New Details on the Austrian Tax Reform Plan

14 min readBy: , ,Key Findings

-

Last week, the Austrian Finance Ministry released its tax reform package, amounting to an annual taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. cut of €8.3 billion by 2022.

-

The tax reform plan includes lower personal income tax rates and lower social security contributions, reducing Austria’s high tax burden on labor.

-

For businesses, the package includes a cut in the corporate income tax rate from the current 25 percent to 23 percent in 2022, followed by 21 percent in 2023.

Introduction

Last week, the Austrian Finance Ministry released its tax reform package.[1] The plan has been developed to go into effect in stages over the next several years, with 2023 the final year. The new reform plan includes changes to personal income taxes, business taxes, excise taxes, and simplifications of the tax system.

The total tax cut will amount to €8.3 billion per year by 2022 (including tax reforms already implemented by the current government, such as the Familienbonus Plus). The following table shows the estimated tax cuts resulting from each element of the tax reform plan.

|

Source: Austrian Finance Ministry. |

|

| Measure | Tax Cut Estimate (in Mio €) |

|---|---|

|

Personal Taxes and Social Security Contributions |

|

|

Lower Social Security Contributions |

€ 900 |

|

Lower Personal Income Tax Rates |

€ 3,900 |

|

Increase in Work-Related Personal Income Tax Deductions |

€ 140 |

|

Profit-Sharing with Employees |

€ 100 |

|

Business Taxation |

|

|

Lower Corporate Income Tax Rate |

€ 1,600 |

|

Expansion of the Corporate Standard Deduction |

€ 100 |

|

Increase in Deduction Limit for Low-Value Assets |

€ 300 |

|

Increase in VAT Threshold |

€ 75 |

|

Environmental Taxes |

€ 55 |

|

Simplifications |

|

|

Simplification of the Income Tax Code |

€ 200 |

|

Other Changes and Elimination of Tax on Sparkling Wine |

€ 20 |

|

TOTAL |

€ 7,390 |

The newly announced reform package should be viewed in the context of some previously announced tax changes including the digital tax package,[2] which introduced a digital advertising tax.

Austria has an opportunity to not only adopt tax cuts, but also to make pro-growth reforms to its tax code. While the announced tax cuts are a move in the right direction, the proposals do not include many fundamental changes to the tax system.

Nonetheless, based on the Tax Foundation’s 2018 International Tax Competitiveness Index,[3] we expect that this Austrian reform package, if implemented in its entirety, would improve the country’s rank from 10th to 9th among OECD countries.

Taxes on Personal Income and Social Security Contributions

The tax reform package puts a special emphasis on income taxes and the social security system, particularly for those with lower incomes. Taxes on workers and social insurance contributions would be reduced by around €5 billion annually, which makes for over 60 percent of the total tax cut. The tax burden would be reduced for all 4.8 million Austrian taxpayers. The plan promises that every full-time employee with a gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” of €1,500 per month (€18,000 per year) will see their taxes and social insurance contributions cut by €500 per year, which would be a 14 percent decrease. The reduction would be highest in absolute numbers for those earning more than €6,000 per month, at €1,661 per year. In relative terms, this higher income group would receive just a 5 percent cut.

