Tax expenditures are a departure from the “normal” tax code that lower the tax burden of individuals or businesses, through an exemption, deduction, credit, or preferential rate. Expenditures can result in significant revenue losses to the government and include provisions such as the earned income tax credit (EITC), child tax credit (CTC), deduction for employer health-care contributions, and tax-advantaged savings plans.

Tax expenditures are determined based on their relation to the “normal” tax code. The U.S. Treasury officially defines them as “revenue losses attributable to provisions of the federal tax laws which allow a special exclusion, exemption, or deduction from gross income or which provide a special credit, a preferential rate of tax, or a deferral of tax liability.”

This definition and the use of the term “special” can make it difficult to know what is and is not an expenditure without also knowing exactly what provisions are included in the baseline tax code. Individual tax expenditures can get especially confusing. For example, child tax credits are tax expenditures, but the standard deduction, which is another of the most common ways taxpayers lower their bill, is not because it’s considered a “normal” part of the code; taxpayers are not typically familiar with that.

Some expenditures aim to influence or reward certain economic activity or social behavior, while others are an attempt to change the tax code bit by bit. The latter is an easier way to reform the existing code and has been used to make the U.S. tax base more efficient or more in line with other OECD countries. Recent examples include reduced rates of tax on dividends and long-term capital gains and reforms to international tax rules intended to shift the U.S. towards a territorial tax system.

Individual vs. Corporate Tax Expenditures

Individual and corporate tax expenditures differ not only in nature, but in how they are perceived. When the claim is made that major businesses do not pay their fair share in taxes—or pay no taxes at all—it is often due to the public’s view of corporate tax expenditures, which are sometimes mischaracterized as “loopholes.”

Corporate tax expenditures are not loopholes. They are legal, intentional features in our tax code typically meant to encourage specific activity, like research and development, or offset the value of depreciation to better reflect corporate income, among other things. These expenditures include full expensing, net operating loss carrybacks and carryforwards, and the R&D tax credit.

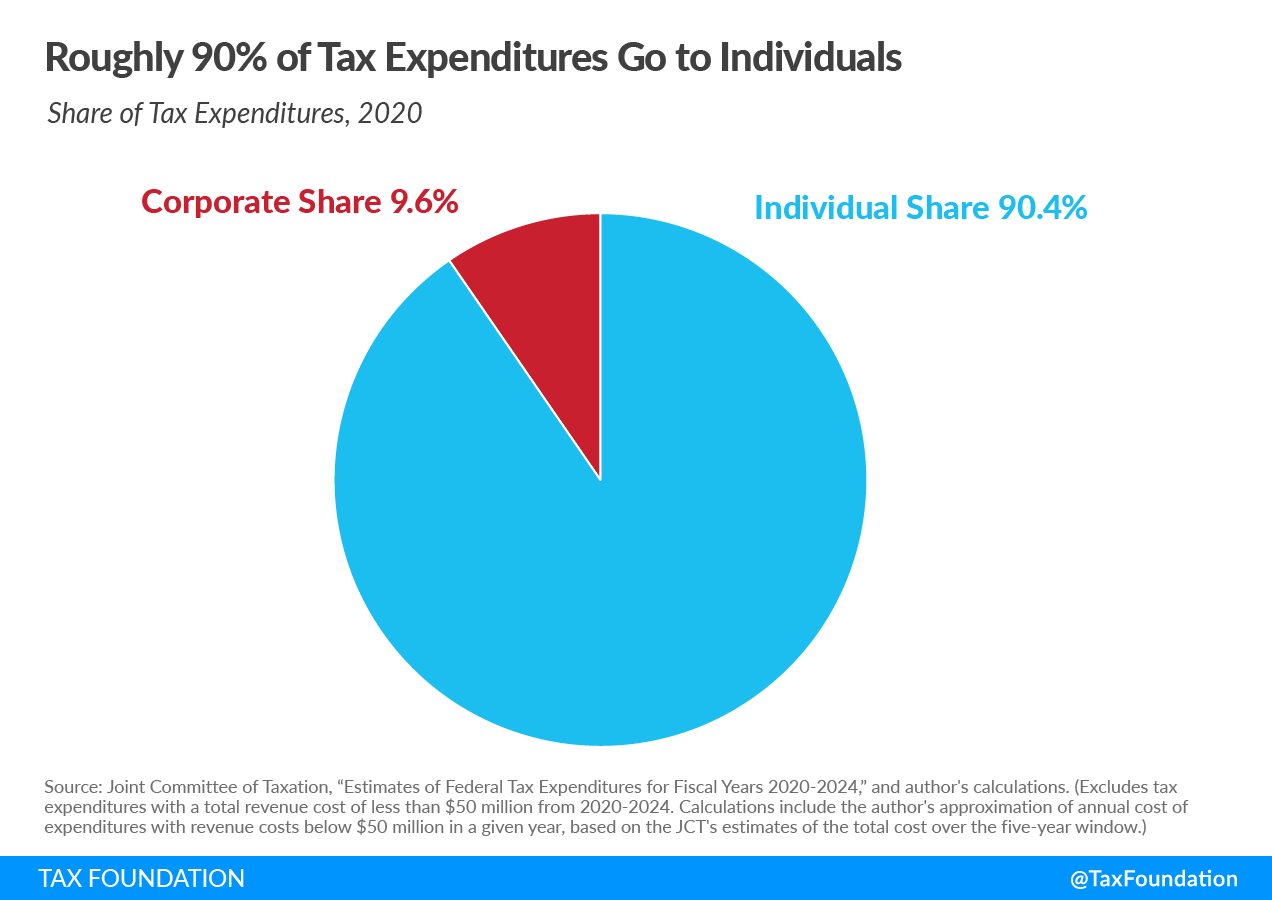

Despite this perception that corporations disproportionately benefit from tax preferences, individuals are also given tax breaks through expenditures which account for over 86 percent of total tax expenditures.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe