On November 6th, Maine voters will decide whether to adopt new income and payroll taxes to fund a proposed Universal Home Care Program. Maine Question 1, the Payroll and Non-Wage Income Taxes for Home Care Program Initiative, would create three new taxes, each applying to income above Social Security’s Old-Age, Survivors, and Disability Insurance (OASDI) contribution and benefits base.

Tax collections would be used to fund a new Universal Home Care Program to provide long-term in-home health care and social services to adults age 65 and older, as well as adults with physical and mental disabilities. Services would be provided to beneficiaries at no cost to themselves or their families, regardless of income.

Providers receiving funds from this program would be required to dedicate at least 77 percent of funds toward the costs of labor. If demand for the program exceeds supply, the Universal Home Care Program Board would be allowed to create waiting lists of eligible beneficiaries but would not be authorized to take income into account when creating such waiting lists.

If adopted, Maine Question 1 would do the following:

- Establish a 1.9 percent payroll excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. , to be paid by employers, on the amount by which each employee’s compensation exceeds the OASDI base;

- Create a 1.9 percent wage income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , to be paid by employees, on Maine adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” exceeding the OASDI base; and

- Impose a 3.8 percent tax on individuals, reduced by a credit in the amount of the tax paid by the employer and employee for wage income, designed to extend the aggregate 3.8 percent tax to non-wage income (including stock dividends and interest income) above the OASDI base.

The OASDI base, set at $132,900 for income earned in 2019, is the threshold above which additional marginal income is exempt from federal payroll taxes for Social Security. The OASDI base is adjusted annually for changes in the national average wage index.

If adopted, the proposed changes in Question 1 would take effect on January 1, 2019, resulting in a significantly higher tax bill for many households and businesses. Notably, Question 1 would introduce a harmful marriage penalty in a tax code currently structured to avoid creating such distortion.

Under current law, Maine has a graduated-rate individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , with a top rate of 7.15 percent applying to marginal Maine adjusted gross income above $50,750 for single filers and $101,550 for married filers, with bracket levels adjusted annually for inflation. By doubling the top bracket width for married filers, Maine currently prevents married taxpayers from being taxed more severely filing jointly than they would be if filing as two single individuals.

However, Question 1 would create a significant marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. by using the OASDI base as the starting point for the tax regardless of whether earnings in excess of that amount are generated by a single filer or by two taxpayers who are married but separately make less than the OASDI base amount. In effect, this would create a new top individual income tax rate of 10.95 percent for Maine adjusted gross income above $132,900 for tax year 2019, regardless of whether that income is generated by a single income earner or two married individuals. Even though employees would get a credit for the portion paid by their employer, employees will ultimately bear the burden of that portion, as well, making it appropriate to think of this as a 10.95 percent top marginal rate.

The table below shows Maine’s current individual income tax rate schedules for single taxpayers and married taxpayers filing jointly, as well as the proposed individual income tax rate schedules under Question 1.

|

Note: Maine’s individual income tax bracket levels are adjusted annually for changes in inflation. |