Lower Personal Income Taxes

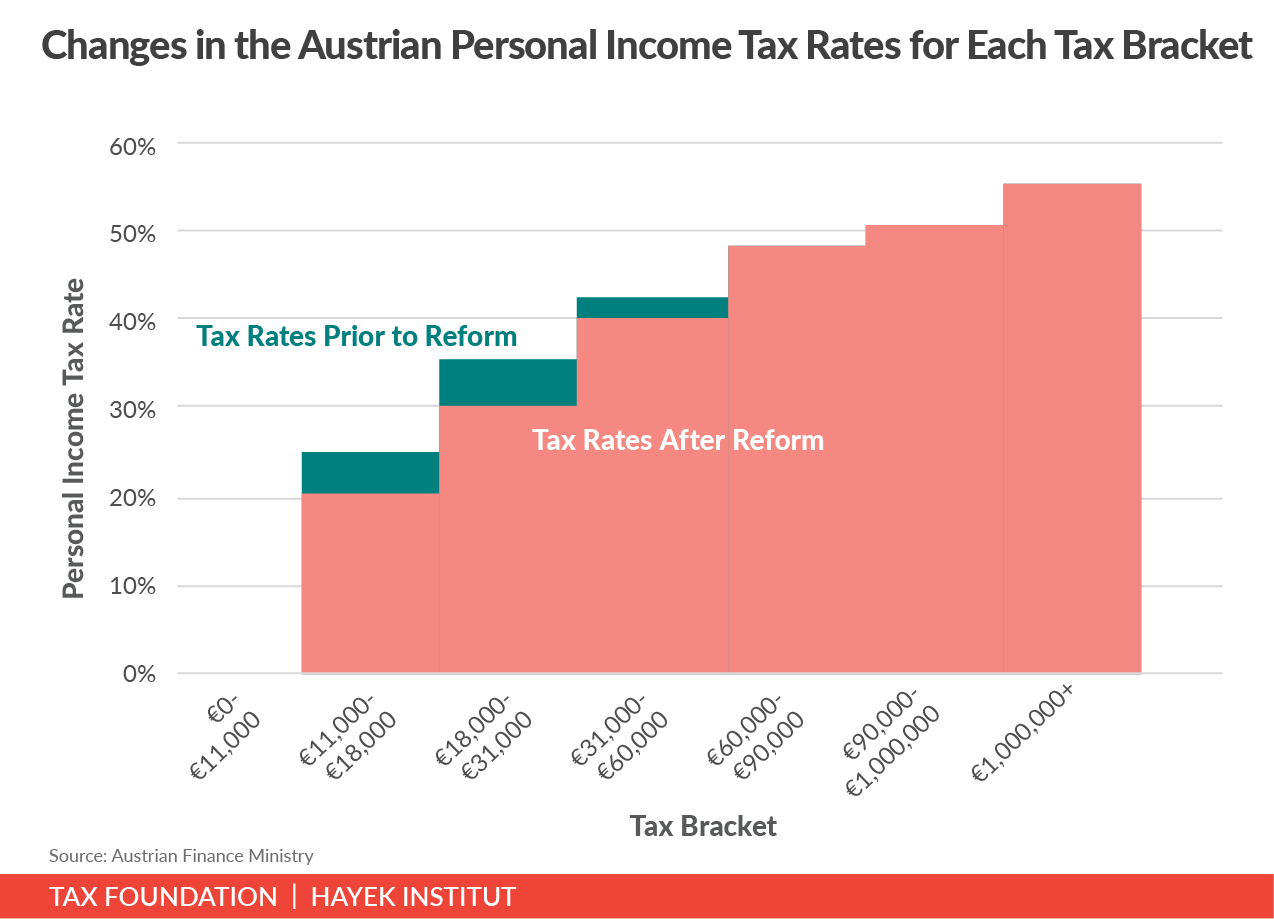

The primary way the tax cuts on labor income would be accomplished is by reducing income tax rates. The reduction would occur over a two-year period. In the end, the second, third, and fourth lowest brackets of the progressive system would have 20, 30, and 40 percent tax rates, instead of the current 25, 35, and 42 percent. The tax cut in the second lowest bracket would be implemented in 2021, the one in the third and fourth lowest brackets in 2022. There would be no adjustment to the tax brackets, just changes to the rates.

If the government follows through with these promises, this would be a major relief for the 4.5 million Austrians that fall in these three brackets. The changes would also benefit higher income taxpayers, who would see part of their earnings taxed at the lower rates. Combined with the other reforms on personal income described below, this would be a long overdue decrease in the high tax burden Austrians have been facing for many years.

|

Source: Austrian Finance Ministry. |

||||

| Gross Income | Previous Rates | New Rates | Number of People in Bracket | |

|---|---|---|---|---|

|

Above |

to |

|||

| €0 | €11,000 | 0% | 0% | 2,600,000 |

| €11,000 | €18,000 | 25% | 20% | 1,400,000 |

| €18,000 | €31,000 | 35% | 30% | 2,000,000 |

| €31,000 | €60,000 | 42% | 40% | 1,100,000 |

| €60,000 | €90,000 | 48% | 48% | 190,000 |

| €90,000 | €1,000,000 | 50% | 50% | 110,000 |

| €1,000,000 | 55% | 55% | 440 | |

Two further measures would also reduce the income tax burden. The first is an incentive for businesses to have profit-sharing arrangements with their employees. A business that decides to share its profit with its employees would be able to distribute up to €3,000 annually per employee up to a cap of 10 percent of the total corporate profit. These distributions would be tax-free without any social insurance contributions. Furthermore, limits on income tax deductions, for work-related expenses such as work clothing, computers, traveling, and other items, would increase from €132 a year to €300.

