Jared Walczak is Vice President of State Projects at the Tax Foundation. He is the lead researcher on the annual State Business Tax Climate Index and Location Matters, and has authored or coauthored tax reform guides on Alaska, Iowa, Kansas, Louisiana, Nevada, New York, Pennsylvania, South Carolina, West Virginia, and Wisconsin.

Jared’s work is regularly cited in The New York Times, The Wall Street Journal, The Washington Post, Los Angeles Times, Politico, AP, and many other prominent national and state outlets.

He previously served as legislative director to a member of the Senate of Virginia and as policy director for a statewide campaign, and consulted on research and policy development for a number of candidates and elected officials. In his free time, Jared enjoys hiking and has a goal of visiting all 63 national parks.

Latest Work

New Mexico Tax Increase Package Advances

7 min read

Wisconsin Tax Options: A Guide to Fair, Simple, Pro-Growth Reform

Despite tax cuts in recent years, Wisconsin’s overall tax structure lags behind competitor states in simplicity, tax rates, and business climate for residents and investment. Explore our new comprehensive guide to see how the Badger State can achieve meaningful tax reform.

11 min read

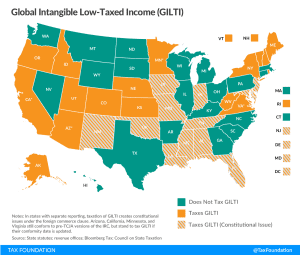

GILTI Minds: Why Some States Want to Tax International Income—And Why They Shouldn’t

The new federal tax on Global Intangible Low-Taxed Income (GILTI) is something of a misnomer: it’s certainly global and it’s definitely income, but the rest of it is, at best, an approximation. It’s not exclusively levied on low-taxed income, nor just on the economic returns from intangible property. So what is GILTI, why might states tax it, and what’s the problem with that?

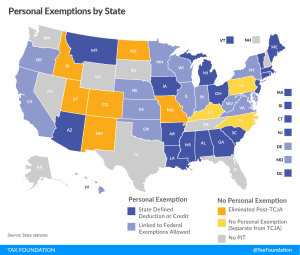

8 min readToward a State of Conformity: State Tax Codes a Year After Federal Tax Reform

States incorporate provisions of the federal tax code into their own codes in varying degrees, meaning that federal tax reform has implications for state revenue beyond any broader economic effects of tax reform.

73 min read

Sorry, Washington State: Capital Gains Taxes are Still Income Taxes—But There’s a Better Way

A new, high tax rate on capital gains income would be a risky move for Washington State even if it didn’t face an enormous constitutional challenge.

5 min read

Tax Trends Heading Into 2019

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read

South Carolina: A Road Map For Tax Reform

South Carolina is by no means a high tax state, though it can feel that way for certain taxpayers. The problems with South Carolina’s tax code come down to poor tax structure. Explore our new comprehensive guide to see how South Carolina can achieve meaningful tax reform.

16 min read

Results of 2018 State and Local Tax Ballot Initiatives

Ballot initiatives are often an afterthought on Election Day, but in many states, voters went to the polls to weigh in on significant tax policy questions. Here are the most recent results we’ve compiled for tax-related ballot measures.

5 min read

Top State Tax Ballot Initiatives to Watch in 2018

Explore our list of the top state tax ballot measures to watch for throughout the country.

11 min read