Garrett Watson is Director of Policy Analysis at the Tax Foundation, where he conducts research on federal and state tax policy. His work has been featured in The Washington Post, The Atlantic, Politico, the Associated Press and other major outlets.

Previously, Garrett was a program manager at a nearby think tank and conducted policy research on economic opportunity and labor markets, including non-compete clause reform.

Garrett earned a bachelor’s degree from St. Lawrence University in upstate New York, where he studied economics and philosophy. Garrett lives in northwest Arkansas and is an avid hockey fan and snowboarder.

Latest Work

Analysis of Democratic Presidential Candidate Individual Income Tax Proposals

Joe Biden and Bernie Sanders have each proposed changes to the individual income tax, one of the largest sources of federal revenue. Our new analysis compares the economic, revenue, and distributional effects of the various proposals.

13 min read

Comparing the Growth and Income-Boosting Effects of Tax Reform Options

As policymakers evaluate changes to the tax code, such as proposals coming from presidential candidates and the White House, it will be important for them to evaluate the relative effects of various provisions. According to our analysis, making full expensing permanent would be one of the most efficient ways to increase after-tax incomes for the middle class.

3 min read

The White House Budget Highlights the Need to Extend Pro-Growth TCJA Business Tax Provisions

Full expensing, if made permanent, would be one of the most cost-effective ways to increase growth as it would produce about 4.5 times more GDP growth per dollar of revenue than making the law’s individual tax provisions permanent, according to our analysis.

3 min read

Analysis of Democratic Presidential Candidate Payroll Tax Proposals

Several 2020 Democratic presidential candidates have proposed changes to federal payroll tax rates and the Social Security payroll tax wage base to raise revenue and maintain solvency for major federal entitlement programs.

24 min read

Two Years After Passage, Treasury Regulations for the Tax Cuts and Jobs Act Surpass 1,000 Pages

Treasury released final regulations on the base erosion and anti-abuse tax (BEAT), which is meant to dissuade firms from engaging in profit shifting abroad. Other high-profile releases from 2019 include final regulations guiding enforcement of Section 199A, commonly known as the pass-through deduction; final regulations on enforcing the new tax on global intangible low-tax income (GILTI); and final regulations on state-level workarounds to the $10,000 limit on the state and local tax deduction (SALT).

5 min read

Proponents of Wealth Taxation Must Consider its Impact on Innovation

Instead of raising revenue from a narrow tax base through high tax rates, policymakers should identify options to raise revenue efficiently through broad-based taxes consistent with sound tax policy.

4 min read

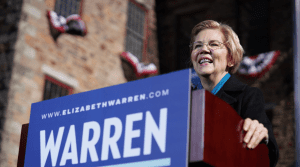

Reviewing Elizabeth Warren’s Tax Proposals to Fund Medicare for All

Elizabeth Warren released a detailed plan on how she would fund Medicare For All, proposing a wealth tax, financial transactions tax, mark-to-market taxation of capital gains income, and a country-by-county minimum tax, among other reforms.

5 min read

Improving the Federal Tax System for Gig Economy Participants

Advances in technology have enabled workers to connect with customers via online platform applications for work ranging from ridesharing to home repair services. The rise of gig economy work has reduced barriers to self-employment, bringing tax challenges like tax complexity and taxpayer noncompliance.

32 min read

States Should Continue to Reform Taxes on Tangible Personal Property

Tangible personal property taxes increase the complexity of state and local tax codes, discriminate against taxpayers based on their capital structure, and change economic behavior by incentivizing taxpayers to modify their property ownership to avoid the tax.

32 min read

Tax Expenditures Taken by Small Businesses in the Federal Tax Code

The expenditures offered to small businesses are not created equal. We review the tax expenditures small businesses rely on most.

3 min read