Despite the effort to cut taxes, there are two issues with these proposals. First, the income tax proposals maintain the steep progressivity of the brackets, and the rate changes make the transition into the higher brackets more significant. As we wrote in our own reform proposals[4]—which included recommendations for a flatter structure, rather than a steeper one—high marginal tax rates can disincentivize workers to earn more, since they may lose out in the end by having to pay an even larger share in taxes. This is a challenge that many progressive tax systems, including the one in Austria, face. The challenge will now be especially true for those earning around €30,000 annually, as they would face either a 30 percent rate below €31,000 or 40 percent above—a 10 percentage-point difference (in contrast to the current 7 percentage-point difference).

The same is true for the upper three income brackets, which would not be changed at all. The 55 percent marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. for incomes above €1 million, though it was supposed to be temporary, would remain. This tax rate is one of the highest in Europe,[5] and can lead to negative consequences like economic distortions, tax avoidance, or high-income earners moving away.

Reduction in Social Insurance Contributions

The Familienbonus Plus was introduced prior to the start of 2019 and replaced the tax deductions for children with a tax credit of €1,500 per year for each child. Now, a second “bonus” would be introduced with the Sozialversicherungsbonus, which would decrease the social insurance contributions. Currently, 36.2 percent of pre-tax costs of labor are social insurance contributions, by far the largest contributor to the total tax burden on labor costs.

With the Bonus, contributions would be reduced by €280 annually on average for workers and by €170 for pensioners. The exact amount depends on the income level. For workers, the Bonus kicks in at a monthly gross income of €450. The amount increases up to an income of €1,350, at which the maximum reduction of €350 is reached. Above €1,350, the Bonus drops off again until a salary of €2,201, at which there would be no more Bonus.

Simplification of the Tax Code

The personal income tax code has been revised and amended “more than 160 times over the last three decades, often making the rules nontransparent and complicated. As part of the reform package, the government would be modernizing and simplifying the income tax code. This can be an important step, although actual details on how it will be accomplished are sparse so far.

Bracket Creep Stays

While tax reductions are an essential step in the right direction for Austria, the impact of these reforms will be limited by so-called “bracket creepBracket creep occurs when inflation pushes taxpayers into higher income tax brackets or reduces the value of credits, deductions, and exemptions. Bracket creep results in an increase in income taxes without an increase in real income. Many tax provisions—both at the federal and state level—are adjusted for inflation. .” As wages and prices rise with inflation, workers often end up in higher tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. without seeing real improvements in their standard of living. Since prices rise, but tax brackets stay the same, taxpayers potentially pay more over time. This can be fixed by annually adjusting tax brackets to inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. .

The Finance Ministry itself calculates that bracket creep could cost Austrian taxpayers €7.5 billion through 2023[6]; other calculations have put the number even higher, ranging from €8.5 billion through 2022[7] to €13.2 billion through 2023.[8]

By not addressing bracket creep, the government has chosen to reduce income tax rates only temporarily. However, there is a chance that this important reform could be addressed in the next legislative session.

Excise and Environmental Taxes

The tax reform plan includes good news not only for workers, pensioners, and entrepreneurs. There is also good news for wine drinkers: the wine tax would be abolished. There is, however, bad news for smokers: the tobacco tax would be increased. There is mixed news for car drivers: owners of cars that cause much pollution would be taxed higher in the future, and those who drive cars that are environmentally friendly would be taxed less.

The latter is part of a (small) attempt to adopt a “greener” tax system. This environmental component of the proposals also includes an input tax deductionA tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. For individuals, some deductions are available to all taxpayers, while others are reserved only for taxpayers who itemize. For businesses, most business expenses are fully and immediately deductible in the year they occur, but others, particularly for capital investment and research and development (R&D), must be deducted over time. for e-bikes and tax savings for energy sources considered environmentally friendly, such as biogas, hydro, and liquified natural gas. Additionally, those who produce electricity for their homes through solar power would no longer have to pay the electricity tax.

