic reality and can result in a firm appearing profitable while paying little or no income tax. , for corporations with more than $1 billion in financial profits. The change would be comparable to the OECD’s Pillar Two proposal, which also calls for a 15 percent minimum tax on the same type of income, but for corporations with more than $769 million in global revenues. Other than thresholds, the other key difference between the two proposals is that Pillar Two would permit certain capital investments to be excluded from the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , while the current IRA provides no such exemptions. This would disproportionately hurt the manufacturing industry, which represents nearly two-fifths of all FDI stock in the U.S.

Academic research indicates foreign direct investment (FDI) is highly responsive to the corporate effective tax rate (ETRs); that is, the tax rate after accounting for all deduction and credits available to corporations. Using a database of 85 countries from PricewaterhouseCoopers, a team of economists found a large negative effect of corporate ETRs on FDI. Raising the ETR by 10 percentage points reduced inbound FDI in the first year by 2.3 percentage points.

A recent analysis by the United Nations Conference on Trade and Development (UNCTAD) examined the impact of the proposed global minimum tax as outlined in Pillar Two on FDI. Unlike GILTI, which has a broader tax base, the Pillar Two minimum tax would only apply to MNEs with revenues larger than 750 million euros (US $763 million). Large MNEs alone, however, account for two-thirds of FDI, so the economic impact could still be significant.

The report calculates ETRs under a Pillar Two regime. Most traditional estimates calculate ETRs as a ratio of taxes paid in a host country to the profits reported there. However, because of profit shifting, the calculation tends to overstate the tax rates multinationals face in host countries. The UNCTAD paper instead calculates an FDI-level ETR, defined as the ratio between the corporate income tax on the income generated by the FDI stock in the host country and the FDI income itself, even though some of the income and tax may be reported in other countries. The paper finds that FDI-level ETRs for the non-tax haven countries are about 2 to 3 percentage points lower than standard estimates.

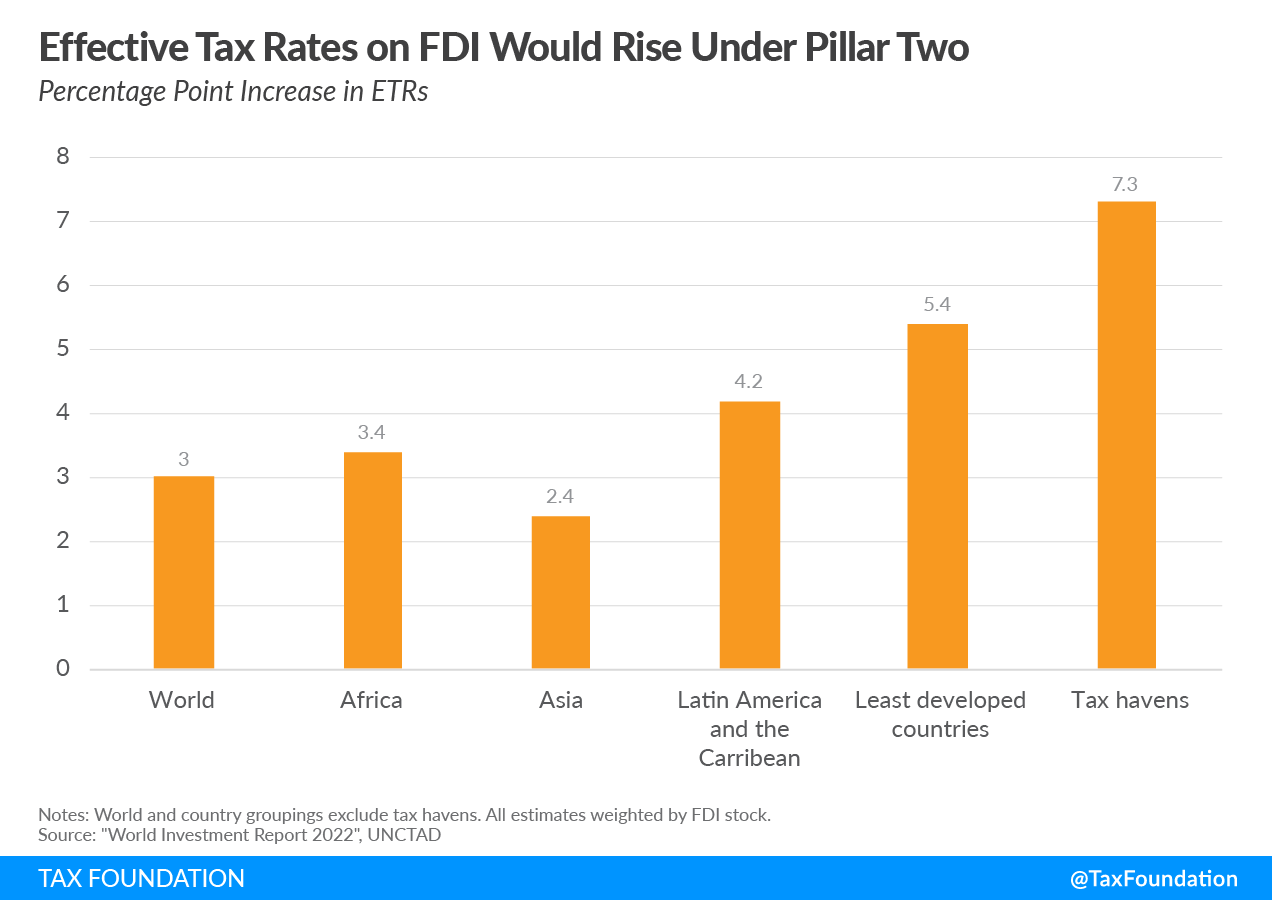

The revisions suggest many more countries would be impacted by the global minimum tax than conventionally estimated. Using the new estimates of ETRs, the share of developing countries with tax rates below 15 percent would rise from 29 percent to almost half. Under Pillar Two, ETRs would rise by about 3 percentage points for the non-tax haven countries, which corresponds to an increase in MNE corporate tax liabilities of 14 to 20 percent. Among the least developed countries, ETRs would rise by 5.4 percentage points, and the increase for the tax havens would be even larger, at 7.3 percentage points.

The paper predicts the increase in firms’ tax liabilities from the imposition of a minimum tax would cause the volume of FDI to fall by as much as 4 percent, as the marginal return on each dollar of investment will be lower. Due to the reduction in tax differentials between the low-tax jurisdictions and other countries, firms would have stronger incentives to shift investment from tax havens to higher tax countries, as occurred during the Tax Cuts and Jobs Act. The paper estimates FDI in tax havens could fall by as much as 7.3 percent.

As foreign direct investment (FDI) provides many benefits to both the host country and foreign countries, policymakers should continue to tread carefully when debating how to change the taxation of cross-border investment, avoiding proposals that would dampen investment.

Note: This is part of our blog series exploring the importance of foreign direct investment (FDI) and its relevance for tax reform.