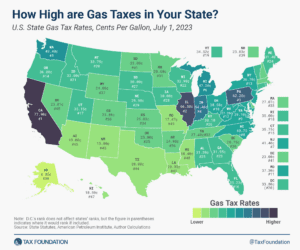

How High are Gas Taxes in Your State?

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

2 min readAdam Hoffer is the Director of Excise Tax Policy at the Tax Foundation. Dr. Hoffer earned his PhD in Economics from West Virginia University and his undergraduate degree from Washington & Jefferson College.

Prior to joining the Tax Foundation, Dr. Hoffer was the Menard Family Associate Professor of Economics at the University of Wisconsin-La Crosse and the inaugural Director of the Menard Family Midwest Center for Economic Engagement and Research. Dr. Hoffer was also a Bradley Freedom Fellow with the Wisconsin Institute for Law & Liberty and a senior editor with the Center for Growth and Opportunity at Utah State University.

Dr. Hoffer published 30 peer-reviewed academic journal articles and he is the lead author and editor of two books: For Your Own Good: Taxes, Paternalism, and Fiscal Discrimination in the Twenty-First Century and Regulation and Economic Opportunity: Blueprints for Reform.

He lives in La Crosse, Wisconsin with his wife and two children.

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

2 min read

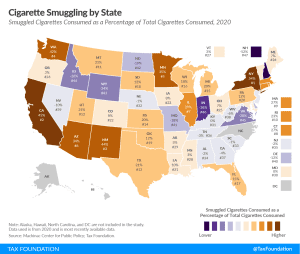

Taxation plays a key role in driving illicit trade. People respond to incentives, and sizable price markups for legal cigarettes create incentives for tax avoidance.

4 min read

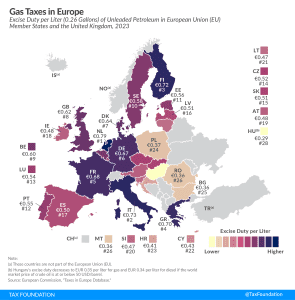

As the EU pursues massive changes in public policy as part of its green transition, expect fuel taxes to be central to any policy discussions.

4 min read

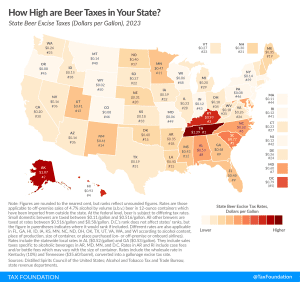

Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.

3 min read

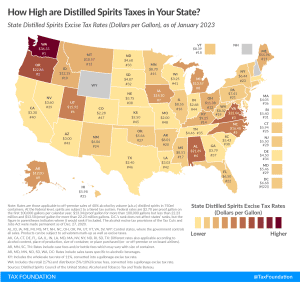

Of all alcoholic beverages subject to taxation, stiff drinks—and all distilled spirits—face the stiffest tax rates. Like many excise taxes, the treatment of distilled spirits varies widely across the states.

4 min read

In the United States, tobacco is taxed at both the federal and state and sometimes even local levels. These layers of taxes often result in very high levels of taxation—the highest of any consumer item. The retail price of cigarettes, for instance, is more than 40 percent taxes on average. In some states, like Minnesota and New York, more than 50 percent of the price paid by consumers comes from taxes.

2 min read

This web tool allows taxpayers to see how cigarette tax revenues have changed since 1955. Across almost all states, a clear pattern of volatility emerges. Tax rate hikes are met with a momentary bump in revenue, followed by a falloff.

2 min read

Our recent policy conference brought together academics and political leaders to present research on some of the most pressing issues in global tax policy and to discuss solutions that can unlock genuine global growth.

9 min read

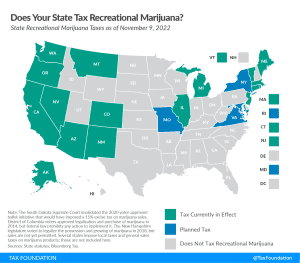

Recreational marijuana taxation is one of the hottest policy issues in the U.S. Currently, 21 states have implemented legislation to legalize and tax recreational marijuana sales.

5 min read

When designed well, excise taxes discourage the consumption of products that create external harm and generate revenue for funding services that ameliorate social costs. The effectiveness of excise tax policy depends on the appropriate selection of the tax base and tax rate, as well as the efficient use of revenues.

83 min read

Younger and healthier Brits have created a $17.1 billion budget hole by smoking and drinking less. Yet, despite this resounding piece of positive news, some see any decline in tax revenues as a public finance crisis. Excise taxes target a tax base that is intended to shrink. Less consumption is a stated goal of the policy.

3 min read

Vermont lawmakers must weigh the potential benefits of cessation for some smokers against increased smuggling (and related criminal activity), and a loss of tax revenue not commensurate with a decline in smoking.

6 min read

California is losing tax revenue while consumers turn to cross-border purchases or, often, illicit trade of flavored cigarettes, which makes everyone worse off.

3 min read

Earlier this month, New York Governor Kathy Hochul (D) proposed increasing the state’s cigarette tax rate by $1.00 a pack, banning the sale of flavored vaping products, and ceasing the sale of all flavored tobacco products. If enacted, these policies would fuel black markets and create a fiscal hole for the state to fill, all while hurting New York businesses and consumers.

4 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

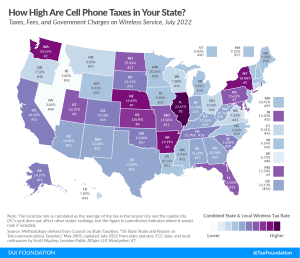

While the wireless market has become increasingly competitive in recent years, resulting in steady declines in the average price for wireless services, the price reduction for consumers has been partially offset by higher taxes.

41 min read

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

19 min read

Later this week, the European Union is expected to release a new Tobacco Tax Directive, the first update in more than a decade. Early reports indicate that the EU will propose a significant increase to the existing minimum cigarette tax rates levied across the Union and expand the product categories that are taxed, including a block-wide vaping tax.

7 min read

Recreational marijuana taxation is one of the hottest policy issues in the U.S. Currently, 19 states have implemented legislation to legalize and tax recreational marijuana sales.

5 min read

While changes to federal cannabis law are slow, changes at the state level are accelerating. Recreational cannabis is on the ballot in five states this November—Arkansas, Maryland, Missouri, North Dakota, and South Dakota—giving voters the ability to join 19 states that have already legalized recreational marijuana.

5 min read