The extent of the revenue loss due to these changes is €55 million. Many countries use tax policy as a tool to encourage “greener” behavior in the way that Austria has done and is proposing to continue to do. However, a multitude of targeted incentives may have unintended effects. From an economic standpoint it is better to have broad, neutral policies that are less likely to distort taxpayer decisions.

The special value-added tax (VAT) rate for e-books and electronic newspapers, which is based on an EU-wide allowance for governments to have special rates on e-media, should be reconsidered, as it would complicate a VAT system which so far ranks as one of the most well-designed and simplest in Europe.

Business Taxation

In addition to the changes previously mentioned, the reform proposals include several changes to business taxes, including a corporate rate cut, and small changes to various tax deductions.

Corporate Income TaxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. Rate

The last time Austria cut its corporate income tax was in 2005, when it moved from 34 percent to the current 25 percent. This new reform package includes a reduction in the corporate income tax rate from 25 percent to 23 percent in 2022, followed by a further reduction to 21 percent in 2023. Each cut in the corporate rate is predicted to decrease the tax burden by €800 million, amounting to a decrease of €1.6 billion by 2023. Austria is following a global trend in declining corporate income tax rates. In 2018, the average corporate tax rate among EU countries was 21.7 percent.[9]

The current proposal does not include the previously discussed reduced tax rate for reinvested profits.[10] According to the Finance Ministry, such a reduced rate would be too complex and, if only granted to Austrian businesses, potentially noncompliant with EU regulations. An alternative approach that would be neutral for all businesses would be to adopt immediate write-offs for business investments rather than the current depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. schedules. This could be modeled after recent changes by the United States[11] and Canada.[12]

Corporate Tax Deductions

Starting in 2022, the base for the corporate standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. would be expanded from €30,000 to €100,000, allowing for a maximum standard deduction of €13,000 (at a rate of 13 percent). Currently, businesses can claim a 13 percent standard deduction on profits of up to €30,000, thus capped at €3,900 per year. This change in the standard deduction is estimated to decrease the corporate tax burden by €100 million annually.

If a business invests in assets such as machinery and buildings, it can claim additional deductions on profits above €30,000, with total deductions (standard deduction and investment-related deduction combined) capped at €45,350. The current tax reform plan does not involve any changes to this cap.

The deduction limit for purchases of low-value assets, which can be fully written off in the year of acquisition, would be raised from €400 to €800 in 2020, with a further increase to €1,000 in 2021. Due to this change, businesses are predicted to save €300 million in corporate income tax.

VAT Threshold

Starting in 2020, businesses with revenues below €35,000 would be exempt from the VAT, raising the current registration threshold of €30,000 by €5,000. According to estimates of the Finance Ministry, this would lead to 400,000 fewer tax returns. This change is predicted to reduce the tax burden by €75 million.

Research Premium

Currently, Austria provides a research and development (R&D) premium of 14 percent of total R&D expenses, with an annual cap of €1 million. The tax reform would involve an expansion of this research premium; however, no details on that expansion have been announced.

Offsetting the Tax Cuts

In the context of these proposals, Finance Minister Hartwig Löger and State Secretary Hubert Fuchs announced that they want to maintain a balanced budget. Because of Austria’s current level of government debt, the tax reforms would only make sense if they do not increase the debt to GDP ratio since that would merely be postponing future tax increases.

As the following table shows, the announced measures of the Finance Ministry to offset the estimated €8.3 billion loss in tax revenue would amount to approximately €6.5 billion, leaving a gap of €1.8 billion. These measures involve an estimated budget surplus, spending cuts, and small tax revenue increases.

|

Source: Austrian Finance Ministry. |

|

| Measure | Government Revenue |

|---|---|

|

Budget |

|

|

Budget Surplus (Stable Economy) |

€1.8bn |

|

Tax Cuts Already Reflected in the Budget |

€2.2bn |

|

Spending Cuts |

|

|

Saving in the System (Federal) |

€1.0bn |

|

Additional Measures in the Legislative Term |

€0.5bn |

|

Additional Self-Financing Effect |

€0.5bn |

|

Revenue Increases |

|

|

Digital Tax Package |

€0.2bn |

|

Closing Tax Loopholes |

€75m |

|

Tax Justice in Foreign Affairs |

€35m |

|

Tobacco Tax |

€0.12bn |

|

Extension of Preliminary Top Marginal Tax Rate (55%) |

€25m |

|

Tax on Gambling |

€50m |

|

TOTAL |

€6.5bn |

More details, however, need to be released on how the budget hole would be filled. In the proposal, it is clear that the government is assuming that the economy will continue to grow at least at the current pace. However, with a large neighboring economy and major trading partner like Germany facing much slower growth, it is possible that Austria will not see the expected growth assumed in the proposal.

