Robert Bellafiore was a Policy Analyst with the Center for Federal Tax Policy at the Tax Foundation. Originally from Albany, New York, Robert is a graduate of the University of Oklahoma, where he studied economics and philosophy.

Previously, he interned at the Heritage Foundation, where he contributed to the 2018 Index of Economic Freedom. Robert enjoys playing classical and jazz piano and reading literature.

Latest Work

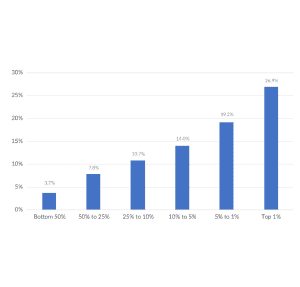

Summary of the Latest Federal Income Tax Data, 2018 Update

The top 50 percent of all taxpayers pay 97 percent of all individual income taxes, while the bottom 50 percent paid the remaining 3 percent.

21 min read

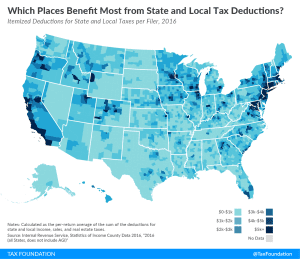

The Benefits of the State and Local Tax Deduction by County

Do taxpayers in your area rely heavily on state and local tax deductions? See how the Tax Cuts and Jobs Act tax plan may impact taxpayers in your county.

2 min read