Bonus Depreciation and New Corporate Investment in 2018

If bonus depreciation is allowed to phase out, then the tax bias against capital investments will increase, discouraging firms from making otherwise profitable investments.

14 min readAlex Muresianu is a Senior Policy Analyst at the Tax Foundation, focused on federal tax policy. Previously, Alex worked on the federal team as an intern in the summer of 2018 and as a research assistant in summer 2020.

He attended Tufts University, graduating with a degree in economics and minors in finance and political science in February 2021. He also worked for the Pioneer Institute in 2019, spent a summer as a journalism intern at Reason magazine, and written op-eds for various print and online publications.

Alex originally hails from outside Boston, and enjoys Dungeons and Dragons, ’80s movies (Back to the Future, Indiana Jones, the Schwarzenegger filmography, Die Hard, etc.), and classic rock.

If bonus depreciation is allowed to phase out, then the tax bias against capital investments will increase, discouraging firms from making otherwise profitable investments.

14 min read

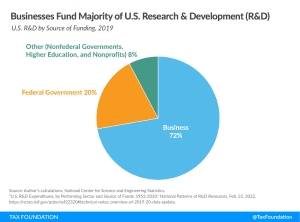

Lawmakers should recognize both the growing importance of business R&D and the need to support it through a commonsense tax policy, namely a return to full and immediate expensing for R&D.

6 min read

The tax treatment of research and development (R&D) expenses is one of the biggest issues facing Congress as the year winds down.

5 min read

Two weeks after the 2022 midterm elections, it’s becoming clearer where tax policy may be headed for the rest of the year and into 2023. In the short term, Congress must deal with tax extenders and expiring business tax provisions that may undermine the economy.

5 min read

Policymakers face a difficult balancing act this year in what is likely to be an unusual tax extenders season.

6 min read

the Inflation Reduction Act gives us a glimpse into a future where the U.S. and EU opt for protectionist tax and trade policies rather than implementing principled tax policies and reducing trade barriers between allies.

5 min read

A border-adjusted carbon tax that uses some of the revenue for pro-investment tax reform could improve U.S. more competitiveness while also addressing concerns with a carbon tax.

29 min read

Taxing university endowments has gained popularity recently, partly in response to the Biden administration’s forgiveness of student loan debt. Some view it as a means of holding universities accountable for the product they’re selling. Others view it as a tool to tamp down tuition rates or punish ideological opponents. But do these arguments hold water and is an endowment tax sound policy?

7 min read

Repealing LIFO, as some policymakers have proposed, is not sound policy. LIFO helps firms avoid the penalty on inventory investment created by FIFO and is neither a targeted tax break nor a subsidy (as some opponents suggest).

17 min read

The Inflation Reduction Act primarily uses carrots, not sticks, to incentivize reductions in carbon emissions. It creates or expands tax credits for various low- or no-emission technologies, rather than imposing a generalized penalty for emissions, such as a carbon tax.

5 min read

The Inflation Reduction Act created numerous tax subsidy programs intended to accelerate the transition to a greener economy.

8 min read

In response to high oil prices, Sen. Wyden has proposed raising taxes on oil and gas companies in three ways. His “Taxing Big Oil Profiteers Act” would create an additional 21 percent tax on so-called excess profits earned over 10 percent of revenues of oil companies with annual revenues over $1 billion; levy a tax on stock buybacks; and remove last-in, first-out (LIFO) tax treatment of inventory accounting.

7 min read

The Inflation Reduction Act increases the IRS’s budget by roughly $80 billion over 10 years. The money is broken into four main categories—enforcement, operations support, business system modernization, and taxpayer services—as well as a few other small items such as an exploratory study on the potential of a free-file system.

6 min read

The Inflation Reduction Act may be smaller than the proposed Build Back Better legislation from 2021, but both sets of legislation propose a reintroduced corporate alternative minimum tax (AMT). The 30-year experience with a corporate AMT shows it is not a good solution.

4 min read

As policymakers on both sides of the Atlantic debate the way forward on carbon border adjustment mechanisms, it is important to keep principles of good tax policy in mind.

7 min read

Our new analysis reviews the basic structure of carbon taxes, how they compare to the existing set of climate policies, and how they could fit into various pro-growth tax reform packages.

26 min read

Federal policymakers are debating a legislative package focused on boosting U.S. competitiveness vis-a-vis China; however, it currently contains little to no improvements to the U.S. tax code.

34 min read

Efforts to improve the taxpayer experience should focus on the IRS’s operations and include structural improvements to the tax code.

4 min read

As the deadline for tax filing nears, the IRS faces scrutiny for its backlog of returns, inaccessible taxpayer service, and delays in issuing certain refunds.

5 min read