|||||

| Single | Married Filing Jointly | ||||

|---|---|---|---|---|---|

| 5.80% | > | $0 | 5.80% | > | $0 |

| 6.75% | > | $21,450 | 6.75% | > | $42,900 |

| 7.15% | > | $50,750 | 7.15% | > | $101,550 |

|

Note: Bracket inflation adjustments for Tax Year 2019 are not yet available. |

|||||

| Single | Married Filing Jointly | ||||

|---|---|---|---|---|---|

| 5.80% | > | $0 | 5.80% | > | $0 |

| 6.75% | > | $21,450 | 6.75% | > | $42,900 |

| 7.15% | > | $50,750 | 7.15% | > | $101,550 |

| 10.95% | > | $132,900 | 10.95% | > | $132,900 |

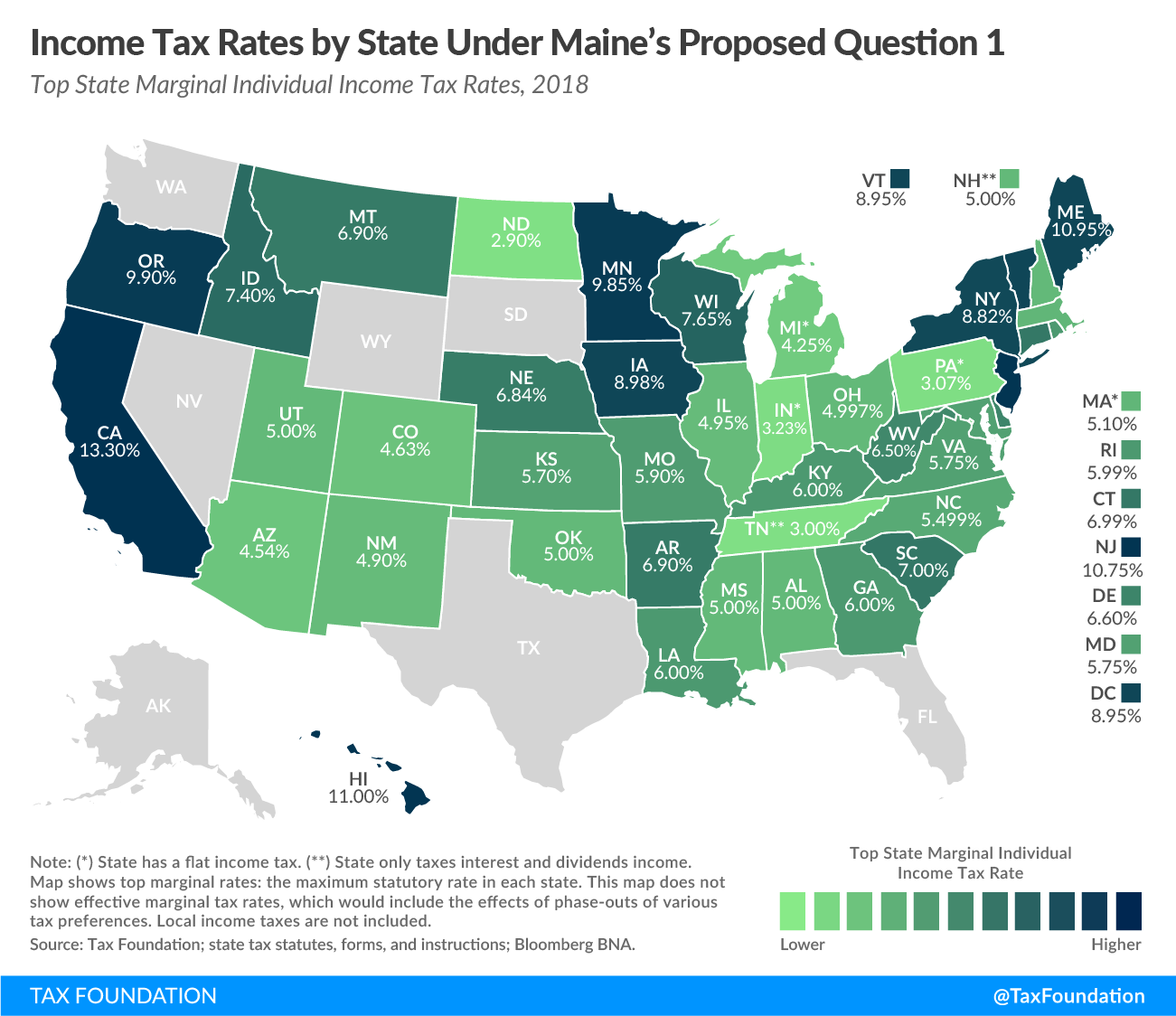

The map below shows Maine’s proposed top individual income tax rate under Question 1, as well as the current top rates of states across the nation. A top marginal rate of 10.95 percent would give Maine the second-highest top rate in the nation, up from its current position at 11th.

In addition to impacting many single and married taxpayers, the proposed new taxes in Question 1 would create serious ramifications for “pass-through” businesses–including sole proprietorships, partnerships, limited liability companies (LLCs), and S corporations–whose owners pay taxes on their business profits under the individual income tax system. Under Question 1, pass-through businesses would be subject to the full 3.8 percent tax on profits above the OASDI base, subjecting many such businesses to thousands of dollars in new tax liability.

Regardless of business structure, pass-through businesses and traditional C corporations alike would be subject to the 1.9 percent payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. provision in this proposal. Under this proposal, employers would be incentivized to keep an employee’s wages under the OASDI base to avoid paying the tax for each employee whose earnings exceed that threshold, and over time, wages above the threshold would adjust to reflect the additional tax cost. As such, Question 1 could restrict employee wage growth.

As previously mentioned, it is important to remember that while employers are responsible for the legal incidence of the employer portion of the payroll tax, the economic burden falls disproportionately on employees. Over time, wages would become slightly lower than they would be otherwise, as a portion of employee compensation goes to remitting the employer portion of the new payroll tax.

The Maine Office of the State Economist, housed within the Department of Administrative and Financial Services, estimates these new taxes would generate $315 million in 2019, before accounting for changes in taxpayer behavior, such as taxpayers changing filing status, exiting the workforce, or leaving the state to avoid these tax increases.

If Question 1 is adopted, Maine would become less attractive for business investment, and the state’s ranking on the individual income tax component of our State Business Tax Climate Index, all else being equal, would fall from 24th to 43rd, bringing the state’s overall ranking down from 30th to 38th.

| Current Law | As Proposed in Question 1 | |

|---|---|---|

| Overall | 30 | 38 |

| Corporate | 41 | 41 |

| Individual | 24 | 43 |

| Sales | 7 | 7 |

| Property | 41 | 41 |

| Unemployment Insurance | 24 | 24 |

In November 2016, a similar ballot initiative, which created a 3 percent income tax surcharge on earnings over $200,000 to supplement K-12 education funding, was adopted by Maine voters but later repealed by the legislature.

More entries in our series on Top State Ballot Initiatives to Watch in 2018.

Errata: An earlier version of this blog post incorrectly described the interaction of the credit. The post has been revised to make clear that taxpayers pay an additional 3.8 percent on all income above the threshold, reduced by a credit by the amount which they and their employer have paid separately on wage income above the threshold.

Share this article