In addition to the potential for growth, €2 billion of the revenue loss may be offset by reducing government spending. This is good news, as these tax cuts should go together with cuts in spending. But very little attention is paid to where the tax cuts will be made, and these cuts will be subject to the political situation over the next years. A further €200 million should come from the digital tax package, which includes the new discriminatory and distortionary digital advertising tax.

Conclusion

The tax reform presented by the government is a clear positive step in the right direction. Austria needs a comprehensive reform for a tax system which ranks near the middle among OECD systems and is suffering under an extremely high tax burden. Considering the government was still planning for a reform with decreases of only €4.5 billion annually early this year, the now-presented plan of €8.3 billion is promising. There is little doubt that if the government actually implements its proposals, Austria would become more competitive internationally and a better place to live, work, and do business.

Nonetheless, more should be done. Changes to the corporate tax system should include reforms to the tax base; the income tax system should be flattened instead of steepened; and bracket creep needs to be prevented. Additionally, concrete plans need to be made on how to finance the tax cuts through spending cuts to not place the tax burden on future generations.

This reform plan is a good start. But with the momentum the current government has, there are opportunities to go even further.

[1] Austrian Finance Ministry, “Einfach weniger Steuern durch ,Entlastung Österreich,’” April 30, 2019, https://www.bmf.gv.at/top-themen/entlastung.html.

[2] Daniel Bunn, “Austria Makes Mid-Stream Adjustment on Digital Tax Efforts,” Tax Foundation, April 3, 2019, https://taxfoundation.org/austria-digital-tax-efforts/.

[3] Daniel Bunn, Kyle Pomerleau, and Scott A. Hodge, 2018 International Tax Competitiveness Index, Tax Foundation, Oct. 23, 2018, https://taxfoundation.org/publications/international-tax-competitiveness-index/.

[4] Daniel Bunn, Kai Weiss, and Martin Gundinger, “Opportunities for Pro-Growth Tax Reform in Austria,“ Tax Foundation, Feb. 20, 2019, https://taxfoundation.org/austria-tax-reform/.

[5] Elke Asen, “Top Individual Income TaxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. Rates in Europe,” Tax Foundation, Feb. 22, 2019, https://taxfoundation.org/top-individual-income-tax-rates-europe-2019/.

[6] Iris Bonavida and Gerhard Hofer, “Was nach der Entlastung kommt,“ Die Presse, May 1, 2019, https://diepresse.com/home/innenpolitik/5621102/Was-nach-der-Entlastung-kommt.

[7] Lukas Sustala, “Der kalten Progression einheizen,“ Agenda Austria, Feb. 15, 2019, https://www.agenda-austria.at/kalte-progression-explainer/.

[8] Max Strozzi, “Bis 2023 kostet kalte Progression die Steuerzahler 13,2 Mrd. Euro,” Tiroler Tageszeitung, Jan. 13, 2019, https://www.tt.com/wirtschaft/wirtschaftspolitik/15209279/bis-2023-kostet-kalte-progression-die-steuerzahler-13-2-mrd-euro.

[9] Daniel Bunn, “Corporate Tax Rates Around the World, 2018,” Tax Foundation, Nov. 27, 2018, https://taxfoundation.org/corporate-tax-rates-around-world-2018/.

[10] Günther Oswald, “Steuerreform: Was wann in Kraft tritt und wer wie stark profitiert,“ Der Standard, April 30, 2019, https://derstandard.at/2000102265928/Steuerreform-Was-wann-in-Kraft-tritt-und-wer-wie-stark.

[11] Erica York and Alex Muresianu, “The TCJA’s Expensing Provision Alleviates the Tax Code’s Bias Against Certain Investments,” Tax Foundation, Sept. 5, 2018, https://taxfoundation.org/tcja-expensing-provision-benefits/.

[12] Stephen J. Entin, “Canada To Adopt Expensing and Accelerated Cost RecoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions. ,” Tax Foundation, Nov. 28, 2018, https://taxfoundation.org/canada-adopt-expensing-accelerated-cost-recovery/.

Share this article