The Tax Foundation is the world’s leading independent tax policy 501(c)(3) nonprofit. For over 80 years, our mission has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

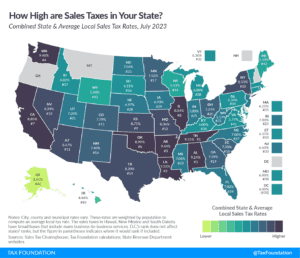

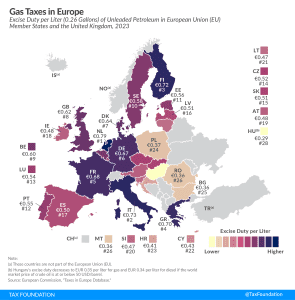

Our Center for Federal Tax Policy, Center for State Tax Policy, and Center for Global Tax Policy each produce timely and high-quality research and analysis that influences the debate toward economically principled tax policies. Our experts are continuously analyzing the day’s most relevant tax policy topics and are relied upon routinely for presentations, testimony, and media appearances on tax issues spanning every level of government.

Likewise, providing journalists, taxpayers, and policymakers with basic data on taxes and spending has been a cornerstone of the Tax Foundation’s educational mission since its founding. As we wrote in our first edition of Facts & Figures in 1941, “Facts give a broader perspective; facts dissipate predilections and prejudices…[and are] an important step to meet the challenge presented by the broad problems of public finance.”

View All Research View All Data