From Gallons to Miles: Rethinking Road Taxes

Buckle up as we navigate the twists and turns of infrastructure and road funding. As electric vehicles gain traction, traditional gas taxes are running out of fuel to support our infrastructure budget.

Adam Hoffer is the Director of Excise Tax Policy at the Tax Foundation. Dr. Hoffer earned his PhD in Economics from West Virginia University and his undergraduate degree from Washington & Jefferson College.

Prior to joining the Tax Foundation, Dr. Hoffer was the Menard Family Associate Professor of Economics at the University of Wisconsin-La Crosse and the inaugural Director of the Menard Family Midwest Center for Economic Engagement and Research. Dr. Hoffer was also a Bradley Freedom Fellow with the Wisconsin Institute for Law & Liberty and a senior editor with the Center for Growth and Opportunity at Utah State University.

Dr. Hoffer published 30 peer-reviewed academic journal articles and he is the lead author and editor of two books: For Your Own Good: Taxes, Paternalism, and Fiscal Discrimination in the Twenty-First Century and Regulation and Economic Opportunity: Blueprints for Reform.

He lives in La Crosse, Wisconsin with his wife and two children.

Buckle up as we navigate the twists and turns of infrastructure and road funding. As electric vehicles gain traction, traditional gas taxes are running out of fuel to support our infrastructure budget.

A tax based on alcohol content would be the most neutral, straightforward means of raising revenue from alcohol. But since such a tax would constitute a redesign of the entire alcohol tax system at both the state and federal levels, the next best approach is to create more categories for new products.

4 min read

Two pieces of tobacco legislation in Michigan have the potential to decrease state tax collections by $320 million per year, deter smokers from switching to less harmful products, and increase illicit trade and crime.

4 min read

An alcohol by volume (ABV) tax could replace the existing alcohol tax system. An ABV tax would make alcohol taxes simpler, more transparent, and substantially more neutral than the current system.

18 min read

Marijuana taxation is one of the hottest policy issues in the United States. Twenty-one states have implemented legislation to legalize and tax recreational marijuana sales.

16 min read

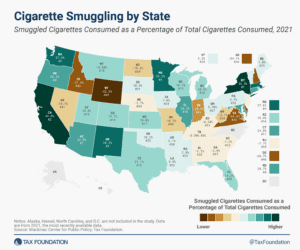

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

17 min read

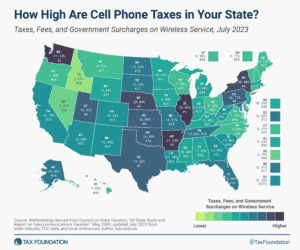

To alleviate the regressive impact on wireless consumers, states should examine their existing communications tax structures and consider policies that transition their tax systems away from narrowly based wireless taxes and toward broad-based tax sources.

18 min read

It’s been almost a year since California banned the sale of all flavored tobacco products, and the big question is: did it work?

4 min read

Minimum markup policies tend to be wildly unpopular among both taxpayers and policymakers. Lawmakers should carefully evaluate whether minimum markup laws are policies that improve the well-being of their constituents.

3 min read

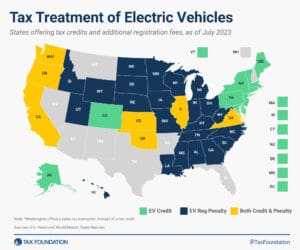

The state EV taxation landscape reflects the evolving transportation sector and the pressing need to address both fiscal gaps in road funding and environmental concerns.

4 min read

Step into the shadows of illicit trade where taxation, incentives, and criminal networks intersect to fuel the lucrative cigarette smuggling market.

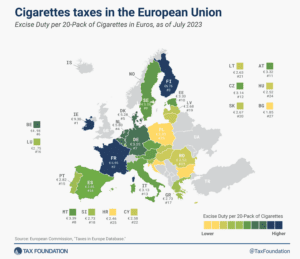

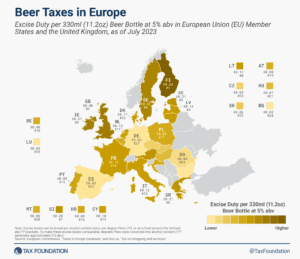

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage.

2 min read

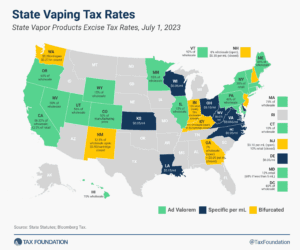

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

3 min read

The potential for alternative tobacco products to save lives is clear and well established. The framework described in this paper uses a scientific approach to tax strategy that will both reduce harm and create a reliable revenue stream for public expenditures.

17 min read

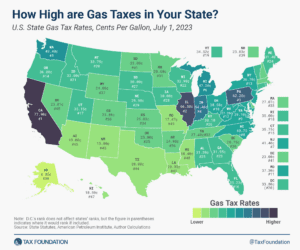

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

2 min read

Taxation plays a key role in driving illicit trade. People respond to incentives, and sizable price markups for legal cigarettes create incentives for tax avoidance.

4 min read

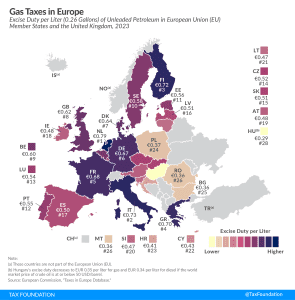

As the EU pursues massive changes in public policy as part of its green transition, expect fuel taxes to be central to any policy discussions.

5 min read

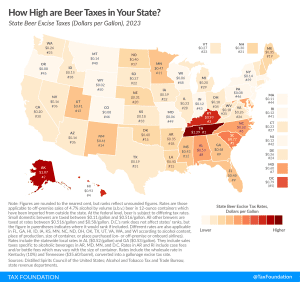

Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.

3 min read

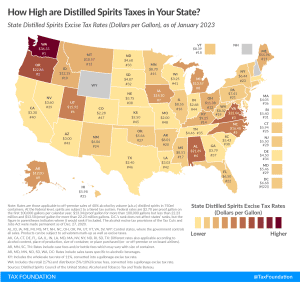

Of all alcoholic beverages subject to taxation, stiff drinks—and all distilled spirits—face the stiffest tax rates. Like many excise taxes, the treatment of distilled spirits varies widely across the states.

4 min read